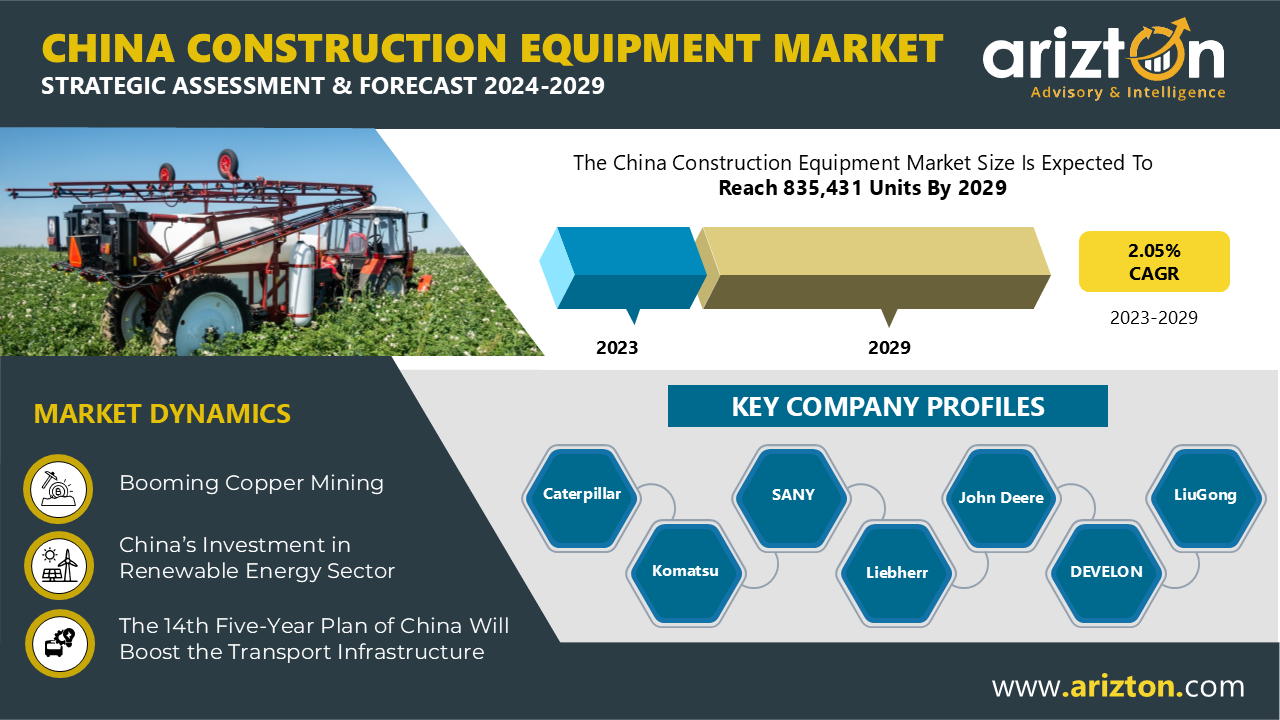

According to Arizton’s latest research report, the China construction equipment market is growing at a CAGR of 2.05% during 2023-2029.

To Know More, Click: https://www.arizton.com/market-reports/china-construction-equipment-market

Report Summary

Market Size (Volume): 835,431 Units (2029)

Market Size (Volume): 739,713 Units (2023)

CAGR (2023-2029): 2.05%

Market Size (Revenue): $74.85 Billion

Historic Year: 2020-2022

Base Year: 2023

Forecast Year: 2024-2029

Stay ahead of the curve with Arizton’s exclusive subscription plan, offering in-depth analysis, market sizing, and growth forecasts for less than $900 per month—a significant value compared to individual report purchases. Click here: https://www.arizton.com/subscription

The Chinese construction equipment market is witnessing significant growth, fueled by extensive infrastructure development. The Chinese government is heavily investing in redeveloping infrastructure projects, including the expansion of ports, railway lines, roadways, and highways nationwide. Ongoing investments under the ‘14th Five-Year Plan’ will continue driving the market throughout the forecast period.

China’s Green Hydrogen Investment Surges to $42 Billion, Leading Global Development

In 2024, China significantly increased its investment in the green hydrogen sector, reaching $42.04 billion, driven by supportive government policies. The country is spearheading green hydrogen advancements with extensive infrastructure plans, including hydrogen refilling stations and pipelines.

China is actively pursuing a low-carbon future with 57 ongoing green hydrogen projects and trials of hydrogen-powered transportation, such as trucks and ships. By 2030, green hydrogen is expected to account for 15% of China’s hydrogen output, with production costs projected to decrease. The nation’s progress in hydrogen technology includes successful pipeline experiments and national construction guidelines, aiming to establish a robust hydrogen energy industry by 2025.

China’s State Power Investment Corp. is investing $5.85 billion in a major project in Qiqihar, Heilongjiang province. This initiative will feature a 3.5-gigawatt wind power plant, a hydrogen production facility, and the generation of sustainable aviation fuel (SAF) and methanol from wind-powered hydrogen.

Recent Product Launches

-

As of April 2024, Dieci will show its first all-electric telehandler at Intermat, alongside the revised Pegasus range, featuring three unique lines. Notable offerings include the Essential 40.18, designed for the rental sector, boasting a 400° non-continuous rotation; and the high-performance Classic 75.25, equipped with Dual Energy, a detachable kit allowing operation without the internal combustion engine.

-

In Jan 2024, Kobelco announced the launch of a new telescopic boom crane, the TKE750G, with a maximum lifting capacity of 75 metric tons. It is also integrated with the EU Stage V-compliant engine.

-

In May 2023, Komatsu manufactured a concept vehicle, a medium-sized hydraulic excavator machine that uses a hydrogen fuel cell. In Feb 2024, Komatsu also launched a concept machine, a hydraulic excavator equipped with a hydrogen fuel cell.

-

In June 2023, Volvo CE launched a compact wheel loader L25 and compact excavator ECR25 under its electric vehicle equipment range in line with Singapore’s Green Plan strategy. Moreover, as per recent news from Volvo CE, it has announced that it will bring three compact excavators (EC35D, ECR35D and ECR40D) to North America.

China Construction Equipment Market Dynamics

Drivers

-

The 14th Five-Year Plan of China will boost the Transport Infrastructure

-

China’s Investment in Renewable Energy Sector

-

Booming Copper Mining

Trends

-

Investment in Green Hydrogen

-

Development of Waste-to-Energy Projects

-

High demand for Excavators

Challenges

-

China’s Real Estate Crises

-

Skilled Labor Shortage

-

High debt issue in the Chinese Economy

Buy this Research @ https://www.arizton.com/market-reports/china-construction-equipment-market

Key Vendors

-

Caterpillar

-

Komatsu

-

Xuzhou Construction Machinery Group (XCMG)

-

SANY

-

Zoomlion Heavy Industry Science & Technology Co., Ltd.

-

Volvo Construction Equipment

-

Hyundai Construction Equipment

-

Liebherr

-

John Deere

-

DEVELON

-

LiuGong

-

SUNWARD

-

Kobelco

-

Takeuchi Manufacturing Co., Ltd.

-

Hyundai Construction Equipment

-

JCB

-

Kubota

-

Yanmar

-

Terex Corporation

-

Manitou

-

Tadano

-

KATO WORKS CO., LTD.

-

Bobcat

-

Haulotte

-

Toyota Material Handling

-

Ammann

-

AUSA

-

Wacker Neuson

-

The Manitowoc Company, Inc.

-

Bomag

-

Aichi Corporation

-

SUMITOMO CONSTRUCTION MACHINERY CO., LTD.

-

Shantui Construction Machinery Co., Ltd.

-

Hangcha Group

-

HELI

-

SAKAI HEAVY INDUSTRIES, LTD.

-

Shandong Lingong Construction Machinery (SDLG),

-

Lonking

-

Xiamen XGMA Machinery Co., Ltd.

-

Yongmao

-

JLG

-

Skyjack

-

Dingli

Distributor Profiles

-

Mantrac Group

-

China Engineers Limited

-

Anhui Dachen Engineering Machinery Co., Ltd.

-

Beijing Komatsu Engineering Machinery Co., Ltd

-

Henan Wotong Construction Equipment Co Ltd

-

Shin Le Te Co., Ltd.

-

Anhui Qiaoyuan Construction Machinery Co., LTD.

Segmentation by Type

-

Earthmoving Equipment

-

Excavator

-

Backhoe Loaders

-

Wheeled Loaders

-

Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

-

Road Construction Equipment

-

Road Rollers

-

Asphalt Pavers

-

Material Handling Equipment

-

Crane

-

Forklift & Telescopic Handlers

-

Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

-

Other Construction Equipment

-

Dumper

-

Tipper

-

Concrete Mixer

-

Concrete Pump Truck

-

Segmentation by End Users

-

Construction

-

Mining

-

Manufacturing

-

Others (Power Generation, Utilities Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

Key Questions Answered in the Report:

How big is the China construction equipment market?

What are the trends in the China construction equipment market?

What is the growth rate of the China construction equipment market?

Who are the key players in the China construction equipment market?

Which are the major distributor companies in the China construction equipment market?

Check Out Some of the Top Selling Reports of Your Interest:

Thailand Construction Equipment Market – Strategic Assessment & Forecast 2024-2029

https://www.arizton.com/market-reports/thailand-construction-equipment-market

Indonesia Construction Equipment Market – Strategic Assessment & Forecast 2024-2029

https://www.arizton.com/market-reports/indonesia-construction-equipment-market

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

1hr of free analyst discussion

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1-312-235-2040/+1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/china-construction-equipment-market