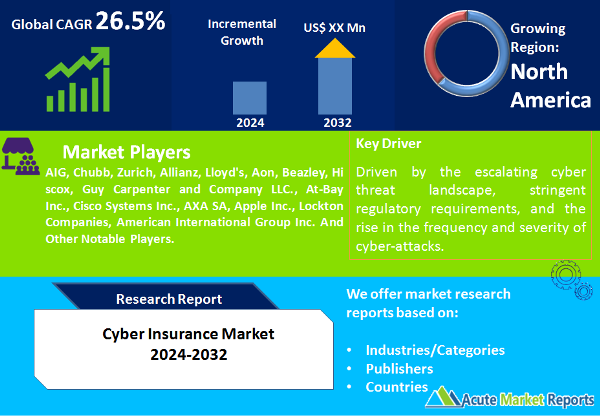

In the digital age, the cyber insurance market is indispensable for mitigating the financial risks associated with cyber threats and data intrusions. Over the period from 2024 to 2032, the cyber insurance market is anticipated to expand at a CAGR of 26.5%. This growth will be propelled by the intensifying cyber threat environment, regulatory oversight, and the increasing frequency and severity of cyber-attacks. Nevertheless, the process of quantifying cyber risk poses considerable obstacles. Market segmentation is a reflection of the varied requirements of organizations; liability coverage is anticipated to experience the highest CAGR, while customized policies are anticipated to gain prominence. From a geographical standpoint, revenue is notably concentrated in North America, whereas the Asia-Pacific region exhibits substantial potential for expansion. Competitive trends shed light on the tactics implemented by prominent entities such as Zurich, AIG, and Chubb. By capitalizing on strategic partnerships and fostering innovation, these businesses sustain a competitive advantage. Sustained success in the critical domain of modern risk management will require ongoing adaptation to evolving cyber risks, collaboration with cybersecurity experts, and resolution of risk quantification challenges as the cyber insurance market advances from 2023 to the forecast period of 2032.

The exponential growth of cyber threats—including ransomware attacks, data intrusions, and sophisticated cybercrimes—is the principal factor driving cyber insurance demand. Prominent examples such as the SolarWinds supply chain compromise and the Colonial Pipeline ransomware attack have demonstrated the ubiquitous and dynamic characteristics of cyber threats. Recognizing the potential financial ramifications of such incidents, organizations are progressively allocating resources toward cyber insurance as a precautionary measure against potential financial losses. The surge in the acquisition of cyber insurance by businesses spanning multiple sectors provides empirical support for the rehensive protection against the ever-changing cyber threat environment.

Organizations are compelled to acquire cyber insurance to comply with rigorous data protection and cybersecurity regulations worldwide, including the CCPA in California and the GDPR in Europe. Such coverage is essential for mitigating legal and financial risks and ensuring organizational compliance. Organizations such as Chubb and AIG have modified their cyber insurance products to correspond with the ever-changing regulatory environments. The continuous updates and enhancements to policy features serve as evidence that organizations possess the requisite coverage to adhere to regulatory frameworks. Due to the escalating intricacy of these regulations and the possible monetary ramifications of failing to comply, organizations are compelled to pursue resilient cyber insurance solutions.

Browse for the report at: https://www.acutemarketreports.com/report/cyber-insurance-market

The demand for cyber insurance is on the rise due to the escalating sophistication of threat actors and the escalating frequency and severity of cyber attacks. Prominent occurrences, including the Equifax data compromise and the NotPetya malware attack, have exemplified the extensive financial ramifications that can befall organizations. Prominent insurance providers, including Zurich and Allianz, have reacted by introducing customized insurance products and specialized cyber risk assessments. The proof is demonstrated through the ongoing adjustment of insurance products to counter emergent cyber threats, demonstrating a proactive stance toward risk mitigation. In light of the ever-changing cyber threat environment, businesses are coming to understand the critical importance of cyber insurance in bolstering their ability to withstand potential financial losses.

Notwithstanding the expansion of the cyber insurance sector, there continue to be obstacles in the precise quantification and evaluation of cyber risk. Due to the ever-changing and dynamic characteristics of cyber threats, insurers encounter challenges when attempting to establish standardized risk assessment methodologies. Lloyd’s and Aon are not an exception to this rule. The complexity of forecasting the financial ramifications of a cyber incident, taking into account elements like reputational harm and enduring business disruption, provides evidentiary support. Despite continuous progress in risk modeling, the formidable challenge of accurately anticipating the extent and gravity of cyber threats remains a substantial impediment. Insurers, cybersecurity professionals, and businesses must engage in ongoing cooperation to improve risk assessment methodologies and expand the industry’s collective comprehension of cyber risk to surmount this obstacle.

Get Sample Copy From https://www.acutemarketreports.com/request-free-sample/140056

The standalone policies that provided comprehensive coverage in isolation from other insurance products generated the highest revenue in the cyber insurance market in 2023. Tailored policies are anticipated to generate the maximum Compound Annual Growth Rate (CAGR) throughout the forecast period (2024-2032). The surge in this dynamic expansion can be attributed to the rising inclination of organizations to acquire tailored protection that corresponds with their particular cyber risk profiles and business activities. It is anticipated that customized policies will become more prevalent as businesses place greater emphasis on a nuanced and individualized approach to cyber insurance.

In 2023, the market was dominated by first-party coverage, which protected direct financial losses suffered by the insured organization. However, liability coverage is expected to experience the maximum CAGR throughout the forecast period. The rationale for this is supported by the dynamic regulatory environment, in which organizations are confronted with escalating legal obligations and monetary penalties for violations of data security. Liability coverage, provided by corporations such as Beazley and Hiscox, safeguards against the financial and legal consequences of third-party assertions. It reflects how the market reacts to the evolving nature of cyber threats. The aforementioned dual segmentation strategy is indicative of the varied coverage requirements of organizations that are committed to mitigating liability and ensuring financial security.

Geographically, North America generated the highest revenue percentage in 2023, due to the prevalence of stringent cybersecurity regulations and the sizeable market. The Asia-Pacific region, on the other hand, is anticipated to generate the maximum CAGR throughout the forecast. Increasing awareness of cyber hazards, regulatory developments, and the expansion of digital business operations in Asia-Pacific nations provide the evidence. The importance of insurers customizing their offerings to regional intricacies and engaging in partnerships with local enterprises to tackle distinct cyber risk challenges is underscored by these geographical patterns.

Prominent entities operating within the cyber insurance sector in 2023 encompassed AIG, Chubb, Zurich, Allianz, Lloyd’s, Aon, Beazley, Hiscox, Guy Carpenter and Company LLC., At-Bay Inc., Cisco Systems Inc., AXA SA, Apple Inc., Lockton Companies, and American International Group Inc. To improve their market positions, these businesses implemented a variety of strategies, such as product innovation, risk assessments, and collaborations with cybersecurity firms. AIG’s CyberMatics platform, which furnishes risk insights, and Chubb’s partnership with cybersecurity firms to provide comprehensive risk mitigation services, are the foundation of the evidence. As of 2023, the competitive environment signifies a dynamic market in which insurance companies are proactively adjusting to ever-changing cyber threats and utilizing technology to deliver comprehensive solutions. The competitive landscape for the forecast period (2024-2032) and revenues for 2023 indicate that market leaders are well-positioned to confront the dynamic and intricate characteristics of cyber threats.

For Latest News: https://www.mobilecomputingtoday.co.uk/news/

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com