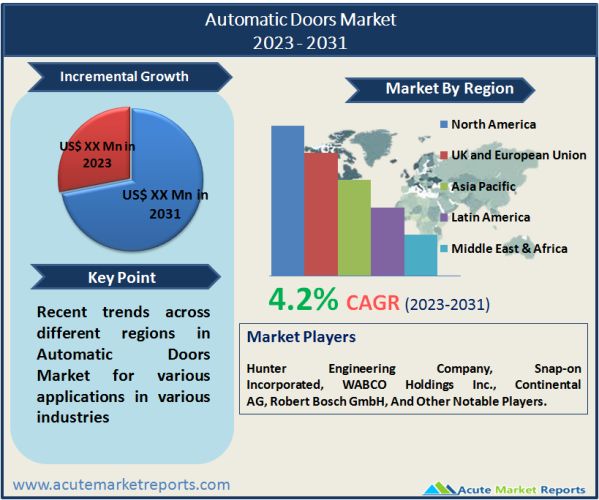

The automotive wheel alignment services market is anticipated to expand at a 4.2% CAGR during the forecast period of 2023 and 2031. This market is essential for sustaining the safety and performance of vehicles, as misaligned wheels can result in uneven wheel wear, decreased fuel economy, and compromised handling. The market revenue of automotive wheel alignment services has consistently increased over the years due to factors such as rising vehicle sales, the expansion of the automotive aftermarket industry, and rising vehicle owners’ awareness of the importance of routine wheel alignments. The CAGR of the market reflects its projected average annual growth rate over a specific period, indicating its expansion potential. The market for automotive wheel alignment services has experienced a significant CAGR, indicating optimistic growth prospects. Globally increasing vehicle sales increase the demand for alignment services. As the number of vehicles on the road continues to rise, the need for routine maintenance and alignment to ensure optimal performance becomes increasingly important. Second, the expansion of the automotive aftermarket industry is a significant market driver. With a robust aftermarket, vehicle owners have simple access to alignment services, and service providers can cater to a larger customer base. In addition, the increasing awareness of the benefits of wheel alignment among vehicle owners is propelling the market growth. More people are recognizing the significance of wheel alignment for improved fuel economy, extended wheel life, and increased safety.

The automotive wheel alignment services market is propelled by the rising number of vehicles on the road and the consistent sales of new vehicles. Demand for maintenance and repair services, such as wheel alignment, increases as vehicle ownership rises. According to the International Organisation of Motor Vehicle Manufacturers (OICA), the global production of motor vehicles in 2020 exceeded 95 million units. This indicates a substantial market opportunity for wheel alignment services, as vehicle owners seek to ensure optimal vehicle performance and safety through proper alignment. According to a report by the International Energy Agency (IEA), global vehicle ownership is expected to increase from approximately 1.4 billion in 2020 to more than 2 billion by 2040, indicating a substantial market opportunity for wheel alignment services.

The emphasis on vehicle safety and performance is a key market driver for the automotive wheel alignment services industry. Improper wheel alignment is essential for sustaining safe driving conditions, as misaligned wheels can negatively affect vehicle control, wheel wear, and fuel economy. As vehicle owners become more aware of the necessity of routine maintenance and safety, the demand for wheel alignment services has increased significantly. In addition, government regulations and safety standards necessitate proper wheel alignment for compliance and safe vehicle operation. The National Highway Traffic Safety Administration (NHTSA) stresses the significance of regular wheel alignment for vehicle safety, stating that misaligned wheels can result in poor handling and increased accident risk.

Browse for the report at: https://www.acutemarketreports.com/report/automotive-wheel-alignment-services-market

Technological advancements in automotive systems, specifically the incorporation of advanced driver assistance systems (ADAS), are driving demand for precise wheel alignment services. ADAS relies on accurate wheel alignment for optimal performance, as misalignment can interfere with the proper operation of sensors and reduce the effectiveness of safety features such as lane departure warning systems and adaptive cruise control. With the increasing prevalence of advanced driver assistance systems (ADAS) in modern vehicles, the demand for specialized alignment services that can accommodate these advanced systems is anticipated to increase. The increasing availability of features such as lane-keeping assist, automatic emergency braking, and blind-spot detection demonstrates the incorporation of ADAS into vehicles. For optimum performance, these advanced systems require precise wheel alignment, highlighting the need for specialized alignment services.

The market for automotive wheel alignment services is hampered by the adoption of advanced vehicle technologies challenges. The complexity of wheel alignment increases as vehicles become more technologically advanced, with features such as electric power steering, adaptive suspension systems, and advanced driver assistance systems (ADAS). Accurate alignments of these advanced technologies require specialized knowledge and apparatus. To properly align these advanced systems, service providers must invest in training their technicians and procuring the necessary hardware and software. Smaller service providers may not be able to meet the growing demand for wheel alignment services for technologically advanced vehicles due to the expense of procuring and maintaining the necessary equipment and expertise. In addition, the rapid pace of technological advancements in the automotive industry necessitates that service providers perpetually update their skills and equipment to meet the unique alignment requirements of new vehicle models. This limitation emphasizes the need for ongoing investments in training and equipment enhancements to effectively meet the alignment requirements of modern vehicles. The increasing number of alignment specifications provided by vehicle manufacturers is indicative of the increasing complexity of wheel alignment requirements for advanced vehicle technologies. Each vehicle model may have unique alignment specifications to accommodate advanced systems, making it difficult for service providers to remain current.

Access Free Sample Copy From https://www.acutemarketreports.com/request-free-sample/139679

This includes passenger vehicles, hatchbacks, sedans, SUVs/MUVs, commercial vehicles, light commercial vehicles, and heavy commercial vehicles. Among these segments, passenger vehicles are anticipated to have the highest revenue in 2022 and the highest CAGR from 2023 to 2031, accounting for a significant share. The passenger vehicle segment encompasses a diverse array of automobiles, from compact cars to prestige sedans and SUVs, which require routine wheel alignment to ensure optimal performance, safety, and wheel life. The increasing global population and disposable income have led to a rise in the demand for passenger vehicles, which has contributed to the expansion of the wheel alignment services market in this segment. Moreover, the SUV/MUV segment of passenger vehicles has experienced significant growth due to the increasing popularity of these vehicles among consumers seeking increased space, versatility, and driving enjoyment. SUVs and MUVs typically have larger wheels and more complicated suspensions, making wheel alignment crucial. Commercial vehicles, such as light commercial vehicles and heavy commercial vehicles, contribute significantly to the market for wheel alignment services. These vehicles are utilized for transportation, logistics, and other commercial purposes, resulting in increased mileage and wheel degradation. In order to ensure fuel efficiency, wheel longevity, and overall performance in commercial vehicles, proper alignment is essential. While the commercial vehicle segment’s CAGR is slightly lower than that of passenger vehicles, it continues to be a significant revenue contributor to the market as a whole. With the increasing demand for passenger vehicles and the continued need for commercial vehicles, the wheel alignment services market is anticipated to experience sustained growth in terms of both revenue and CAGR across these vehicle segments.

The automotive wheel alignment services market can be segmented according to the service providers involved, which include original equipment manufacturers, dealership-authorized service centers, wheel manufacturers, franchisees, and other independent service providers. Among these segments, dealership-authorized service centers held a significant share with the highest revenue in 2022 and the highest anticipated CAGR from 2023 to 2031. Authorized by vehicle manufacturers, these service centers offer a comprehensive range of services, including wheel alignment, for the vehicles they sell. Because they are directly affiliated with the manufacturers, dealership-authorized service centers have access to the most recent technical knowledge, specialized equipment, and genuine materials necessary for accurate wheel alignment. This provides them with a competitive advantage in meeting the alignment requirements of specific vehicle models. In addition, original equipment manufacturers play a crucial role in the wheel alignment services market, as they frequently operate their own service centers and authorized workshops. These centers have extensive knowledge of their vehicle’s systems, ensuring precise alignment and adherence to the manufacturer’s specifications. Additionally, wheel manufacturers have a significant presence in the market for wheel alignment services. As part of their wheel service offerings, they provide accurate and efficient wheel alignments by leveraging their wheel expertise. Franchisees, such as those affiliated with well-known automotive service chains, significantly contribute to the market. These franchisees enjoy brand recognition, standardized procedures, and established consumer confidence. Despite the fact that dealership-authorized repair centers have the highest revenue and CAGR, other independent service providers play an essential role. These include local garages, independent workshops, and specialty alignment centers that service a variety of vehicles and offer customized services. With the increasing demand for professional wheel alignment services, it is anticipated that all of these service provider segments will experience growth in revenue and CAGR. However, dealership-authorized service centers, with their strong OEM association and technical expertise, are likely to remain at the vanguard of the automotive wheel alignment services market in terms of both revenue and growth.

Other Popular Reports: https://www.acutemarketreports.com/category/automotive-market

Due to the presence of a large number of vehicles and a well-established automotive industry, North America held a prominent position in the market in 2022, accounting for a significant revenue share. wheel alignment services are in demand due to the region’s high disposable income, technological advancements, and increased awareness of vehicle maintenance. Europe also holds a significant share in the market, driven by the strong presence of luxury and high-performance vehicles, which require precise wheel alignment for optimal performance. With its large population and expanding automotive industry, the Asia-Pacific region is anticipated to record the maximum CAGR from 2023 to 2031 in the wheel alignment services market. The rising middle-class population, increasing urbanization, and improving road infrastructure in countries like China and India are driving the demand for passenger vehicles and subsequently the need for alignment services. In addition, the wheel alignment services market in the Middle East and Africa is growing steadily due to the increasing number of commercial vehicles and infrastructure development initiatives. In addition, Latin America contributes to the market, which is predominantly driven by the rising demand for passenger vehicles in countries such as Brazil and Mexico.

Several major competitors vie for market share in the automotive wheel alignment services market, which is highly competitive. Prominent companies in the market include Hunter Engineering Company, Snap-on Incorporated, WABCO Holdings Inc., Continental AG, and Robert Bosch GmbH, among others. These businesses provide an extensive selection of wheel alignment services and solutions to meet the diverse requirements of vehicle proprietors and service providers. One of the key strategies is product innovation and development. Companies are investing in research and development to introduce advanced wheel alignment systems and technologies that offer enhanced precision, efficiency, and ease of use. They are also focusing on integrating advanced features such as 3D imaging, laser technology, and cloud connectivity to streamline the alignment process and improve customer experience. Furthermore, customer-centric approaches are being adopted to enhance the overall service experience. This includes providing personalized solutions, offering value-added services such as wheel rotation and balancing, and ensuring timely and efficient service delivery. Many companies are investing in training programs and certifications for their service technicians to ensure the highest level of expertise and professionalism. Additionally, the integration of advanced technologies such as artificial intelligence, machine learning, and automation is likely to reshape the market, enabling faster and more accurate wheel alignments. Overall, the competitive landscape of the automotive wheel alignment services market is expected to remain dynamic and competitive, with players striving to differentiate themselves through technological advancements, service quality, and customer satisfaction.

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com