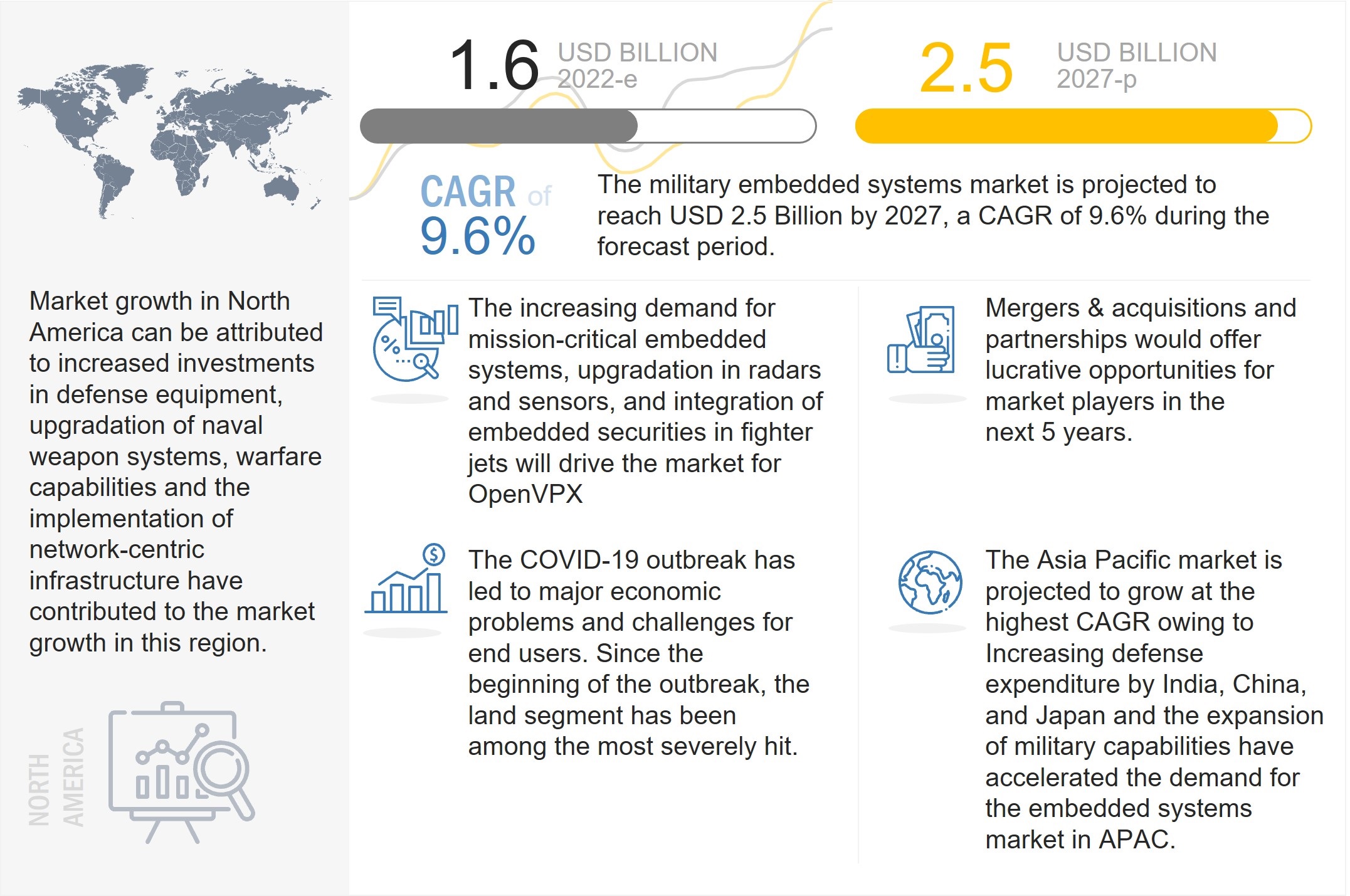

According to the new market research report “Military embedded systems Market by Application, Platform (Land, Airborne, Unmanned, Naval, Space), Server Architecture (Blade Server, Rack-mount Server), Installation Type, Component, Services, and Region – Global Forecast to 2027” The Military embedded systems market is estimated to be USD 1.6 billion in 2022 and is projected to reach USD 2.5 billion by 2027, at a CAGR of 9.6% from 2022 to 2027. Growth of this market can be attributed to the rise in enhancement programs for land vehicles in US, developments in the Navigation & Communication systems for Naval & Airborne platforms, and Developments in Space sector.

• Informational PDF Brochure :- https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=112996974

Major players in the Military embedded systems market include Curtiss-Wright Corp. (US), Mercury Systems (US), Kontron (S&T AG) (Austria), AMETEL (US), and General Dynamics Corp. (US). The report covers various industry trends and new technological innovations in the Military embedded systems market for the period, 2018-2027.

Browse 222 market data tables and 63 Figures spread through 276 Pages and in-depth TOC on “Military embedded systems Market, by Region – Global Forecast to 2027. “View detailed Table of Content here – https://www.marketsandmarkets.com/Market-Reports/military-embedded-system-market-112996974.html

Increased focus on cloud computing and wireless technologies

The trend of cloud and wireless technologies is increasing at a rapid pace in the defense industry. The integration of the cloud with embedded systems can offer various advantages for mission-critical applications, due to which the demand for embedded systems is growing continuously. For a long time, military embedded systems were standalone systems. Since the evolution of wireless connectivity, the situation has changed completely. Short-range protocols, such as RFID (radio frequency identification) and NFC (near-field communication), and long-range protocols, such as LTE (long term evolution), WiMAX (worldwide interoperability for microwave access), and WLAN (wireless local area network), are going to witness wide military applications in the near future. Currently, the trend is shifting toward the system on chip architecture and the application of short-range protocols. The current serial data rate is about 20/25 Gbits/S per link, and when it reaches 40/50 Gbits/S, it creates signal impairment. Signal integrity engineers are developing new technologies to increase the data rate limits on boards and electrical back planes. As technology in military embedded systems matures, many military personnel will need a fast and secure network to stay connected at all times during critical missions. Therefore, the use of wireless technology is fueling the demand for embedded systems in the defense industry. According to the article published on May 2022, The US Army is in the midst of a significant shift in how it buys, builds and delivers technological capabilities to war fighters. At the crux of those plans is a cloud infrastructure called cArmy that can deliver communications, tools and sensor data so commanders can have a clear digital picture of the battle space and make crucial decisions more quickly.

By Application, Communication & Navigation segment is Projected to grow at highest CAGR During Forecast Period

Digitization of communications is a crucial part of defense programs and is associated with the transformation of military forces across the world. Digital technology makes more efficient use of the spectrum bandwidth for communications. Communication refers to both the communication medium and communication devices used in the information transfer process, which is vital from the military perspective. Computers and radio networking technologies for communication require the use of technologically advanced embedded systems with easy enhancement capability. Military communication applications require a high level of reliability and security for improved situational awareness. Fielded communication modules, such as soldier-borne radio communications and software-defined radio-based data links, are often signal processing-intensive, power-constrained, and have strong security requirements. For these reasons, there is a high demand for advanced military embedded systems for uninterrupted communications. And this demand is driving the communication & navigation systems market.

The communication & navigation segment is estimated to be USD 288 million in 2022 and is projected to reach USD 477 million by 2027, at the highest CAGR of 10.6%.

By Military Embedded Systems Installation Type, the New Installation segment accounts for the largest share of the total market in 2022.

The new installation segment refers to the procurement and installation of military embedded systems, which are integrated with various naval weapon systems, radar systems, command and control, electronic warfare systems, and communication systems to enhance the connectivity and coordination of maneuvering forces at the tactical level. Countries like the US and the UK are allocating defense budgets for the new installation of advanced military embedded systems, which are anticipated to drive this segment globally. The growing emphasis on the deployment of advanced military embedded systems across various defense platforms is driving the military embedded systems market.

The new installation segment is estimated to account for a larger share of the military embedded systems market in 2022. This segment is estimated to be USD 1,141 million in 2022 and is projected to reach USD 1,832 million by 2027, at a CAGR of 9.9%.

North America region accounts for the largest market share in Military embedded systems market

North America is estimated to account for a share of 37% of the military embedded systems market in 2022. The market in this region is projected to grow at a CAGR of 10.0% during the forecast period. North America is a developed market for military embedded systems. Increased investments in defense equipment and warfare capabilities and the implementation of network-centric infrastructure have contributed to the market growth in this region. The major countries in this region are the US and Canada, with the US leading the military embedded systems market in North America. The US is a technologically superior country with a huge potential for investment in military electronics.

North America is the major hub for technologically advanced applications. The US is a technologically advanced country with a huge potential for investment in embedded system technologies. Increased investments in next-generation communication technology and integrated warfare capabilities contributed to the market growth in this region.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/military-embedded-system-market-112996974.html