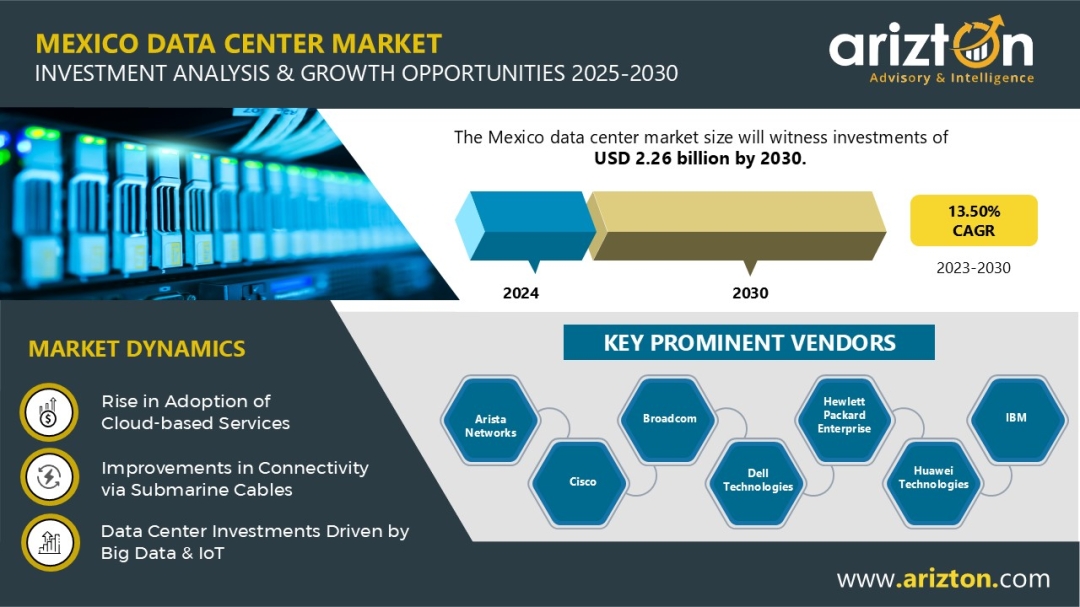

According to Arizton’s latest research report, the Mexico data center market is growing at a CAGR of 13.50% during 2024-2030.

Looking for More Information? Click: https://www.arizton.com/market-reports/mexico-data-center-market-investment-analysis

Report Scope:

Market Size -Investment (2030): $2.26 Billion

Market Size – Area (2030): 422 Thousand Sq. Ft

Market Size – Power Capacity (2030): 96 MW

CAGR -Investment (2024-2030): 13.50%

Colocation Market Size – Revenue (2030): $740 Million

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

Mexico is poised to play a key role in the expansion of data centers across Latin America, driven by its digital transformation initiatives, rising IoT devices, and growing Big Data analytics. Its strategic location near the US enhances its appeal for low-latency solutions and disaster recovery. The country is improving connectivity with new submarine cables and is supported by MEXDC, which unifies stakeholders and promotes industry growth. Key players like Equinix and KIO Networks are expanding, with Queretaro emerging as a major hub. Government initiatives, such as tax incentives and simplified processes, foster the digital economy. Challenges like rising costs due to inflation are expected but overcome by ongoing investments in infrastructure. In 2024, new legislation for AI development strengthens Mexico’s position as a technological leader.

Investment Opportunities in Mexico

- In January 2024, AWS announced the launch of its new cloud region named as AWS Mexico (Central) Region in Queretaro with three availability zones. The new cloud region is a part of the company’s announcement to invest around $5 billion in Mexico for 15 years.

- In December 2024, Google launched its new cloud region in Queretaro, named as (northamerica-south1), which includes three availability zones. This new cloud region is expected to create over 100,000 jobs and add more than $11 billion to Mexico’s GDP by 2030.

- In September 2024, Oracle Cloud announced its plan to launch a new cloud region in the Nuevo León area of Mexico. Once operational, it will be the company’s third cloud region in the country.

Mexico’s Advancements in Submarine and Inland Connectivity

Mexico is significantly advancing its digital infrastructure through substantial investments and strategic partnerships aimed at enhancing connectivity across the region. The ongoing expansion of submarine cable infrastructure plays a key role in boosting the country’s data center market, improving international bandwidth, and reducing latency. This positions Mexico as a vital hub for global data flow in Latin America.

As of January 2025, Mexico operates seven submarine cables, with four additional cables set to launch in the next 2–3 years. Notable developments include DE-CIX’s expansion with new Internet Exchanges in Mexico City and Queretaro, strengthening connections between North and South America.

Key submarine cable projects include:

- Bifrost Submarine Cable: Set for service in Q1 2025, this high-capacity cable spans 12,358 miles and is a collaborative effort by Keppel T&T, Meta, and Telin.

- MANTA Submarine Cable: Expected to be operational by 2027, this 3,480-mile cable, owned by Gold Data, Liberty Latin America (LLA), and Sparkle, will connect Colombia, Mexico, Panama, and the US.

- TAM-1 Submarine Cable: Ready for service in 2025, this 4,350-mile cable, owned by Trans Americas Fiber, links several countries, including Mexico, Costa Rica, and the US.

These developments enhance Mexico’s role in the digital economy, expanding global connectivity and supporting regional growth in data services.

Mexico’s Growing Technological Hub: Advancements in Big Data and IoT

Mexico is emerging as a leader in technological innovation, particularly in Big Data and the Internet of Things (IoT). These advancements reflect the country’s ongoing commitment to integrating cutting-edge technologies into its economic, industrial, and urban development strategies.

As the second-largest economy in Latin America, Mexico boasts one of the region’s highest levels of mobile and internet penetration. The IoT market in Mexico is expected to generate $12 billion in revenue by 2025, with an annual growth rate of 11% (CAGR 2025–2029), reaching over $18 billion by 2029.

The Mexican government has prioritized digital transformation, incorporating programs like Mexico Digital to foster innovation and expand access to technology. Both public and private investments in IT infrastructure create a favorable environment for IoT and data-driven solutions.

Notable IoT applications in Mexico include:

Arantec’s Disaster Prevention Technology: Arantec uses IoT solutions to monitor climatic conditions, river flows, and water quality, helping to predict and prevent natural disasters such as landslides, droughts, fires, and floods.

Smart Farming: IoT-enabled sensors are revolutionizing agriculture by providing real-time data on soil moisture, temperature, and nutrient levels, which helps farmers optimize crop yield and resource use.

Urbanization is another key trend, with over 80% of Mexico’s population living in urban areas. Cities like Mexico City, Guadalajara, and Monterrey have launched smart city initiatives to address issues like traffic congestion, pollution, and public safety.

Industries such as BFSI (banking, financial services, and insurance), healthcare, education, energy, and telecom are increasingly adopting Big Data and IoT technologies. For example, the finance sector is leveraging these technologies to improve operational efficiency and enhance customer experience.

The growing adoption of Big Data and IoT technologies necessitates high computing power and results in substantial data traffic. This, in turn, drives demand for data centers, high-performance servers, and advanced infrastructure like converged and hyperconverged systems to manage large volumes of data and support future growth.

Why Should You Buy this Research?

This research provides a detailed overview of Mexico’s data center market, covering investment trends, colocation revenue forecasts (2021–2030), and the market landscape. It includes data on existing (39) and upcoming (11) data centers, with insights on IT load capacity, area size, and power capacity. The study also analyzes market trends, growth opportunities, and restraints, along with pricing models for wholesale and retail colocation. Additionally, it profiles key players in IT infrastructure, construction, and support services. With forecasts and comprehensive data, this report offers valuable insights into Mexico’s growing data center market.

Book the Free Sample Now: https://www.arizton.com/market-reports/mexico-data-center-market-investment-analysis

The Report Includes the Investment in the Following Areas:

IT Infrastructure

- Server Infrastructure

- Storage Infrastructure

- Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Rack

- Other Mechanical Infrastructure

Cooling Systems

- CRAC and CRAH Units

- Chillers Units

- Cooling Towers, Condensers and Dry Coolers

- Other Cooling Units

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Building & Engineering Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Vendor Landscape

IT Infrastructure Providers

- Arista Networks

- Broadcom

- Cisco

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Lenovo

- NetApp

- Oracle

- Pure Storage

- Supermicro

Data Center Construction Contractors & Sub-Contractors

- AECOM

- Aceco TI

- DLR Group

- Fluor Corporation

- Gensler

- KMD Architects

- Mendes Holler Engineering

- Soben

- Syska Hennessy Group

- The Weitz Company

- Turner Construction

Support Infrastructure Providers

- ABB

- Alfa Laval

- Axis Communications

- Bosch Security & Safety Systems

- Caterpillar

- Cummins

- Daikin Applied

- Delta Electronics

- Detroit Diesel

- Eaton

- Honeywell

- Johnson Controls

- Legrand

- Mitsubishi Electric

- Munters

- Piller Power Systems

- Panduit

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Data Center Investors

- Amazon Web Services

- Ascenty

- Equinix

- HostDime

- KIO Networks

- Mexico Telecom Partners

- Microsoft

- ODATA (Aligned Data Centers)

- Scala Data Centers

New Entrants

- CloudHQ

- EdgeConneX

- Layer 9 Data Centers

- MDC Data Centers

Key Questions Answered in the Report:

How big is the Mexico data center market?

How much MW of power capacity will be added across Mexico during 2025-2030?

What factors are driving the Mexico data center market?

What is the growth rate of the Mexico data center market?

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/mexico-data-center-market-investment-analysis