The global research antibodies market size is expected to reach USD 5.6 billion by 2027, exhibiting a CAGR of 6.2% over the forecast period, according to a new report by Grand View Research, Inc. Major market drivers include rise in R&D initiatives undertaken by biopharmaceutical and biotechnology companies and government bodies, growing interest in the study of neurobiology and stem cell, availability of technologically advanced products, and strategic collaborations among various market players and academic research organizations.

Designer antibodies are also anticipated to attract the attention of various academic organizations for their use in the R&D of novel products. For instance, in April 2019, scientists from ALS Canada Research Program developed a set of antibodies that can help in the detection of misfolded TDP-43 in various lab experiments that utilize post-mortem brain tissues. Rising usage of research antibodies for the development of novel diagnostic therapies is thus anticipated to fuel market growth in the near future.

Increase in the usage of research antibodies to develop treatment options for various diseases is also expected to boost market growth during the forecast period. For instance, in June 2019, the Institute of Life Sciences (ILS, India) developed antibodies against chikungunya viral infection. These antibody structures were developed to aid in the understanding of various aspects of virus pathogenesis, entailing further research on antiviral therapies. Growing government funds and initiatives for R&D is anticipated to fuel the Asia Pacific market during the forecast period. According to the 2018-2019 Australian Budget, approximately USD 94 million was estimated for four years for new industry collaborations, research as well as new biomedical and medical programs.

Request a sample Copy of the Global Research Antibodies Market Research Report @ https://www.grandviewresearch.com/industry-analysis/research-antibodies-market/request/rs1

Additionally, rise in funds invested by pharmaceutical and biotechnology companies to enhance the study of proteomics and genomics is expected to drive the market. For instance, in 2017, Biognosys Inc. raised USD 5 million in funds to increase, advance, and develop next-generation proteomics products and workflow for high throughput and high content protein analysis. Rise in the number of major market players investing in advanced technologies and collaborating with other market players is also anticipated to positively impact market potential in the near future. For instance, Abcellera uses technologically advanced techniques to test antibodies from single B cells, map and screen natural immune responses, and to discover novel antibody therapies. The company has also partnered with Sanofi, Pfizer, Teva, Merck, and GSK to discover and develop new antibody-based therapies.

North America dominated the research antibodies market in owing to increasing focus on R&D in the fields of biomedicine, stem cell, and cancer. Rising prevalence of chronic diseases such as cardiovascular and blood diseases is also expected to fuel market growth.

Launch of novel antibody structures for diagnosis of various diseases is also a major factor expected to boost the market. For instance, in August 2018, BioGenex launched a range of new antibodies for its use in cancer immunohistochemistry. The company’s immunohistochemistry solution offers about 400 reagents, primary antibodies, consumables, and ancillaries. Key players in the market include Abcam Plc; Bio-Rad Laboratories Inc.; PerkinElmer, Inc.; Agilent Technologies; Roche; Cell Signalling Technology, Inc.; Thermo Fisher Scientific; Lonza Group; and BD.

Key suggestions from the report:

- By product, primary antibodies held the dominant share in 2019 in terms of revenue owing to greater specificity, therefore leading to increased adoption in R&D activities

- Based on type, monoclonal antibodies captured a substantial market share in 2019 as they offer higher sensitivity for detection of antigens and also showcase efficient staining properties for various applications

- The Western blotting technology segment has witnessed exponential growth owing to increasing prevalence of diseases with limited treatment options and rise in R&D activities conducted by pharmaceutical and biotechnology companies and academic institutes

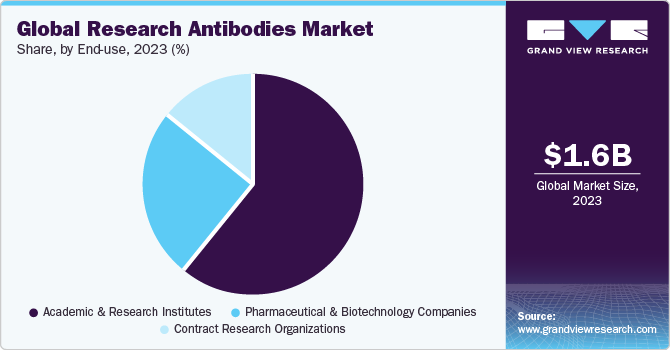

- Based on end use, pharmaceutical and biotechnology companies were dominant in terms of revenue in 2019 owing to increased adoption of research antibodies in drug development and discovery

- North America accounted for a substantial share of the research antibodies market in 2019, which is attributable to high presence of many biotechnologies as well as biopharmaceutical manufacturers, research academies, and laboratories.

Have Any Query? Ask Our Experts @ https://www.grandviewresearch.com/inquiry/5018/ibb

Grand View Research has segmented the global research antibodies market on the basis of product, type, technology, source, application, end use, and region:

Research Antibodies Product Outlook (Revenue, USD Million, 2016 – 2027)

- Primary

- Secondary

Research Antibodies Type Outlook (Revenue, USD Million, 2016 – 2027)

- Monoclonal

- Polyclonal

Research Antibodies Technology Outlook (Revenue, USD Million, 2016 – 2027)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Other Technologies

Research Antibodies Source Outlook (Revenue, USD Million, 2016 – 2027)

- Mouse

- Rabbit

- Goat

- Other Sources

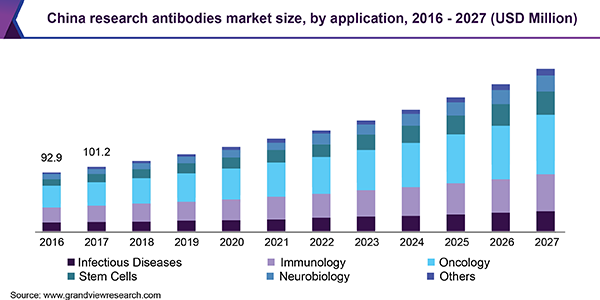

Research Antibodies Application Outlook (Revenue, USD Million, 2016 – 2027)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Other Applications

Research Antibodies End-use Outlook (Revenue, USD Million, 2016 – 2027)

- Academic & Research Institutes

- CROs

- Pharmaceutical & Biotechnology Companies

Research Antibodies Regional Outlook (Revenue, USD Million, 2016 – 2027)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- Australia

- India

- Japan

- Singapore

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Find more research reports on Biotechnology Industry, by Grand View Research:

Clinical Oncology Next Generation Sequencing Market – The global clinical oncology next generation sequencing market size was estimated at USD 627.2 million in 2018.

Cell Sorting Market – The global cell sorting market size was valued at USD 405.47 million in 2018 and is expected to witness lucrative CAGR of 10.5% over the forecast period.

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/research-antibodies-market