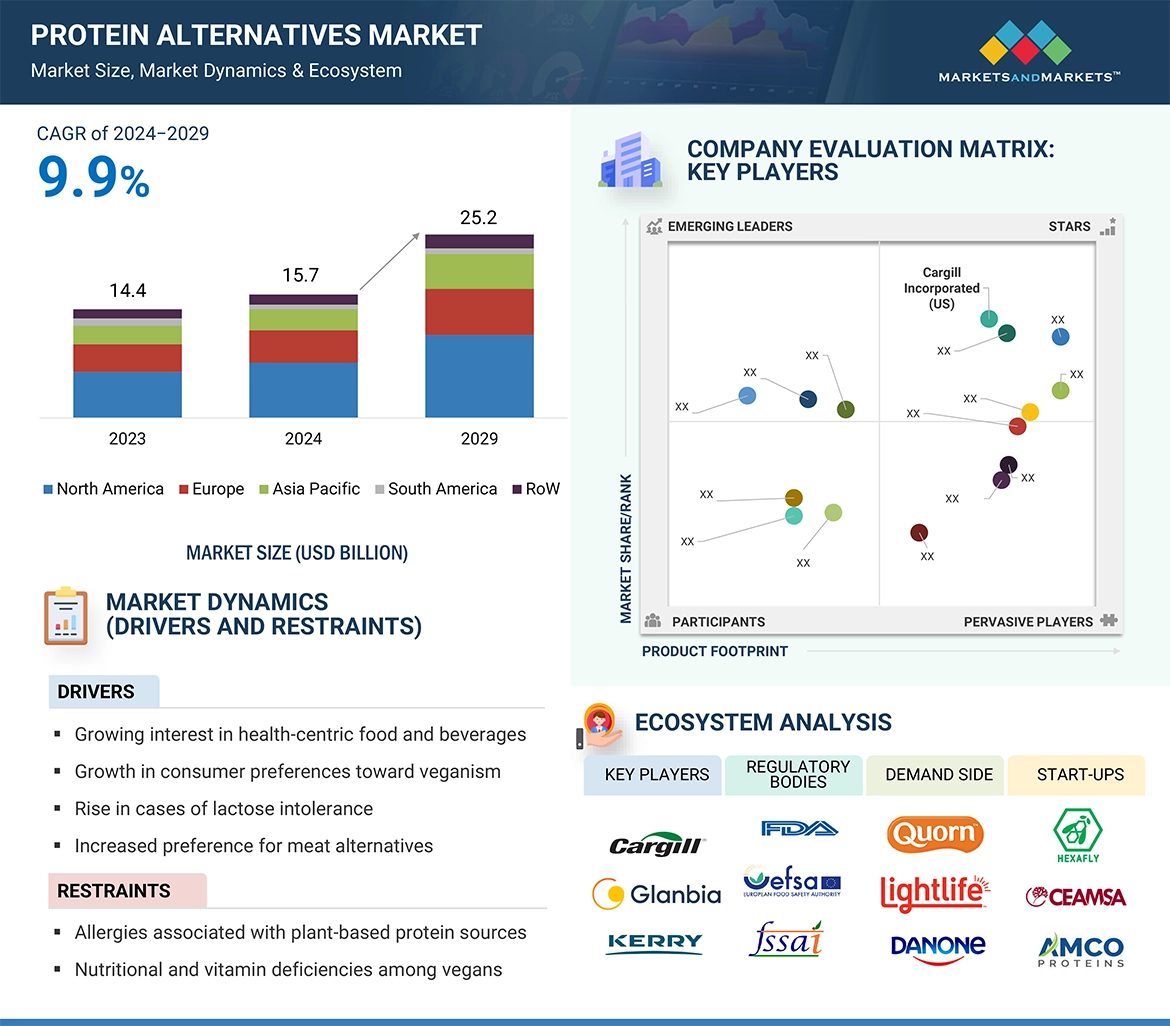

The global protein alternatives market size is estimated at USD 15.7 billion in 2024; it is projected to grow at a CAGR of 9.9% to reach USD 25.2 billion by 2029. The protein alternatives market has experienced rapid growth and diversification in recent years, driven by increasing consumer demand for sustainable, health-conscious, and ethically produced food options. Key drivers of this market include rising concerns over the environmental impact of traditional animal agriculture, the health benefits associated with plant-based diets, and ethical considerations regarding animal welfare. Major segments within the protein alternatives market include plant-based proteins, insect-based proteins, and microbial proteins. Companies like Beyond Meat, Impossible Foods, and Oatly have become household names, reflected the mainstream acceptance and expanding consumer base for these products. Technological advancements and significant investments from both food industry giants and venture capitalists have further accelerated the development and accessibility of innovative protein alternatives.

Protein Alternatives Market Drivers: Increasing Demand for Alternate Protein

The increasing global population underscores the necessity for alternative protein sources. Over the past decade, significant efforts have focused on developing proteins from non-traditional crops and livestock. This trend is particularly noticeable in Europe and North America, where consumer interest and investment in alternative proteins have surged. The conventional sources of animal protein like pork, beef, and chicken are projected to be insufficient to meet future demands, creating opportunities for the expansion of the insect protein market. In addition to proteins and fats, insects are valued for their rich mineral and vitamin content. Among younger demographics, particularly in sports nutrition, insect proteins, such as cricket flour, are gaining popularity and are being incorporated into various nutritious food products. For instance, startups like Next Step Foods in the UK produce cricket protein bars like “Yuana” available in multiple flavors.

The shift to alternative proteins also promises environmental benefits, notably in reducing greenhouse gas emissions compared to traditional meat production, as highlighted by the World Economic Forum in 2019. Moreover, adopting alternative proteins addresses diet-related health concerns in developing countries and promotes healthier lifestyles in developed regions such as North America and Europe. These areas have already embraced alternative protein sources such as edible insects, plant-based meat, plant protein ingredients, and cultured meat. Industry experts predict significant market growth potential for these products, with cultured and plant-based meat alone expected to see over 40% growth in the coming years.

In 2022, a study funded by the European Regional Development Fund revealed that 22% of UK consumers preferred alternative protein sources over meat, with the younger demographic showing an even higher preference exceeding 25%. These trends underscore the growing market opportunities in the insect protein sector.

Protein Alternatives Market Opportunities: Changes in consumer lifestyles

The global population’s expansion is placing heightened strain on limited resources, with escalating energy prices and raw material expenses impacting food costs, particularly affecting lower-income demographics. Additionally, the strain on food resources is being intensified by water scarcity, notably prevalent across Africa and Northern Asia. Within the Asia Pacific region, there exists a cost advantage in terms of both production and processing, fostering high demand and offering favorable conditions for dairy alternative suppliers and manufacturers to target this market.

As lifestyles evolve rapidly, there’s a noticeable shift towards more nutritious and health-conscious food options. The distinction between fast food and junk food is anticipated to grow, with consumers increasingly seeking quick yet wholesome alternatives. Recognizing naturally rich nutritional products presents a significant opportunity for suppliers and manufacturers to meet evolving consumer preferences.

Furthermore, the rise in disposable incomes is driving demand for convenient, healthy, and highly nutritious products across Asia Pacific nations. Emerging economies within the region present substantial opportunities for growth within the protein alternatives market.

Plant protein is estimated to be the fastest source segment in the protein alternatives market during the forecasted period of 2024–2029.

Plant protein has rapidly emerged as the frontrunner in the protein alternatives market, prized for its speed of adoption and nutritional benefits. With consumers increasingly focused on health, sustainability, and ethical considerations, plant-based proteins offer a compelling solution. Unlike traditional animal-derived proteins, which often come with environmental concerns and ethical debates, plant proteins are generally more sustainable to produce and consume.

One of the key reasons for the swift ascent of plant protein in the market is its versatility. Manufacturers can extract protein from a wide array of plant sources, such as peas, soybeans, hemp, and even algae, offering a diverse range of products that cater to different dietary preferences and needs. This diversity fuels innovation, leading to products that not only match but sometimes surpass their animal-based counterparts in taste, texture, and nutritional profile.

Furthermore, plant protein’s rapid digestion and absorption rate make it highly appealing to athletes and health-conscious individuals seeking efficient protein sources for muscle recovery and overall wellness. As research continues to highlight the health benefits of plant-based diets, including reduced risks of chronic diseases, the popularity of plant protein is expected to continue its meteoric rise in the protein alternatives market.

Make an Inquiry to Address your Specific Business Needs: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=233726079

The North American region is projected to dominate the protein alternatives market.

North America stands as the dominant region in the protein alternatives market, owing to its robust infrastructure, technological advancements, and growing consumer demand for sustainable food sources. This leadership is underscored by strategic developments such as in January 2022 ADM’s (US) collaboration with Innova Feed (France), aimed at supplying insect protein for ADM’s pet food division while leveraging waste heat and water resources effectively. This partnership not only enhances ADM’s product offerings but also reinforces sustainability initiatives in the pet food industry. Similarly, In May 2021, Cargill’s (US) strategic partnership with InnovaFeed (France) focuses on supplying insect feed for aquaculture and integrating insect oil into pig feed, addressing the increasing need for innovative protein sources in animal nutrition. These collaborations highlight North America’s pivotal role in advancing protein alternatives through strategic alliances that promote sustainability and technological innovation in the food and feed sectors.

Top Protein Alternatives Companies

Key Market Players in this include Tate & Lyle PLC (London), Kerry Group PLC (Ireland), DSM Firmenich (Switzerland, ADM (US), Cargill Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland), AGT Food and Ingredients (Canada), Tate & Lyle (UK), PURIS (US), Ynsect (France), Global bugs (Thailand), and Innovafeed (France).

ADM (US)

ADM, known formally as the Archer Daniels Midland Company, is a significant entity in multiple industries, including food ingredients, animal feed, biofuels, and industrial chemicals. With a rich history exceeding a century, ADM has developed a diverse portfolio that spans the entire agricultural value chain. The company excels in sourcing, processing, and distributing agricultural commodities globally, particularly grains and oilseeds. ADM’s extensive network of facilities and logistics infrastructure enables efficient connections between farmers and customers worldwide.

In the nutrition sector, ADM is recognized as a global leader, especially in plant protein innovation. With 75 years of expertise, it is one of the world’s largest soybean processors. ADM operates through four main segments: Ag Services and Oilseeds, Carbohydrate Solutions, Nutrition, and Other Business. The company offers a wide range of protein alternatives which are plant-based, suitable for various food applications, from bakery goods to meat alternatives.

ADM’s global presence spans North America, South America, Europe, Asia Pacific, and Africa, supported by a comprehensive supply chain network that includes crop procurement locations, manufacturing facilities, innovation centers, and transportation networks.

Cargill, Incorporated (US)

Founded in 1865, Cargill, Incorporated has grown to become one of the largest privately held companies in the United States, with a robust global footprint. The company provides a wide range of products, including food ingredients, bio-industrial goods, animal nutrition solutions, protein, salt, and financial services. Cargill operates through 75 business units organized into four primary segments: agriculture, food, financial services, and industrial products.

Cargill’s plant-based protein offerings are integral to various food products such as bread, snacks, confectionery, and culinary ingredients. The company maintains strategically located research and development facilities in Europe and North America, and its operations span across Africa, Europe, Asia, Latin America, North America, and the Middle East. Cargill operates in 70 countries through its subsidiaries and affiliates, with notable subsidiaries including Cargill Meat Solutions (US), Cargill Enterprises Inc. (Russia), and Cargill Asia Pacific Holdings Pte Limited (Singapore).

In addition to plant-based proteins, Cargill also offers a range of protein alternatives that include both plant-based and microbial-based options. These alternative proteins are increasingly incorporated into a variety of food products to meet the growing demand for sustainable and nutritious food sources. By leveraging its extensive global network and advanced research capabilities, Cargill is at the forefront of innovation in the alternative protein market, ensuring that their products not only meet but exceed consumer expectations for taste, texture, and nutritional value.

Protein Alternatives Industry News:

In January 2024, Ÿnsect became the first company authorized to commercialize mealworm proteins for dog food in the United States as of January 24, 2024. This milestone allows Ÿnsect to expand its sustainable insect protein offerings into the US pet food market, meeting the rising consumer demand for eco-friendly pet nutrition. This authorization is expected to enhance Ÿnsect’s market presence and support the trend of using insect-based proteins in pet food.

In February 2024, Roquette expanded its Nutralys plant protein line by launching four new pea protein products, encompassing isolates, hydrolysates, and textured variants. These versatile pea proteins are designed to address formulation challenges in plant-based foods and high-protein nutritional products. They pave the way for innovation in various items, including nutritional bars, protein beverages, and plant-based meat and dairy alternatives.

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=233726079

About MarketsandMarkets™

MarketsandMarketsTM has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/alternative-protein-market-233726079.html