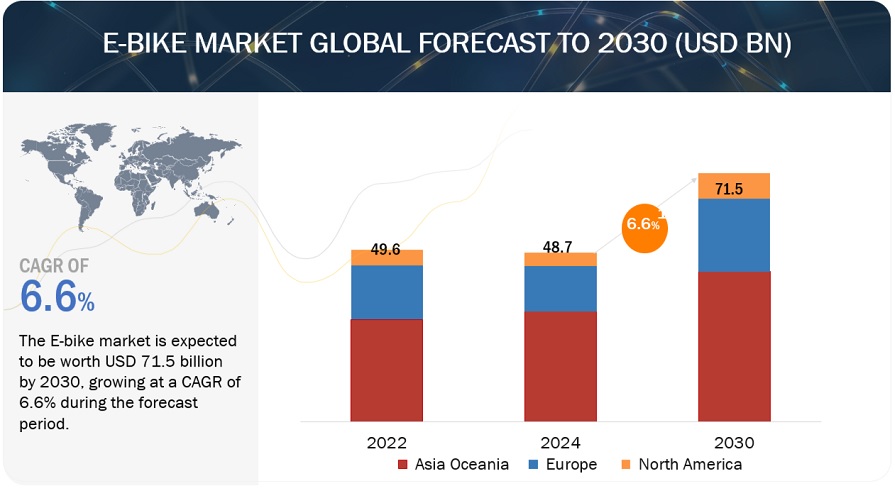

The e-bike market is projected to grow from USD 48.7 billion in 2024 to USD 71.5 billion by 2030, with a CAGR of 6.6%. The market experienced significant growth from 2019 to 2021, followed by steady growth in 2022. In 2023, e-bike sales declined again in some countries due to economic downturns, market uncertainty, and increased competition, which led to increased price competition. These trends are expected to be temporary, with growth anticipated to resume in 2024 and continue through 2026. The long-term outlook for the e-bike industry remains positive. While the global market for Class-I e-bikes is expected to dominate, Class-III e-bikes are projected to see promising growth during the forecast period, driven by increased demand for high-capacity e-bikes, particularly in North America. Cargo e-bikes and E-MTBs are experiencing a sudden demand as E-MTBs equip riders with the power to tackle challenging off-road adventures. The high-torque motors help them climb steeper hills, navigate rougher terrain, and maintain momentum on loose surfaces. E-cargo bikes offer a sustainable and efficient alternative to cars for short-distance hauling tasks. They can navigate traffic congestion and easily find parking, making them ideal for urban environments and efficient last-mile delivery options.

“>70NM motor power is estimated to be the fastest growing market for e-bikes over the forecast period.”

Riders increasingly seek e-bikes that can handle challenging terrains like hills, rough roads, or heavy cargo. Motors exceeding 70 NM offer the necessary muscle to maintain speed and conquer inclines. E-MTBs are a rapidly growing segment that heavily relies on powerful motors (often exceeding 70 NM) to navigate off-road adventures effectively. E-cargo bikes, particularly those designed for heavy loads, require powerful motors to maintain stability and efficiency while carrying groceries, equipment, or passengers. High-torque motors can contribute to achieving faster speeds, especially for Class III bikes on flat terrain. This can make commuting by bike more time-competitive than traditional bikes, especially for longer distances. North America is estimated to be the largest market for >70NM. The NILOX URBAN – Cargo e-bike C2 CARGO MID produces 80NM of torque, and the Pedibal E-Cruiza Fat Tyre Electric Bike 80NM are a few examples of >70NM motor power e-bikes.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=110827400

“City/urban bikes are projected to be the largest segment during the forecast period as they are a practical, cost-effective, and environmentally friendly solution for urban transportation.“

City/Urban e-bikes are estimated to be the largest e-bike segment during the projected period. City e-bikes are designed with comfort, ease of use, and practicality, making them well-suited for urban commuting. As e-bikes gain popularity as an eco-friendly and efficient mode of transportation in cities, the demand for electric city bikes has increased, fueling segment growth. E-bikes have lower running costs due to minimal electricity consumption for charging and require less maintenance than cars. The price range of City/Urban eBikes can range between USD 1,000 and USD 3,000. One of the critical reasons why city/urban electric bikes are regarded as environmentally friendly is their potential to lower carbon footprints. Research by the European Cyclist Federation highlights that in France, for instance, an e-bike produces only 9 grams of CO2 per kilometer. This is significantly lower than the average conventional vehicle, which emits 271 grams of CO2 per kilometer, making e-bikes about 30 times more efficient in emissions.

Asia Oceania is considered the region with the most significant city/urban e-bike sales in value in 2024. Cities with traffic congestion are shifting towards micro-mobility services, and most city/urban bikes are used for micro-mobility, like Hellobike (China), Anywheel (Singapore), Coo Rides (India), and many more. Prominent players who manufacture city/urban e-bikes are Giant Manufacturing Ltd. (Taiwan). Yadea Group Holdings Ltd. (China), Emotorad (India), and Trek Bicycle Corporation (US). Examples of City/Urban e-bikes include Rad Power Bikes RadCity 5 Plus, Tenways CGO600 Pro, Giant Escape+ E+ 3, Trek Verve+, and Specialized Turbo Vado 4.0.

“Europe is anticipated to be the second largest e-bike market in 2024 due to the rising demand for e-bikes.”

Ebike sales in Europe declined in 2023 due to several factors: the Russia-Ukraine war, a global economic slowdown, rising living costs, supply chain disruptions, and high retail inventory levels. According to data from Zweirad-Industrie-Verband (ZIV),. According to data from Zweirad-Industrie-Verband (ZIV), e-bike sales in Germany in 2023, is 2.0 million units and is declined by 8.0% from 2022. Besides replacing old bikes with new ones, there is an increasing trend of acquiring a second or third bike. The market is expected to grow slowly in the coming years due to government incentives, the growing popularity of e-bikes for commuting, and the increasing availability of ebike infrastructure. In July 2022 At Eurobike 2022 in Frankfurt (Germany), the CHAdeMO Association showcased its progress on EPAC standards, which include a unified charging plug, socket, and communication protocol. This initiative aims to create a straightforward charging station featuring a compact connector with a maximum output power of 800W (20A), optimized for eBikes. Additionally, the charging station will be compatible with existing eBikes. In May 2023, The European Declaration on Cycling, signed a significant commitment by the EU to advance sustainable transportation. Transport Commissioner Adina Vălean, along with prominent EU officials, endorsed cycling as a crucial element of Europe’s mobility strategy. The declaration aims to incorporate safe and comprehensive cycling networks with public transport systems, provide secure bike parking, and establish e-bike charging stations. These initiatives are intended to improve infrastructure, boost the popularity of cycling, and align with the EU’s broader industrial and environmental objectives. This will create emerging opportunities for the e-bike market by improving the infrastructure of the cities.

Key Market Players:

Major players operating in the Asia Oceania e-bike market are Giant Manufacturing Co. Ltd (Taiwan), Hero Lectro (India), TAV Systems (Australia), Yamaha Motor Company (Japan), Merida Industry Co. (Taiwan), and Emotorad (India).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=110827400

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-bike-market-110827400.html