According to a report,“Automotive Foams Market Size, Share & Trends Analysis Report By Type (Polyurethane, Polyolefin), By Application (Seating, Door Panels), By End Use (Cars, LCV, HCV), By Region, And Segment Forecasts, 2019 – 2025”, published by Grand View Research, Inc., The global automotive foam market size is anticipated to reach USD 50.44 billion by 2025. It is projected to expand at a CAGR of 9.8% during the forecast period. Growing population, disposable income, and purchasing power parity in emerging economies of Asia Pacific are expected to propel demand for automobiles over the forecast period, thus impacting the market for automotive foam.

Key Takeaways from the report:

-

In terms of revenue, PU foam type is anticipated to reach USD 2.62 billion by 2025, growing at a CAGR of 7.9% from 2018 to 2025

-

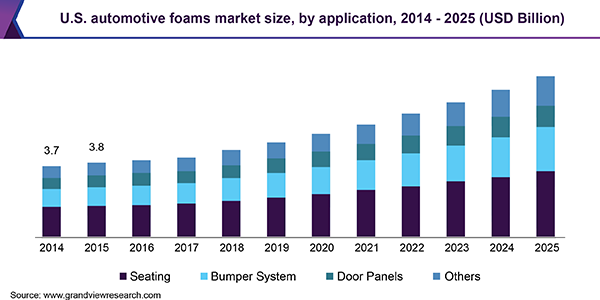

Seating application segment held the largest market share of over 42.8% in terms revenue in 2017. These foams are corrosion resistant and can bear various types of severe conditions, which is anticipated to bode well for growth

-

The U.S. automotive foam market is anticipated to reach USD 8.37 billion by 2025 owing to the presence of various manufacturers and suppliers in the country

-

The market is competitive with the presence of a number of global, medium, and small scale companies catering to the global and local demand

-

Some of the key companies include Armacell International S.A., BASF SE, Rogers Corporation, Bridgestone Corporation, The Woodbridge Group, Recticel NV, Borealis AG and Saint-Gobain. The companies use strategy such as mergers and acquisitions and portfolio expansion to gain market share.

Browse More Reports in Plastics, Polymers & Resins:

• Corrosion Resistant Resin Market: The modernization of construction industry is a huge development figure, which is driving the overall market advancement of corrosion resistant resins. Corrosion resistant resins are utilized as a part of end-use industries, for instance, in chemical processing, marine, car, oil and gas, and others.

• Polycarbonate Market: The resin finds applications across a wide range of industries that include automotive & transportation, construction, packaging, consumer goods, and medical devices.

Transitioning lifestyles and wide availability of low-end sports models have positively impacted automotive demand from 2014 to 2017. Easy financing of automobiles owing to the EMI concept with attractive interest rates made it simpler and affordable for a medium income group consumers to purchase a vehicle of their choice. Easy availability of loans for vehicle purchase has also affected vehicle sales on similar lines. The aforementioned factors played an important role in propelling growth of the automotive industry both in developed as well as developing regions and the trend is likely to continue in the forthcoming years.

The market is expected to face instability in terms of raw material supply over the coming years owing to uncertain operation rates and plant closures by raw material manufacturers. However, relationships between manufacturers and suppliers are expected to get stronger, thus leading to stronger tie-ups at multiple distribution levels. This is expected to be a critical factor for companies to gain a competitive advantage over the forecast period.

Increasing demand for automotive foam particularly in the emerging economies of North America, Europe, Asia Pacific, and Central and South America, offers growth opportunities for the manufacturers of automotive foam and related raw materials to expand their product portfolios and market reach. The R&D initiatives undertaken by some companies to enhance their product specifications and market reach.

Substantial growth in automotive industry in Asia Pacific has fueled the demand in the automotive foam market in recent past. Significant presence of automotive and automotive foam manufacturers has played a key role in driving the product demand over the past few years and is expected to continue over the forecast period.

Grand View Research has segmented the global automotive foam market on the basis of type, application, end use, and region:

Automotive Foam Type Outlook (Volume, Kilotons; Revenue, USD Million, 2014 – 2025)

-

Polyurethane (PU)

-

Polyolefin (PO)

-

Others

Automotive Foam Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 – 2025)

-

Seating

-

Door Panels

-

Bumper System

-

Others

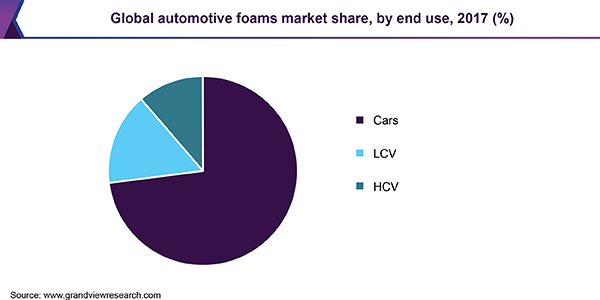

Automotive Foam End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2014 – 2025)

-

Cars

-

LCV

-

HCV

Automotive Foam Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 – 2025)

-

North America

-

U.S

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

Explore automotive foams market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

For more information: www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: Switzerland

Website: www.grandviewresearch.com/industry-analysis/automotive-foams-market