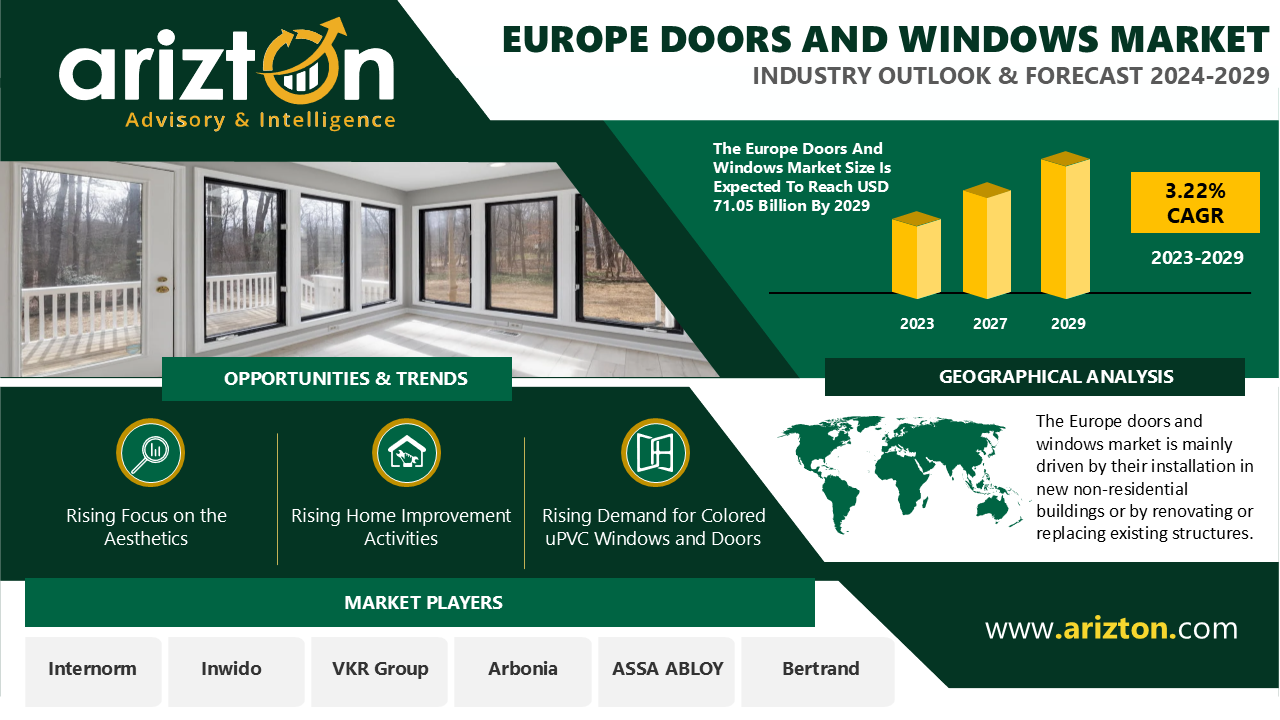

According to Arizton’s latest research report, the doors and windows market in Europe is growing at a CAGR of 3.22% during 2023-2029.

To Know More, Click: https://www.arizton.com/market-reports/europe-door-and-window-market

Report Summary

Market Size (Revenue): USD 71.05 Billion (2029)

Market Size (Revenue): USD 58.75 Billion (2023)

CAGR (2023-2029): 3.22%

Market Size (Shipment): 149.34 Million Units

Historic Year: 2020-2022

Base Year: 2023

Forecast Year: 2024-2029

Market Segmentation: Product, End-user, Type, Material, Installation, Operation, and Geography

Geographical Analysis: Germany, UK, Italy, France, Spain, Netherlands, Poland, and Nordic Countries (Sweden, Norway, Denmark, and Finland)

Stay ahead of the curve with Arizton’s exclusive subscription plan, offering in-depth analysis, market sizing, and growth forecasts for less than $900 per month—a significant value compared to individual report purchases. Click here: https://www.arizton.com/subscription

In 2023, the European window and door markets saw limited investment, particularly in new construction, due to high inflation, increased interest rates, and reduced real wages impacting consumer spending. The market experienced an unprecedented volume decline, with significant slowdowns in new construction projects in Sweden and Finland, leading to lower order intakes and sales, especially in the latter half of the year. Despite these challenges, Europe remains a leading market for doors and windows, with renovation and retrofit projects driving demand. In 2023, these activities accounted for nearly 59% of the revenue and 58% of the units sold. The region’s existing building stock is energy inefficient, prompting a shift towards eco-friendly technologies to reduce environmental impact. European residential, institutional, and commercial buildings are increasingly incorporating smart technologies to manage energy use, yet overall power consumption continues to rise. Buildings in Europe are major energy consumers, responsible for about 40% of total power consumption and 36% of CO2 emissions. The construction industry, being a major consumer of materials and energy, faces challenges with energy conservation, especially as residential buildings use a significant portion of their energy for space heating. Efforts are underway to improve building energy efficiency through updated codes and policies, but heat loss from poorly insulated doors and windows remains a concern.

Rising Renovation Trend Boosts Doors and Windows Market in Europe

Homeowners across Europe increasingly opt to renovate their existing properties rather than move to new ones. This shift is fueled by rising new construction costs, a desire to personalize living spaces, and a growing focus on energy efficiency and sustainability. This trend will continue driving demand in the doors and windows market, impacting replacement and new installation sectors.

A significant EU initiative to upgrade social housing aims to improve city living conditions. In Trieste, Italy, a model construction project is underway to create new green spaces and enhance existing ones, promoting outdoor activity and social interaction. This project, known as SUPERSHINE, is part of a broader EU research initiative funded to accelerate the renovation of homes for those struggling with energy costs. Launched in November 2022, SUPERSHINE is inspired by the New European Bauhaus (NEB) initiative and will run until March 2026.

With approximately 85% of EU buildings constructed before 2000 and 75% having poor energy performance, renovating Europe’s building stock is crucial to achieving a zero-emission goal by 2050. To support this, the EU-funded “Save the Homes” project developed one-stop shops in Rotterdam and Valencia, offering technical advice and funding information for renovations. This project, which concluded in February 2024, assessed energy-efficient renovations for around 1,600 residents in Valencia and completed renovations on 33 homes in Rotterdam.

The prevalent basic and standard European architectural practices and high adoption of framed doors and windows are favorable for the region’s doors and windows market. Unlike the Indian subcontinent’s preference for wooden doors and carpentry, Europe’s modern architecture drives demand for premium and stylish doors and windows.

Residential Segment Dominates European Door and Window Market with Significant Growth Forecast

In 2023, residential windows and doors drove the European market, capturing a substantial 64.74% share. This segment is anticipated to maintain its leading position through the forecast period, with an expected absolute growth of 22.17% by 2029. This dominance is fueled by increasing construction and renovation activities in residential buildings across Europe. While the commercial sector is also expected to grow, it will remain behind the residential segment throughout the forecast period.

Fragmented European Door and Window Market Faces Shift Towards High-Efficiency Products

The European door and window market remains highly fragmented, with over 5,000 manufacturers and a diverse range of small-scale vendors. Despite continuous product innovations, the sector has struggled with infrequent updates and longer replacement cycles, impacting overall demand. Recent trends indicate a growing shift towards high-efficiency doors and windows driven by increasing energy conservation efforts and government incentives to reduce carbon footprints.

Vendors are responding by integrating advanced features such as double and triple glazing and improved insulation capabilities. This shift is largely influenced by rising energy consumption concerns and new policies across Europe promoting energy efficiency. As a result, the market for innovative doors and windows, particularly in renovation and replacement projects, is expected to grow.

The market’s structure includes key stakeholders such as manufacturers of uPVC and aluminum profiles and fabricators who assemble and customize the final products. Despite a large number of small vendors, the market is consolidating, with large vendors pursuing acquisitions of smaller, locally significant businesses to strengthen their market position.

To remain competitive, vendors must adapt to technological advancements, manage production costs effectively, and offer unique value propositions. The anticipated growth will likely lead to increased market consolidation and a focus on differentiating products through high functionalities and modern features.

Buy this Research @ https://www.arizton.com/market-reports/europe-door-and-window-market

Key Company Profiles

-

JELD-WENBusiness Overview

-

Internorm

-

Inwido

-

VKR Group

-

AluplastBusiness Overview

-

Product Offerings

-

Anglian Home Improvement

-

Arbonia

-

ASSA ABLOY

-

Astraseal

-

Bertrand

-

Crystal Windows

-

Deceuninck

-

dormakaba

-

Drutex

-

Eko-Okna

-

Finstral

-

Ford Windows

-

Gartfen

-

Gealan

-

GEZE

-

Gilje

-

Goran

-

Gretsch-Unitas

-

Indigo Products

-

Josko

-

Karo

-

KEYOR

-

Korzekwa

-

MALERBA

-

Masonite

-

Neuffer Windows + Doors

-

NorDan

-

Nusco

-

Oknoplast

-

Piva Group

-

Profel Group

-

Profine Group

-

Rawington

-

REHAU Group

-

Reynaers Aluminum

-

Schuco International

-

Slowinscy

-

Svenska Fonster

-

Veka

-

Weru

Market Segmentation

-

Product: Doors and Windows

-

End-user: Residential and Non-residential

-

Type: Interior and Exterior

-

Material: Plastic & Glass, Wood, Metal, Composite, and Other

-

Installation: Replacement and New Construction

-

Operation: Manual and Automatic

-

Geography: Germany, UK, Italy, France, Spain, Netherlands, Poland, and Nordic Countries (Sweden, Norway, Denmark, and Finland)

Key Questions Answered in the Report:

Who are the key players in the Europe doors and windows market?

What are the significant trends in the Europe doors and windows market?

What is the growth rate of the Europe doors and windows market?

Which region dominates the Europe doors and windows market share?

How big is the European doors and windows market?

Check Out Some of the Top Selling Reports of Your Interest:

Door And Window Handles Market – Global Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/door-and-window-handles-market

Doors And Windows Market in North America – Industry Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/north-america-doors-and-windows-market-size-analysis

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

1hr of free analyst discussion

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/europe-door-and-window-market