NeurAxis (NYSE-Amer: NRXS) stock is doing something many newly listed companies’ shares aren’t: trading higher. In fact, despite the bullish start by many in the past few months, short-selling investors have been feasting on recent IPOs, taking advantage of low outstanding share counts and even lower trading floats. That’s not been the case for NRXS shares, however. Despite a brief intra-day dip below its $6 IPO price, shares continue to score bullish interest, closing at or higher than their opening day level in each of its trading sessions. Shares ripped over 10% higher last Friday on the heels of an analyst report from Goldman Smallcap Research that models NRXS shares reaching $14 in the next six to twelve months.

That bullish appraisal is supported by several factors. Foremost, the analyst notes NRXS being well-positioned to revolutionize treatment strategies for children and adults who suffer from chronic and debilitating conditions. Remember that this proposal isn’t a long-term wait-and-see proposition; it’s already a mission in progress at NRXS. The company is treating pediatric cases of Functional Abdominal Pain (FAP) and Irritable Bowel Syndrome (IBS) in patients 11-18 years old with the first FDA-cleared therapy that utilizes its innovative Percutaneous Electrical Nerve Field Stimulation (PENFS) technology. However, providing effective treatment is just one value driver.

A bigger one is that the success shown to date puts NRXS technology a significant step closer to earning a front-line treatment designation. Earning that spot can be transformative, noting it could enable NRXS to secure a substantial share of the estimated $9 billion total addressable pediatric care market. Earning even a portion of that market share can be lucrative. For example, just 25% of the expected yearly cases – about 200,000 children – presents a roughly one billion dollar revenue-generating opportunity at current reimbursement rates. There’s more potential excellent news for NRXS.

First Mover Advantage Can Be Transformative

A robust IP portfolio, over 700 patient reports, and a number of publications supporting NRXS technology as a best-in-class treatment option could drive potentially exponential revenue growth. In fact, with NRXS having at least four major carriers providing payer coverage and more expected this year, trying to compete against NRXS may be challenging or even futile, especially for companies committed to using off-label pharmaceutical use to treat the same indications. Notably, the side effects from that regimen are sometimes worse than the condition itself.

In other words, NRXS is timely to its opportunity. And given its focus on providing safer, effective, and scalable means to treat pediatric indications with limited or no existing treatment options, GSCR’s revenue estimates for NRXS to reach $22 million by 2025 could fall on the conservative side. Not only is top-line growth expected, but revenues are expected to be met with 88% gross margins, similar to those over the past two years. Thus, whether modeling PPS growth through top-line, bottom-line, or a combination of both, a case for NRXS shares is well-supported.

Keep this in mind when appraising the NeurAxis opportunities. The company is monetizing its assets by addressing critical clinical needs that have gone unmet or under-served, and by filling those gaps, NRXS is positioned to exploit a clear commercial pathway. Supporting that mission is the potential for treating new indications approved through its FDA De Novo clearance and being protected by robust IP covering devices and methods related to its innovative technology. The FDA De Novo clearance is an important value driver in the NRXS equation. It’s an application that, if granted, establishes a new “device type” along with classification, regulation, necessary controls, and product code. It also creates a pathway toward earning future expedited approvals by making the device eligible to serve as a predicate for new medical devices through an expedited 510(k) process.

Transformative Approach Treating Unmet Pediatric Care Needs

From a valuation perspective, the De Novo clearance can’t be under-appreciated. Beyond potentially expediting new approvals, the designation supports NRXS being an innovator whose work can result in bringing an entirely new treatment method to the market. Of course, its position to lead is no coincidence. It results from extensive work developing its PENFS technology, with the IP inherent to that strengthening NRXS’s competitive advantage. Remember, NRXS doesn’t want to treat with chemicals; instead, they are pioneering unique neuromodulation work that provides access to the central nervous system. Once its target is reached, it stimulates and ultimately induces a change in brain pathways and connectivity.

In all measures, the NRXS technology can be a treatment game-changer. And while patients will ultimately benefit from an improved standard of care, NRXS and its investors also stand to gain appreciably. Remember that NRXS’s IB-Stim™ PENFS technology is already generating revenues, expected to increase significantly through accelerating care-provider adoption this year to treat pediatric cases of FAP and IBS. Attractive to providers and patients, IB-Stim provides a non-drug and non-surgical approach to treatment that can be used in outpatient settings, reducing pain through neuromodulation to branches of cranial nerves. Even better, the NRXS approach to treatment can generate favorable treatment results in roughly three weeks.

In addition to facilitating quick results, care providers appreciate PENFS mitigating the often enduring side effects of drugs being prescribed off-label. Those can be severe, including suicidal ideation, depression, and weight gain. On the other hand, PENFS notes its side effect as irritation at the treatment site. For NRXS, it’s a case where being different from competitors brings clear advantages. Another critical distinction is that PENFS treatment is targeted via the brain-gut axis, appreciably different from conventional localized and peripheral care, which, as noted, often comes with severe unintended consequences.

IB-Stim is Validated by Research

NRXS is on the precipice of curing that dilemma. In fact, there’s plenty of research supporting IB-Stim’s value to patient needs, including four current publications, data from over 700 published patients, six different study types, thirteen children’s hospital studies, and an expected fourteen publications documenting the positive contributions from NRXS innovation and technology by the end of 2023. Additionally, research data shows compelling advantages of IB-Stim compared to other treatments. While there’s a long list of benefits, it’s what IB-Stim doesn’t do that is ushering in its adoption.

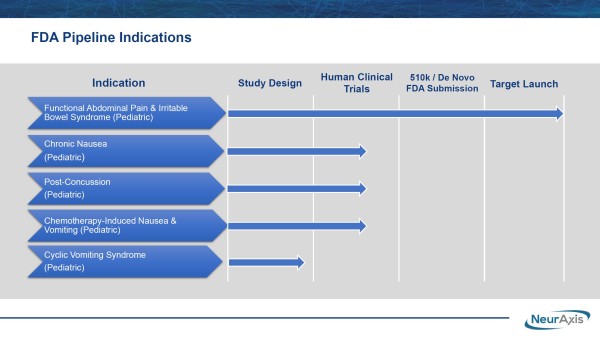

Unlike commonly prescribed off-label treatments, IB-Stim doesn’t foster suicidal ideation, dementia, abdominal pain, or allergic reactions. Neither does it induce vomiting or diarrhea, documented symptoms associated with current drugs treating FAP and/or IBS, including some from Mallinckrodt (NYSE-Amer: MNK), Johnson & Johnson (NYSE: JNJ), AbbVie (NYSE: ABBV), and Pfizer (NYSE: PFE). By the way, NRXS doesn’t intend to rest on its laurels. In addition to treating pediatric FAP and IBS, they are advancing a pipeline to treat chronic nausea, post-concussion, cyclic vomiting syndrome, and chemotherapy-induced nausea in children. Those are clearing human clinical design and are on the precipice of human clinical trials.

That’s happening now, with NRXS advancing its prospective, randomized, double-blind study for post-concussion syndrome at Children’s Hospital of Orange County. The company noted that additional site(s) could be added to strengthen the research data and expedite NRXS targeting a $1.9 billion market opportunity from the estimated 400,000 patients diagnosed annually. Like its other treatments, this actively-enrolling study targets an unmet medical need, again potentially positioning NRXS to capture the value inherent to an approved and likely front-line therapy.

Infrastructure to Quickly Monetize Expected Approvals

Perhaps the most essential part of the NRXS value proposition is that, in addition to compelling assets, they have the infrastructure to meet demand. Its in-house capabilities utilize 69,000 square feet of space for its offices, factory, warehouse, and environmentally-controlled needs. That’s ample space for controlled and monitored manufacturing capacity, is sufficient in size for additional NRXS needs, and, most importantly, is FDA-registered, ISO-certified, and ITAR-registered to meet quality management standards and practices.

Furthermore, it shows that NRXS has assembled the pieces to deliver better treatments to the markets without diluting asset ownership. Strengthening its ability to stand alone are eight issued and eighteen pending patents covering devices and methods. These protections are valid through 2039 without adding to existing claims that enhance patent longevity. Even better, NRXS expects these patents to be protected internationally, which allows them to operate freely and negotiate from a position of strength regarding potential partnerships and licensing.

However, factoring in the entirety of NRXS assets and its capital position after its IPO, they likely can go it alone. Remember, they were indeed strong before last week’s IPO. But today, it’s fair to judge NRXS as being in the best position in its history to turn ambition into revenues. With cash, expert management, and treatment technology already generating revenues from a $9 billion sector, NRXS is doing what others can’t do: capitalize on PENFS technology that treats patients in a 21st-century manner.

No drugs, no surgery – just a better, safer, and more efficient treatment using neuromodulation to provide intended results. Combine that with NRXS’s industry-leading Medical Advisory Board, a tiny trading float, and operations and infrastructure to support growth and scale, the $14 price target earned may be more than appropriate; it’s justified.

Disclaimers: Trendingsmallcaps.com (TSM) is responsible for the production and distribution of this content. TSM is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by TSM is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall TSM be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by TSM, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. TSM strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, TSM, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. Trendingsmallcaps.com has been compensated up to twenty-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for NeurAxis, Inc. for a period of one month ending on September 4, 2023. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Contributors are under no obligation to accept revisions when not factually supported. Furthermore, because contributors are compensated, readers and viewers of this content should always assume that content provided shows only the positive side of companies, and rarely, if ever, highlights the risks associated with investment. Thus, readers and viewers should accept the content as an advertorial that highlights only the best features of a company. Never take opinion, articles presented, or content provided as a sole reason to invest in any featured company. Investors must always perform their own due diligence prior to investing in any publicly traded company and understand the risks involved, including losing their entire investment. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: Trending Smallcaps

Contact Person: Jeffrey Allen

Email: contact@trendingsmallcaps.com

Country: United States

Website: https://trendingsmallcaps.com/