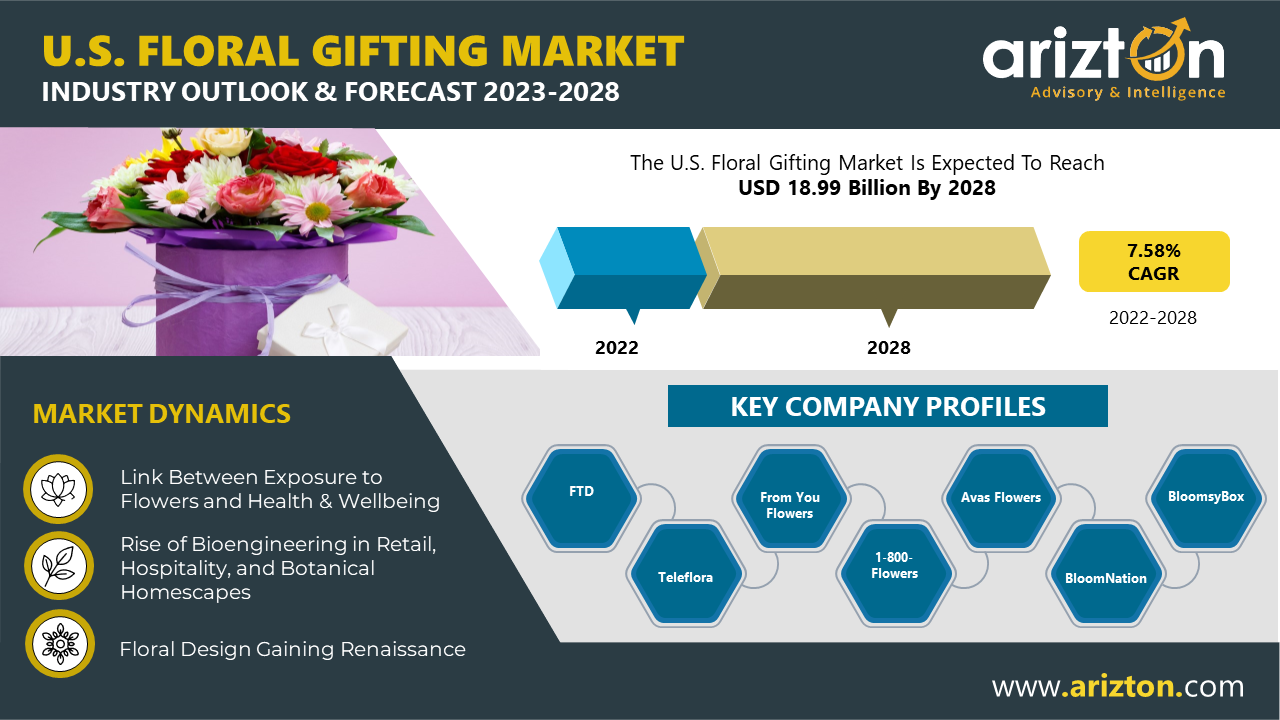

According to Arizton’s latest research report, the US floral gifting market will grow at a CAGR of 7.58% from 2022-2028.

To Know more, Download the Free Sample Report: https://www.arizton.com/request-sample/3802

The US is one of the world’s largest importers of cut flowers and foliage. According to data from the USDA, in 2020, the US imported approximately $1.6 billion worth of cut flowers. There is a consistent demand for flowers as a gifting option for various occasions, such as Valentine’s Day, Mother’s Day, and weddings. People in the US consider flowers as a memorable gift, and around 85-90% of people in the US remember the last time they gave flowers to someone. The growing awareness of environmental issues leads to increased demand for sustainably sourced and eco-friendly flowers and floral products. Advancements in technology are allowing vendors to offer more personalized and customized floral arrangements and improve supply chain management and delivery logistics.

The purchase of flowers is predominantly growing when obligatory events are in the picture. Weddings, funerals, graduations, and social engagements are occasions where the trend toward purchasing flowers is higher. There are also in-between moments, such as tumbleweed and ‘just because’ moments, and with consumers being more time-pressed than ever, floral gifts are more relevant than ever. Positioning flowers as gifts that will never cease to please can be a significant point of differentiation when competing with other gift options in the market. Vendors can look at the path to purchase habits of gift-givers and plug in this messaging via social and mobile channels to drive growth in the US floral gifting market.

The market also witnesses floral wire services that use a proprietary network communication system to take orders and pass them on to the members of the floral network. Their services include marketing clearinghouse services, among others, to support florists registered with the network. Smaller retail florists mainly depend on these networks for their orders. However, there is a decline in the number of retail florists, driving up rivalry in the market. This has been offset by the entry of other companies and non-florist retailers expanding their offerings to cover floral gifting.

Get 10% Free Customization Worth $1500: https://www.arizton.com/customize-report/3802

Personalization Key to Success

Consumers increasingly seek unique and customized gifts that show thoughtfulness and attention to detail. With the rise of e-commerce and online flower delivery services, vendors offer various personalization options to cater to this demand. Therefore, personalization options have become a significant factor driving the growth of the floral gifting market in the US. Personalization has become a keyway for vendors to differentiate themselves in a highly competitive market, proving to be a successful strategy for driving growth. Vendors can meet the needs and preferences of a broader range of customers by offering customization options, leading to increased sales and customer loyalty. As such, personalization is expected to continue to be a key driver of growth in the US floral gifting market.

The increasing penetration of the internet and smartphones has led to a surge in online sales. Online flower delivery platforms such as 1-800 Flowers, FTD, and Teleflora have become popular choices for customers. The convenience of ordering online, the availability of a wide variety of floral arrangements, and the ability to track deliveries have made online sales a preferred channel for many. In-store sales still account for a significant market share, particularly for last-minute purchases or customers who prefer the touch-and-feel experience before purchasing. Mobile sales are also rising as customers use their smartphones for on-the-go purchases. With the increasing popularity of online and mobile sales, traditional brick-and-mortar stores are adapting to new technologies to remain competitive. As the demand for convenience and ease of purchase continues to grow, the online and mobile segments are expected to drive the future growth of the US floral gifting market.

Vendors in the market need to work on growing the share of wallets. Self-gifting started because of the prevalence of sales during the holiday seasons. Since most of the advertising for the holiday season is around gifting others, vendors can provide stimulus to self-gifting by offering discount coupons to drive sales and increase profitability during a high point in the market.

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% of customization

California is One of the Major Floral Gifting Markets in the U.S

The US floral gifting market has grown in all regions in the US, but some areas are expected to witness more significant growth than others. The West and Northeast U.S. are anticipated to grow due to their large population and higher per capita income. The South and Midwest regions are also expected to grow significantly, but not as much as the West and Northeast.

California is one of the US’s largest markets for floral gifting due to its large population and tourism industry. The state is home to many florists and flower farms, and its mild climate makes it an ideal location for growing a wide variety of flowers. However, increasing competition and rising labor costs are factors affecting the market’s growth in the state.

Key Company Profiles

- FTD

- 1-800-Flowers

- Teleflora

- From You Flowers

- 5th Ave Floral

- Avas Flowers

- Benchmark Bouquets

- BloomNation

- BloomsyBox

- Blooms Today

- Farmgirl Flowers

- Floom

- Flora2000

- FloraQueen

- Flowerbud

- FlowerPetal

- JustFlowers.com

- KaBloom.com

- The Flower Shop

- The Bouqs

- Urban Stems

- Gotham Florist

- H. Bloom

- Venus Et Fleur

- Florists.com

- 1st in Flowers

- Kremp Florist

- Send Flowers

- Global Rose

- JUST FLOWERS DOT COM

- Winston Flowers

- Ode à la Rose

- The Sill

- Farm Fresh Flowers

- ENJOY FLOWERS

- Freytag’s Florist

- McShan Florist

- Phoenix Flower Shops

- U.S. Retail Flowers

- THE FLOWER SHOP ATLANTA

- Phillip’s Flowers & Gifts

- In Bloom Flowers

- BOKAY

- Flowers4Dreams

- Winston Flowers

- FLOWERS OF THE FIELD

Market Segmentation

Occasion

- Personal & Self-Gifting

- Wedding

- Corporate

- Sympathy

Platform

- In-store

- Online

- Mobile

Product

- Bouquets & Arrangements

- Stems

Purchase option

- One-time purchase

- Subscription

Buy the Report Now: https://www.arizton.com/market-reports/floral-gifting-market-in-united-states-2025

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.4 MARKET SEGMENTS

4.4.1 MARKET SEGMENTATION BY OCCASION

4.4.2 MARKET SEGMENTATION BY PLATFORM

4.4.3 MARKET SEGMENTATION BY PRODUCT

4.4.4 MARKET SEGMENTATION BY PURCHASE OPTIONS

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

7.1 MARKET OVERVIEW

7.2 REPORT OVERVIEW

7.3 OPPORTUNITY & CHALLENGE ANALYSIS

7.4 SEGMENT ANALYSIS

7.5 GEOGRAPHICAL ANALYSIS

7.6 COMPETITIVE LANDSCAPE

8 INTRODUCTION

8.1 OVERVIEW

8.1.1 SUPPLY CHAIN CRITICALITY

8.1.2 PRICING STRATEGIES

8.1.3 FACTORS IMPACTING FLORAL WHOLESALERS

8.2 US FLORAL IMPORTS

8.2.1 OVERVIEW

8.2.2 MIAMI FLORAL IMPORTS

8.2.3 CUT FLOWER IMPORTS THROUGH OCEAN SHIPMENTS

8.3 VERTICAL INTEGRATION IN THE MARKET

8.4 GIFTING INDUSTRY IN THE US

8.5 VALENTINE’S DAY 2022

8.6 CONSUMER TREND ANALYSIS

8.6.1 SELLING DIRECT-TO-CONSUMER: RECENT TREND

8.7 FLORAL GIFTING MARKET

8.7.1 FLOWER PRODUCTION

8.7.2 LOGISTICS & TRANSPORTATION

8.7.3 PACKAGING & PRESENTATION

8.7.4 RULES & REGULATIONS

8.8 CONSUMER BEHAVIOR

8.8.1 KEY CONSIDERATION DRIVERS

8.8.2 DEGREE OF VALUE

8.8.3 PURCHASE BARRIERS

8.9 GENERATIONAL INSIGHTS

8.9.1 MILLENNIALS

8.9.2 GENERATION X

8.9.3 BABY BOOMERS

8.10 TARIFFS, QUALITY STANDARDS, & CERTIFICATIONS

8.11 IMPACT OF COVID-19

8.11.1 OVERVIEW

8.11.2 FLOWER SHORTAGE

8.11.3 TECHNOLOGY IN FLORAL INDUSTRY AMID THE PANDEMIC

8.11.4 FLORAL INDUSTRY CRISIS INSIGHTS 2021

9 MARKET OPPORTUNITIES & TRENDS

9.1 HIGH DEMAND FOR PERSONALIZATION

9.2 RISING INCLINATION TOWARD HEALTH & WELLNESS

9.3 SPREAD OF FARMER-FLORIST MOVEMENT

9.4 RISING FOCUS ON LOCAL FLOWERS

9.5 BROADENING RANGE OF BOUQUET ELEMENTS

9.6 INCREASING DEMAND FOR SUSTAINABILITY

9.7 INTENSIFYING MICRO-REGIONALISM

9.8 INTRODUCTION OF FLAT-PACKED BOUQUETS

10 MARKET GROWTH ENABLERS

10.1 BETTER LOGISTICS AND DELIVERY

10.2 TECHNOLOGICAL DEVELOPMENT

10.3 RISE OF BIOENGINEERING IN RETAIL, HOSPITALITY, & BOTANICAL HOMESCAPES

10.4 LINK BETWEEN EXPOSURE TO FLOWERS AND HEALTH & WELLBEING

10.5 FLORAL DESIGN GAINING RENAISSANCE

10.6 INCREASING NUMBER OF NEW ENTRANTS IN THE INDUSTRY

10.7 DIMINISHING BARRIERS OF COST

10.8 GROWTH OF MULTI-CULTURAL AUDIENCES

10.9 RISK AVERSION DURING GIFT-GIVING

11 MARKET RESTRAINTS

11.1 COMPETITION FROM NON-FLORAL GIFT ITEMS

11.2 DEARTH OF UNIFIED CAMPAIGNS AGAINST ‘BLOOD FLOWERS’

11.3 INVESTMENTS IN DRIED & ARTIFICIAL FLOWERS

11.4 HIGH WASTAGE

11.5 RISING POPULARITY OF PLANT GIFTS

11.6 DISPARITIES AND ISSUES WITH FLOWER DELIVERIES

11.7 NEGATIVE PUBLICITY OF FLOWERS

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.3 SWOT ANALYSIS

12.3.1 STRENGTHS

12.3.2 WEAKNESSES

12.3.3 OPPORTUNITIES

12.3.4 THREATS

12.4 PEST ANALYSIS

12.4.1 POLITICAL

12.4.2 ECONOMIC

12.4.3 SOCIAL

12.4.4 TECHNOLOGY

12.5 FIVE FORCES ANALYSIS

12.5.1 THREAT OF NEW ENTRANTS

12.5.2 BARGAINING POWER OF SUPPLIERS

12.5.3 BARGAINING POWER OF BUYERS

12.5.4 THREAT OF SUBSTITUTES

12.5.5 COMPETITIVE RIVALRY

13 OCCASION

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 PERSONAL & SELF-GIFTING

13.3.1 MARKET SIZE & FORECAST

13.4 WEDDING

13.4.1 MARKET SIZE & FORECAST

13.5 CORPORATE

13.5.1 MARKET SIZE & FORECAST

13.6 SYMPATHY

13.6.1 MARKET SIZE & FORECAST

14 PLATFORM

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 IN-STORE

14.3.1 MARKET SIZE & FORECAST

14.4 ONLINE

14.4.1 MARKET SIZE & FORECAST

14.5 MOBILE

14.5.1 MARKET SIZE & FORECAST

15 PRODUCT

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 BOUQUETS & ARRANGEMENTS

15.3.1 MARKET SIZE & FORECAST

15.4 STEMS

15.4.1 MARKET SIZE & FORECAST

16 PURCHASE OPTIONS

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 MARKET OVERVIEW

16.3 ONE-TIME PURCHASE

16.3.1 MARKET SIZE & FORECAST

16.4 SUBSCRIPTIONS

16.4.1 MARKET SIZE & FORECAST

17 GEOGRAPHY

17.1 US FLORAL GIFTING INDUSTRY BY KEY STATES IN THE

17.1.1 OVERVIEW

17.2 CALIFORNIA

17.2.1 MARKET OVERVIEW

17.3 WASHINGTON

17.3.1 MARKET OVERVIEW

17.4 OREGON

17.4.1 MARKET OVERVIEW

17.5 FLORIDA

17.5.1 MARKET OVERVIEW

17.6 HAWAII

17.6.1 MARKET OVERVIEW

17.7 ALASKA

17.7.1 MARKET OVERVIEW

17.8 TEXAS

17.8.1 MARKET OVERVIEW

17.9 NEW YORK

17.9.1 MARKET OVERVIEW

18 COMPETITIVE LANDSCAPE

18.1 COMPETITION OVERVIEW

18.1.1 MARKETING

19 KEY VENDORS

19.1 FTD

19.1.1 BUSINESS OVERVIEW

19.1.2 PRODUCT OFFERINGS

19.1.3 KEY STRATEGIES

19.1.4 KEY STRENGTHS

19.1.5 KEY OPPORTUNITIES

19.2 1-800-FLOWERS

19.3 TELEFLORA

19.4 FROM YOU FLOWERS

20 OTHER PROMINENT VENDORS

20.1 5TH AVE FLORAL

20.1.1 BUSINESS OVERVIEW

20.1.2 PRODUCT OFFERINGS

20.1.3 KEY STRENGTHS

20.1.4 KEY STRATEGIES

20.2 AVAS FLOWERS

20.3 BENCHMARK BOUQUETS

20.4 BLOOMNATION

20.5 BLOOMSYBOX

20.6 BLOOMS TODAY

20.7 FARMGIRL FLOWERS

20.8 FLOOM

20.9 FLORA2000

20.1 FLORAQUEEN

20.11 FLOWERBUD

20.12 FLOWERPETAL

20.13 JUSTFLOWERS.COM

20.14 KABLOOM.COM

20.15 THE FLOWER SHOP

20.16 THE BOUQS

20.17 URBAN STEMS

20.18 GOTHAM FLORIST

20.19 H. BLOOM

20.20 VENUS ET FLEUR

20.21 FLORISTS.COM

20.22 1ST IN FLOWERS! AND !1ST IN FLOWERS!

20.23 KREMP FLORIST

20.24 SEND FLOWERS

20.25 GLOBAL ROSE

20.26 JUST FLOWERS DOT COM

20.27 WINSTON FLOWERS

20.28 ODE À LA ROSE

20.29 THE SILL

20.30 FARM FRESH FLOWERS

20.31 ENJOY FLOWERS

20.32 FREYTAG’S FLORIST

20.33 MCSHAN FLORIST

20.34 PHOENIX FLOWER SHOPS

20.35 U.S. RETAIL FLOWERS

20.36 THE FLOWER SHOP ATLANTA

20.37 PHILLIP’S FLOWERS & GIFTS

20.38 IN BLOOM FLOWERS

20.39 BOKAY

20.40 FLOWERS4DREAMS

20.41 WINSTON FLOWERS

20.42 FLOWERS OF THE FIELD

21 REPORT SUMMARY

21.1 KEY TAKEAWAYS

21.2 STRATEGIC RECOMMENDATIONS

22 QUANTITATIVE SUMMARY

22.1 MARKET BY OCCASION

22.2 MARKET BY PLATFORM

22.3 MARKET BY PRODUCT

22.4 MARKET BY PURCHASE OPTION

23 APPENDIX

23.1 ABBREVIATIONS

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/floral-gifting-market-in-united-states-2025