Investors looking to take advantage of valuation disconnects in fast-growing companies may find that GPO Plus, Inc. (OTCQB: GPOX) presents a compelling opportunity at current levels. Trading at roughly $0.17 a share on Wednesday, GPOX shares are priced at what “angel investors” would have liked to pay ahead of an IPO. That’s not an exaggeration. The reason why GPOX trades at sub-dollar levels isn’t that they don’t have an ambitious business plan. They do, and it’s already showing significant revenue-generating progress. Instead, the main reason valuations have remained so low is that GPOX is flying well under, even off, the radar of smallcap investors. One reason for this CEO, Brett H. Pojunis said, “when we decided to launch DISTRO+ we had limited resources, and I made the decision to focus on building the foundation of our business first, and now that we have experienced success its time to share our business model with our shareholders and the investment community.” Unleashing the value is happening now.

That means the current low share price is not necessarily bad news, as it allows investors to catch an investment in GPOX at ridiculously low prices. But that window of opportunity may not last for long, as GPOX is making deals with major retail players, expanding its geographical presence, and expecting to post its highest-ever revenues this year.

And those revenues won’t be the comma-less figures posted by many of its microcap peers. On the contrary, GPOX is on pace to score over $14 million in revenues (based on their fiscal year). That estimate assumes GPOX doesn’t plan on opening a single new retail channel, which isn’t the case. The company has stated its intention to open up to 1,000 additional retail customer locations, which, by the way, are generally instantly profitable. Admittedly, reaching that target may sound overly ambitious, but it isn’t.

GPOX has a genius plan to manage these locations through “Mini Hubs,” or warehouse centers typically around 1500 sq. ft. – 2,500 sq. ft. These hubs are managed by just one or two key employees, with additional staff brought in as needed to service accounts with “white glove” treatment. That “white glove” service is creating a tsunami of interest, and rightfully so.

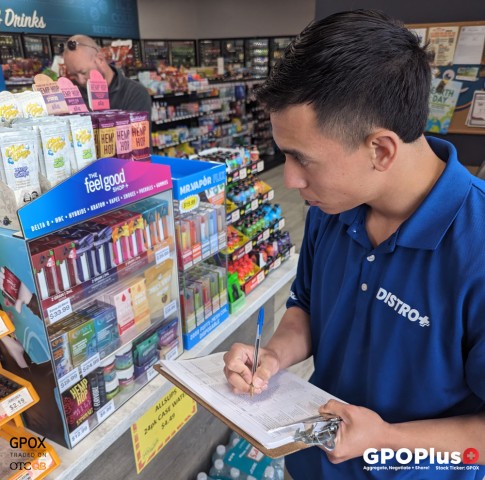

The strategy effectively relieves the management at those locations from any responsibilities other than simply signing off on each visit confirming the restocked inventory. Meanwhile, the GPOX team delivers, stocks, provides POS material, and manages each sales display. In addition to retail managers embracing the relationship, the model impacts sales positively, with regular product support and account maintenance included as part of the product and display(s) placement.

Driving Revenues Significantly Higher in 2023

Fair to say, the GPOX business and service model is a game changer for retail stores, especially busy ones where management often has too much to do in too little time, noting that the labor market pool at best, is not good. Remember, most vendors at stores like Walgreens (NYSE: WBA), CVS Health (NYSE: CVS), and Rite Aid (NYSE: RAD) simply drop off pallets that employees have to deal with. Those pallets could sit there for hours, even days, before being unpacked. That isn’t to bad-mouth those vendors and point toward a business losing sales by not getting products to the shelves. Rather, the point being made is that because GPOX DOES service the account, from stocking to cleaning its displays, they are continuously positioned for sales. Managers appreciate that difference. Remember: the higher a store’s sales, the better review for management, and those familiar with retail know how much that matters.

Indeed, sales generated from GPOX products have been impressive by all measures. The average monthly sales per location for those upgraded to “white glove” DSD (Direct to Store Delivery) service eclipses $2,121 per month. Notably, those not enrolled for “white glove” may want to do so. In addition to driving sales, which GPOX has established through actual performance records, the upgrade to DSD service takes only 4 to 6 weeks to implement. Once fully implemented, retailers benefit from better point-of-sale displays, increased product SKUs, and personal service at least 2 times a month to maintain inventories. That hands-on approach to service is a model GPOX believes will do more than change the vendor service landscape; it will potentially open thousands of new retail sales store-in-store locations in the next two years.

That’s not overly ambitious. With GPOX delivery drivers stocking the shelves, ensuring its products are in the best possible location for maximum exposure, and generating an invoice on the spot for the store manager to approve, adopting and integrating GPOX products provides a mutual win-win proposition. Of course, reaching these new locations requires an infrastructure to support the increased presence. GPOX is checking that box, too.

Growing methodically, GPOX is implementing additional sales and marketing campaigns supported by Mini Hubs that provide on-premise support for product service and marketing. Until the Mini Hubs are established, GPOX services through Regional Hubs. While the distance to the service may be further in those cases, the quality and attention remain a priority. Remember, GPOX is a service-oriented company, with reps making their presence known and appreciated at client locations. The goal, however, is to build the market to require a Mini Hub. That’s a good thing.

Mini Hub Business Model: Engaging and Profitable

Mini Hubs are established once its anchor retail partners reach a number that makes setting one economically feasible. These deliver high touch, “white glove” DSD (“Direct to Store Delivery) service, ensuring excellence on all service fronts. They directly support the “Region Hub” strategy, with the “Mini Hubs” located outside the 150-mile radius. A Mini Hub typically consists of a 1,000 to 2,500 square feet facility and 1 to 3 drivers. When launched, a Mini Hub is assigned to GPOX’s retail partners in the immediate area, typically involving 35 to 45 initial locations. Implementing this approach, with two new Mini Hubs, has resulted in over a threefold increase in sales and growing.

Specific geographies can sponsor multiple Hubs. In fact, plans are in place to launch 5 to 7 additional Mini Hubs by December 2023 to reach a target of over 1,000 retail customer locations. After that, they plan to open its next Regional Hub. Plans include launching the new Mini Hubs in Dallas and Austin, Texas, Albuquerque, New Mexico, and Wyoming/South Dakota. Expectations are that at least 116 new retail stores will be added to its sales channels, bringing its White Glove DSD service to around 216 stores. Remember, each new location is an immediate revenue generator. Better still, it takes little time for each presence to become profitable. That advantage could put a fire under GPOX’s share price, considering the multiples given to companies in the food and retail convenience sector.

Core-Mark (NASDAQ: CORE), for instance trades with a 31.27X P/E ratio. Other companies follow suit. Sysco sports a (NYSE: SYY) 24.25 P/E ratio, U.S. Food (NYSE: USFD) a. impressive 31.44 P/E, and Unilever, while lower than the others has a 16.01 P/E. (* P/E rations on 6/30/23, 1:53 PM EST)

Comparison to those industry giants is warranted. GPOX sales won’t be limited to convenience stores. The business model facilitates expanding its footprint throughout specialty retail locations, including gas stations, smoke and vape shops, airports, and virtually any type of business with demand for its products. Those products are catching a substantial wave of interest, with GPOX currently servicing approximately 570 stores across 12 states centralized in the Southwest and Midwest regions of the United States. Its primary distribution hub is in Lubbock, Texas, servicing 470 retail locations and expanding.

GPO Plus is Changing Vendor Landscape

For those new to GPOX, here’s a quick overview: the company specializes in the development, manufacturing, and distribution of Farm Bill-compliant hemp-derived CBD, recreational hemp gummies, vapes, and nutraceuticals. Additionally, they represent and distribute additional products well suited for specialty retailers, with primary categories including vitamins, nutraceuticals, disposable nicotine vapes, Kratom, CBD, and general supporting merchandise.

While they sell it, don’t think of GPOX as a CBD/Recreational Hemp product company. It’s part of their diversification strategy to add value. There’s plenty accruing through a multi-channel approach to reaching customers, including leveraging the inherent strength of GPOX Labs, its division responsible for deploying and enhancing all technology and web properties. They contribute to revenue streams through retail partner relationships, direct to consumers sales, and online and social media channels.

While the value drivers noted are impressive, there’s more to support the GPOX investment proposition. Last year, GPOX announced the formation of DISTRO+, an operational division that aims to drive increased retail distribution. Additionally, the company announced its Phase One initiative focused on adding products and retail partners. That phase proved successful, as DISTRO+, entered into distribution agreements with brands, signed up retailers, and identified distributors they expect are ripe for acquisition. Those weren’t the only milestones reached.

GPOX secured a license agreement to create Yuengling’s Ice Cream flavored recreational hemp products. Yuengling is an extremely popular household name in the northeast, and currently enjoying national expansion, boosting distribution into potentially thousands of retail locations. GPOX also scored a master distributor agreement with Tech Armor, selling screen protectors and mobile device accessories which they plan on rolling out to retailers soon. Further, a Master Services Agreement was established with SurgePays, providing Surgepays fintech products and services to GPOX retail partners while facilitating the distribution of GPOX products through the SurgePays marketplace. Additionally, SurgePays has offerings that will enable GPOX to generate additional revenue per store each month. There’s more.

GPOX secured yet another master distributor agreement with Hempacco, which sells hemp cigarettes, smoking paper, and alternatives to nicotine tobacco products. Hempacco’s products include Hemp Hop, a partnership with hip-hop icon Rick Ross and Rap Snacks founder and CEO James Lindsay, and Cheech and Chong licensed products with more influencer driven products coming soon.

On the acquisition front, GPOX purchased Nutriumph, a leading seller of nutraceutical and vitamin supplements, including their banner product Herberall®. All told, 2022 and thus far in 2023 have been transformative to GPOX’s growth – and guidance suggests they won’t be slowing anytime soon.

Shifting to Warp Speed Growth In 2023

In fact, recent developments indicate the company is shifting from hyper to warp-speed growth, leveraging the power of its asset portfolio to accelerate market expansion, penetrate new markets, and capitalize on a business model that is quickly profitable and efficiently managed. Combining the intrinsics with inherent potential, the sum of GPOX’s parts exposes a valuation disconnect between share price and performance worth seizing. In fact, with GPOX’s precedent of surpassing expectations, it’s a window of opportunity that should rightfully close sooner than later.

Bottom Line: Few companies priced at GPOX levels can boast strong partnerships, licenses, expanding distribution networks, and a product portfolio capable of generating substantial revenues at excellent gross margins, especially for their industry. GPO Plus checks those boxes and intends to add to them. With DISTRO+, Feel Good Shop+, GPOX Labs, and its Herberall line firing on all cylinders, the path of least resistance for GPOX decidedly favors growth. And as it often does, the share price will follow. Thus, consider seizing this opportunity at $0.17 a share while it’s available. Great deals seldom last.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to ten-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for GPO Plus, Inc.. for a period of one month ending on 08/03/23. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Country: United States

Website: https://primetimeprofiles.com/