At the beginning of 2021, many industries around the world are facing the same problem: chips are out of stock. The global shortage of chips is becoming more and more serious, the automobile industry is affected, the mobile phone industry is also affected, and the prosperity of the semiconductor industry continues to rise. Partly because of the epidemic, factories stopped running, production capacity was reduced and chips were out of stock. Then, the Corona Virus Disease 2019, COVID-19 around the world, and the shortage of chips became even more serious. The epidemic began to spread around the world, resulting in a surge in demand for PCs, cameras, keyboards, displays and tablets. In addition, 5g has further boosted demand, and the demand of smart phone industry has almost recovered to the level before the pandemic. At the same time, by the end of 2020, the sales of new cars will increase greatly, and the market demand will take general motors, Ford and Honda by surprise, resulting in a serious shortage of auto chips. The SSD master chip, which was not a problem, also had trouble. On the one hand, the capacity of TSMC, liandian and other foundry factories continued to be tight. On the other hand, Samsung’s 12 inch wafer factory in the United States was cut off from water and power, and the production was interrupted, further aggravating the problem. There was also a shortage of various electronic components, such as inductors, capacitors, resistors, PCBs, and so on It also affected the whole electronic industry.

1. In the automotive industry, many chip suppliers focus on the more popular products such as smart phones during the epidemic period, which leads to the shortage of chip supply in the automotive industry and the restraint of automobile production capacity. Many automotive enterprises, such as Volkswagen, Ford and Toyota, have to take measures to deal with the crisis;

2. In the security industry, some enterprises say that cameras need main control chips, memory chips, WiFi chips and other components, which account for about 60% of the total cost of products. At present, in addition to the difficulty in ordering, the prices of many chips have increased to varying degrees.

3. In the semiconductor sector, with the global semiconductor equipment expenditure entering the rising cycle, China has become the largest semiconductor equipment market as the semiconductor industry moves to China. According to the previous research report of CITIC Securities, Yangtze storage, Huahong group, SMIC international, Changxin storage and other wafer factories are actively expanding their production, driving the growth of domestic semiconductor equipment market to double that of the world. Under the tight industry capacity, the expansion progress is expected to accelerate. In fact, last year, the global semiconductor industry boom continued to improve, and the performance of A-share semiconductor leader in the market is expected to rise. Huajin securities research report pointed out that during the Spring Festival, a blizzard broke out in Texas in the United States, a number of semiconductor companies including Samsung, NXP and Infineon partially stopped production, and a 7.3 magnitude earthquake occurred in Japan, resulting in the shutdown of semiconductor manufacturing and raw material factories including Renesas electronics, and the shortage of semiconductors will be further aggravated.

Judging from the latest financial reports recently released by overseas semiconductor manufacturers and the revenue data in January released by Taiwan manufacturers, both of them achieved year-on-year growth that exceeded expectations, benefiting from the strong recovery of demand for consumer electronics, automotive semiconductors, etc. At present, we see that some manufacturers plan to expand their production capacity to cope with the upward cycle of the industry, including wafer manufacturing, packaging and testing and other manufacturers. Therefore, the semiconductor industry continues to rise, and domestic supply chain manufacturers will still benefit in the next 1-2 quarters, especially those with market scale effect. In terms of market performance, on the 23rd of this month, semiconductor chip stocks continued to adjust after the weakness of the previous trading day. Within the plate, only Ruixin micro (603893-cn) rose by more than 6%, with the largest increase; Longli Technology (300752-cn) and Jingchen shares (688099-cn) rose by more than 5%, with most of the other stocks falling.

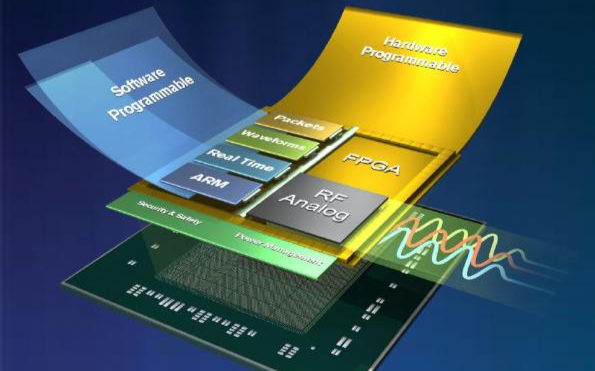

To this end, FPGAMALL relevant people said that from the current many chip enterprises and process requirements, in 2021, the temporary shortage of chips will be further eased, domestic chip enterprises will usher in an important development opportunity, the demand for security chips will be met in a wider range, the cost will enter a more reasonable category, and the technology will be upgraded and iterated.

Media Contact

Company Name: FPGAMALL

Email: Send Email

Phone: +00852-56428680

Address:Jiahe Building, ZhongHang Road

City: Shenzhen

State: Guangdong

Country: China

Website: https://www.fpgamall.com/