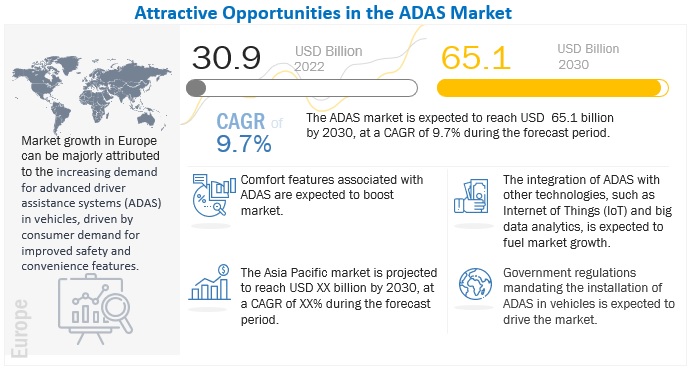

The ADAS market is projected to grow from USD 30.9 billion in 2022 to USD 65.1 billion by 2030, registering a CAGR of 9.7%. The demand for Advanced Driver Assistance Systems (ADAS) is increasing quickly due to the rise in traffic accidents on a global scale. To make driving safer and cut down on accidents, automakers are heavily investing in the development of these technologies. Customers are increasingly choosing vehicles with ADAS capabilities as they become more aware of the safety advantages of these systems. The need for ADAS is being further increased by governments drafting legislation to make such systems required in vehicles.

BEV segment to be the largest market by value during forecast period

BEVs have an increasing demand due to concerns about emission reductions worldwide. Due to the low availability of charging stations and the high cost of EV batteries, BEVs had a low demand. However, the demand for BEVs has increased significantly due to the decreasing cost of EV batteries at a fast and steady rate coupled with increasing EV range and a growing EV charging network worldwide. BEVs contributed to a considerable part of top-selling EVs in the market in 2022. BEVs are available in multiple segments, including sedans, SUVs, and hatchbacks. Many OEMs are launching electric vehicles to cater to the market demand. Tesla, Volkswagen AG (Germany), SAIC Motors (China), BYD, and Stellantis (Netherlands) are the pure electric vehicle companies topping sales. In contrast, OEMs such as Nissan, Toyota, and GM offer tough competition to electric vehicle manufacturers. Tesla is a bestseller in North America and Europe, whereas Wuling HongGuang Mini EV is a low-cost EV popular in China. BEV models such as Tesla Model X offer autopilot ADAS features, including adaptive cruise control, auto park, and lane departure warning systems. OEMs such as Nissan, BMW, Mercedes Benz, Ford, GM, and others provide ADAS features across their premium models. For instance, Nissan offers pro-pilot features to its Nissan Leaf and Nissan Altima electric cars. The pro-pilot ADAS features include ACC, IPA, and LDW. Similarly, Mercedes Benz provides a drive-pilot for its S Class model, which comes with autonomous emergency braking, blind spot detection, lane change warning, evasive steering assist, traffic jam assist, speed limit assist, and remote parking assist. Mercedes is one of the best providers of level 3 automation in passenger cars.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1201

Software to be the fastest growing segment during the forecast period

Increasing demand for accurate and faster object recognition will be a major growth driver for the software segment of the ADAS market. Modern vehicles are equipped with high-resolution cameras and long-range radar sensors for driver assistance. Hence, developments in image recognition technology will play a critical role in deploying these sensors in upcoming vehicles. Newer features such as pedestrian recognition, cyclist recognition, vehicle detection, driver monitoring systems, and traffic sign recognition are being tested, and plans to roll them out in more vehicles for improved occupant safety are underway. More sophisticated ADAS features would demand faster and more accurate software algorithms/platforms for detecting objects with low latency. BlackBerry (Canada) has developed QNX as a modular, flexible, and hardware-optimized software platform for ADAS applications. ADAS software consists of algorithms that perform pre-decided functions based on the input data from cameras, radar, LiDAR, and ultrasonic sensors. The input data is processed by the ECUs and activates the physical vehicle components such as steering, brakes, throttle, and others to evade accidents. The entire process is controlled and monitored by the software platform, from analyzing the input data to the decision-making. Automakers are turning toward deep learning as they look for innovative ways to enable smart camera applications and automated driving systems for next-generation vehicles. In December 2020, Renesas Electronics (Japan) developed an R-car software development kit. This complete software platform enables quick and easy software development and offers validation for smart cameras and automated driving applications used in commercial, passenger, and off-road vehicles. It manages the software complexity and supporting features ranging from entry safety compliance to advanced highway pilot.

“Europe is leading the ADAS market as of 2022”

Automotive is one of the key industries in Europe. In June 2022, the region had 301 automobile assembly and production plants, of which 134 produce passenger cars, 41 produce vans, 52 build trucks, 66 produce buses, 72 make engines, and 18 make batteries. According to the European Automobile Manufacturers Association (ACEA), Europe accounted for around 22% of global vehicle production in 2022. The European automotive market registered steady growth in the last six years despite the recent global automotive slowdown. Leading European automotive manufacturers to offer high-performance engines and advanced safety features to stay competitive. Passenger car sales of major automakers such as the Volkswagen Group, Mercedes Benz, Renault, Hyundai, BMW, Toyota, and Stellantis led to the demand for ADAS-enabled vehicles in the region.

According to experts, stringent emission regulations and zero emission targets in Europe would majorly affect both passenger car and commercial vehicle manufacturers during the forecast period. The growth of the European ADAS market can be attributed to technological advancements in driver assistance features such as traffic jam assist and blind-spot detection with rear cross-traffic and mandates that have been set up since July 2022 or features such as DMS, AEB and LCW in passenger cars. The growing shift to EVs and the growing demand for road safety will increase ADAS demand in the region.

Key Market Players:

The ADAS market is dominated by established players such as Robert Bosch (Germany), Denso (Japan), Continental AG (Germany), Magna International (US), and ZF Friedrichshafen (Germany), among others. These companies provide ADAS components to global OEMs. These companies have set up R&D infrastructure and offer best-in-class products to their customers.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1201

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/driver-assistance-systems-market-1201.html