Robotic Process Automation Industry Overview

The global robotic process automation market size was valued at USD 1.89 billion in 2021 and is anticipated to reach USD 30.85 billion by 2030, registering a CAGR of 38.2% in the forecast period.

Factors such as the need to optimize operations to gain improved productivity and generate maximum return, integration of the latest technologies, and changing business processes across enterprises is expected to boost the market growth. Furthermore, during the COVID-19 pandemic, businesses switched to remote work culture, and the need to automate workflow was also increased thus this factor accelerated the market growth. As RPA is becoming mature, it is anticipated to grow increasingly more sophisticated during the forecasted period.

Technological advancement such as machine learning, Optical Character Recognition (OCR), and analytics within the RPA domain is potentially creating a demand for intelligent automation systems. As a result, intelligent automation is anticipated to eliminate more than 40% of service desk interactions by 2025. The combination of cognitive RPA and various chatbot technologies would enable unattended modes of automation at the services desk, thereby reducing human interventions and improving operational productivity.

Gather more insights about the market drivers, restrains and growth of the Global Robotic Process Automation Market

The growing demand for automation of business processes is one of the significant factors influencing the increasing adoption of RPA technology. The core purpose of RPA is to document the activities of an organization for efficient management. Moreover, automated data collection provides seamless data entry & storage and eliminates errors and repetitions. Such practices reduce the time and cost required to rectify the mistakes in data gathering and processing. According to a survey conducted by UiPath (U.S.) in 2020, a global software company for robotic process automation, and The Economist Intelligence Unit (U.K.), a research and analysis division of the Economist Group, 90% of the organizations adopted RPA for automating business processes. In comparison, 73% of the surveyed agreed to be completely satisfied with the benefits resulting from automation.

Further, the increased demand to simplify the complex handling process is expected to augment the industry growth. Organizations across several verticals are deploying RPA and AI to increase productivity and efficiency. In a highly competitive market, it has become essential to improve work agility and deliver enhanced customer experiences. RPA robots can perform tasks across different legacy systems to get information on the digital platform. For instance, bank customers can check their account details online and process KYC verification and automatic bill payment along with other functions through the internet. These services have minimized manual involvement and are guiding in delivering a better customer experience.

Even though the market is anticipated to grow steadily due to the benefits mentioned above, the reluctance of companies to switch from manual to automated processes is expected to restrain the market growth. Organizations around the globe are looking at deploying RPA solutions to improve business processes. However, lack of understanding about the technology pose a barrier to the adoption of this software. Professional service providers are planning to implement RPA solutions in their organizations within the next two to three years.

During the COVID-19 pandemic, businesses switched to remote work culture and increased the need to automate workflow. Thus, significant adoption of RPA for maintaining and automating workflow was witnessed in the year 2020 – 2021. Also, the growing interest of companies in no-code automation platforms has fueled the adoption rate for RPA and has become a part of the automation process for businesses. Furthermore, cloud-based solutions have gained tremendous demand during the pandemic. The cloud automation solutions deliver excellent business value inconsistent deployment, operational cost reductions, and overall resilience and security. It also improves the backend processes in the enterprise workflows.

Robotic Process Automation Market Segmentation

Based on the Type Insights, the market is segmented into software and services.

- The software segment is estimated to expand at a steady CAGR in the forecast period as RPS software enables agile and cost-effective business operations through rapid automation of rule-based, manual, and back-office administrative processes. It improves accuracy and reduces the cost of implementation by creating a virtual workforce.

- The service segment dominated the global market with a 61.89% share in 2021 and is expected to continue its dominance over the coming years. The service segment comprises consulting, implementing, and training services. The high competition among enterprises has urged the service providers to improve their consulting, training, and advisory services.

Based on the Deployment Insights, the market is segmented into cloud and on-premises

- The cloud segment growth is attributable to the rising adoption of RPA outsourcing services in which the solution is installed on the cloud for enterprises. The RPA service provider buys and converts licenses for the client to deploy RPA bots into a process.

- The on-premise segment is expected to be the highest revenue share of 79.54% in 2021 and will expand further at a steady CAGR from 2022 to 2030. On-premise deployment in organizations ensures that RPA access policies follow in-house protocol.

Based on the Organization Size Insights, the market is segmented into large enterprises and small & medium enterprises

- The large enterprise segment estimated for the largest revenue share of more than 66.47% in 2021. Many large enterprises deploy RPA to reduce the time invested in conventional activities and invest the saved time in strategic decision-making.

- The SME segment is expected to register the highest CAGR during the forecast period. These enterprises are aggressively opting for RPA due to flexibility, cost-effectiveness, lower technology risks, resource utilization scalability, and improved organizational productivity.

Based on the Application Insights, the market is segmented into BFSI, pharma & healthcare, retail & consumer goods, information technology (IT) & telecom, communication and media & education, manufacturing, logistics and energy & utilities and others

- The BFSI sector held the largest revenue share in 2021, accounting for 28.89% of the overall market. The application of RPA in BFSI sectors enables banks and other financial institutions to automate business processes, such as account opening, deposits, and lending loans, primarily to optimize costs.

- The Pharma & Healthcare segment is anticipated to record the fastest growth over the forecast period owing to the rising demand for RPA to automate the hospital management systems.

- RPA in the IT & telecom sector is mainly used to tackle the ever-changing regulatory compliance and support a product through its entire lifecycle.

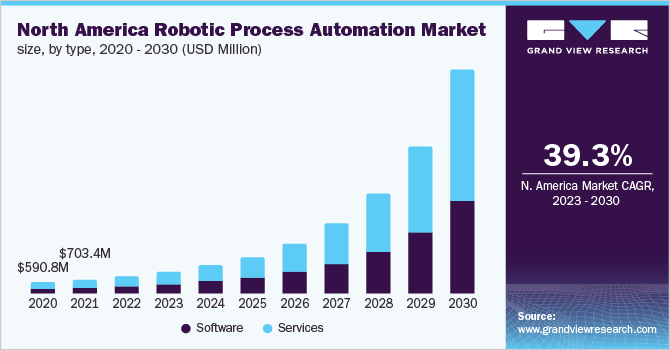

Based on the Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- North America accounted for 37.26% revenue share in 2021 and is expected to grow steadily over the forecast period. This is estimated by the high penetration rate of automation solutions and process management among government agencies and enterprises in the region.

- Asia Pacific has been the largest growing region in the robotic process automation market due to the rising solutions and services adoption across the healthcare, pharma, IT and Telecom, manufacturing, and retail industries. Further, rising automation demand in the Business Process Outsourcing (BPO) sector and rising knowledge of automation among various industries and SMEs are factors impacting the region’s favorable market growth.

Browse through Grand View Research’s IT Services & Applications Industry Research Reports.

- Trade Management Software Market – The global trade management software market size was valued at USD 683.1 million in 2016. It is expected to expand at a CAGR of 8.9% over the forecast period. Increasing demand for automation of trade management processes and growing need to reduce organizational costs are among the key trends escalating market growth. Globalization in trade is encouraging numerous organizations to expand their business operations across multiple countries. As a result, companies involved in trading are trying to curb compliance penalties, improve process efficiency, and reduce complications associated with imports and exports.

- Enterprise Search Market – The increasing demand for time-saving data search solutions is expected to be the key growth factor for the enterprise search market. The increasing data volumes sourced from different gateways in the large enterprises has created a need for managing it. Enterprise search solutions help in organizing and managing this data, due to which these solutions have found a large adoption in large enterprises. Enterprise search solutions enable the availability of required data or information to the user from a pool of databases, emails, intranet, data management systems, and so on.

Market Share Insights:

- October 2021: Walmart uses over 500 bots not only to automate duties like answering employee inquiries or collecting helpful information from audit papers but also to track inventory flow and identify slow-moving commodities and headstock.

- June 2021: Kofax Inc. a U.S. based company acquired PSIGEN Software, Inc., a leading provider of content management, document capture, and workflow automation software and solutions, providing a wide range of solutions and software in the marketplace and augmenting the intelligent automation platform of the company.

- August 2020: OnviSource, Inc. launched Liaa TeleServ Intelligent Virtual Agent, which provides Telephone Answering Service (TAS) and fully automated teleservice applications and user-friendly interactions.

Key Companies Profile:

Apart from growing the company’s size and reach, the technology vendors provide solutions by partnering with consulting firms and resellers. Value-added packages such as free tech support and other sales services that provide customized solutions are frequently sold by IT companies that collaborate with consulting organizations, thus increasing the adoption of robotic process automation to manage many queries. Customers can find value-added resellers at the retail level for computer gear and services in abundance.

Some prominent players in the global robotic process automation market include:

- Automation Anywhere

- Blue Prism

- EdgeVerve Systems Ltd.

- FPT Software

- KOFAX, Inc.

- NICE

- NTT Advanced Technology Corp.

- OnviSource, Inc.

- Pegasystems

- UiPath

Order a free sample PDF of the Robotic Process Automation Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/robotic-process-automation-rpa-market