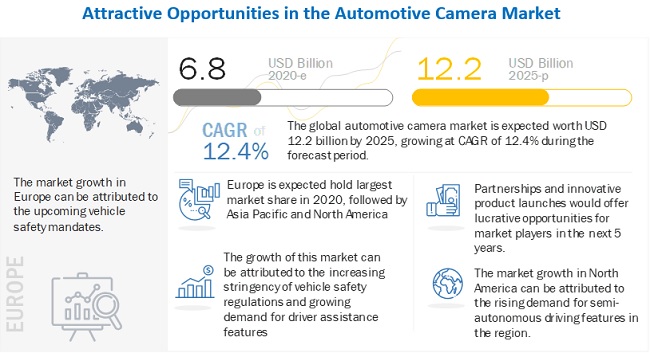

The Automotive Camera Market is projected to grow at a CAGR of 12.4% during the forecast period. It is estimated to be USD 6.8 billion in 2020 and is projected to reach USD 12.2 billion by 2025. The market growth is primarily driven by factors such as regulatory changes and increasing demand for active safety system.

The emergence of newer safety technologies in the automotive industry and the growing demand for electric cars have driven the automotive camera market. Added safety and convenience for the driver has been a major objective of developing camera systems. Moreover, the increasing government mandates related to active safety system are driving the automotive camera market. For instance, in May 2018, the government of Canada and the US mandated that all vehicles under 10,000 pounds must be equipped with a backup camera. Also, the US government has a voluntary agreement with many manufacturers to fit autonomous emergency braking (AEB) by 2022. European governments are focusing on mandating ADAS such as an emergency braking system and lane departure warning system. These mandates are expected to drive the automotive camera market. However, the regional adoption of camera technology varies according to government norms and customer preference. Moreover, vehicle manufacturers plan to offer advanced features such as a multi camera system in vehicles to acquire more customers and boost profitability, thereby inflating the growth of the automotive camera market.

The Asia Pacific automotive camera market is expected to grow at the highest rate, followed by North America, RoW and Europe. The growth of the Asia Pacific market can be attributed to the growing automotive sector in countries such as China, Japan, South Korea, and India. Low automobile market penetration and increased vehicle production in this region offer attractive market opportunities to automobile manufacturers and tier-1 suppliers. Moreover, Major automotive camera solution providers such as Robert Bosch (Germany), Continental (Germany), and Denso (Japan) have production facilities across the region.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=125124333

The L1 segment of the automotive camera market, by level of autonomy is expected to grow at the highest CAGR during the forecast period. The L1 camera unit is expected to lead the automotive camera market. The higher penetration of camera-based driver assistance solutions such as BSD, park assist, and surround-view systems require multi camera configurations to function. The cost-effective mono cameras have encouraged OEMs to fit more L1 cameras in mid and lower segment vehicles. Rapid advancements and the decreasing cost of ADAS components and solutions are expected to propel the growth of the camera market. L1 camera unit is the largest market as it has the highest penetration in the market.

The advanced thermal cameras with AI can determine how effectively an object emits heat. Every object has a different emissivity, and this enables the camera to sense any object in its path and also detect and classify whether the object is human or inanimate. With this information, thermal cameras can detect lane markings and the positions of pedestrians, and in most cases, determine whether a pedestrian is about to leave the sidewalk and cross the road. OEMs such as Audi, BMW, GM, and Honda provide thermal cameras in night vision systems in their high-end passenger car models. OEMs are focusing on deploying night vision systems to reduce accidents at night, which in turn would drive the market of thermal camera.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=125124333

Key Market Players

The global automotive camera market is dominated by major players such as Robert Bosch (Germany), Continental AG (Germany), ZF Friedrichshafen (Germany), Denso (Japan), Aptiv (UK), Ficosa (Spain), and Magna International (Canada).

COVID-19 impact on automotive camera market:

Major automotive camera providers such as Bosch and Continental have announced the suspension of production due to the reduced demand, supply chain bottlenecks, and to ensure the safety of their employees in France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for automotive camera solutions is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from OEMs and tier 1 manufacturers. Major automotive camera solution providers lost revenue in Q1 2020. Due to the severity of the pandemic, resuming vehicle production is unlikely, especially in the US and major European countries, and tier 1 players suspect a further decline in revenue in the remaining quarters of 2020. For instance, Aptiv’s advanced safety and user segment logged revenue of USD 902 million in Q1 2020 compared to USD 1,023 million in Q1 2019, a decline of 13%. According to the company, the scenario could be worse in Q2 as global vehicle production is expected to fall by 50-60%. The company suspended production in China, followed by North America and Europe. Camera providers are facing disruptions in supply chains as countries are in a state of lockdown to prevent the spread of the disease. Thus, the market for automotive camera is estimated to undergo a declining phase in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/automotive-camera-market-125124333.html