The global automotive wheels aftermarket size is expected to reach USD 7.19 billion by 2025, registering a 3.0% CAGR from 2019 to 2025. Prominent factors driving the market include replacement of wheels, increment in rim size, and enhancement in design. Further, the use of carbon wheels mainly for sports and luxury cars is fueling the wheels aftermarket growth. Growing sales of the automotive vehicle is also expected to leverage the sales of wheels through a large distribution network. And the distribution channel growth is driven by the proprietary brands and extensive product range.

The current trend of improving the efficiency of passenger cars and commercial vehicles is expected to surge the demand for lightweight wheels. As aluminum wheels are lighter as compared to the other types of wheels, nowadays significantly used by the manufacturers to decrease the weight of vehicles. Government regulations impeded by various countries regarding weight reduction to decrease fuel consumption is expected to create high growth opportunities for these types of wheels. Further, with the growing technological complexities in the vehicle, manufacturers are opting to provide better customer satisfaction and service by following government safety standards.

High disposable income, affordability among the consumers, and the increasing number of vehicle parc on road are some of the primary reasons, which are expected to influence the sale of luxury vehicle wheels over the forecast period. The demand for new commercial vehicle wheels is expected to advance in the next couple of years, the average growth of passenger cars also can lead to fruitful prospects for the wheels market.

Automotive Wheels Aftermarket Report Highlights

-

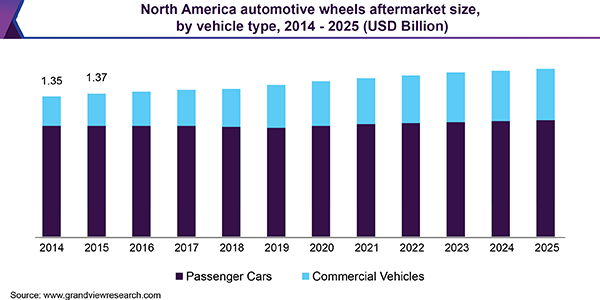

On the basis of vehicle type, the passenger car segment dominated the global market in 2018 and is expected to witness growth at a lucrative CAGR during the forecast period.

-

In terms of material type, the aluminum segment is estimated to gain a high CAGR over the forecast period. The surging applicability of various material types in a dynamic environment is expected to drive the market.

-

On the basis of coating type, the powdered segment accounted for the largest market share in 2018. The segment is expected to experience a high CAGR over the forecast period.

-

Based on the rim size, the 13-19 segment was accounted for the maximum share in the market. On the other hand, 21 inches and above segment is estimated to deliver significant growth in the market owing to the rising trend of larger rim size is estimated to create significant demand for the 19 to 21 and 21 size rims.

-

On the basis of the distribution channel, the retailers segment accounted for the largest market share in 2018. Besides, the wholesalers & distributors segment is expected to grow with a high CAGR over the forecast period.

“Would you Like/Try a Sample Report” Click the link below: https://www.grandviewresearch.com/industry-analysis/automotive-wheels-aftermarket/request/rs1

Automotive Wheels Aftermarket Segmentation

Grand View Research has segmented the automotive wheels Aftermarket on the basis of vehicle type, material type, rim size, coating type, distribution channel, and region:

Automotive Wheels Aftermarket Vehicle Type Outlook (Revenue, USD Billion, 2014 – 2025)

-

Passenger cars

-

Basic

-

Racing

-

-

Commercial vehicles

Automotive Wheels Aftermarket Material Outlook (Revenue, USD Billion, 2014 – 2025)

-

Alloy

-

Steel

-

Aluminum

-

Others (Carbon Fiber, Nickel)

Automotive Wheels Aftermarket Coating Type Outlook (Revenue, USD Billion, 2014 – 2025)

-

Liquid Coating

-

Powdered Coating

Automotive Wheels Aftermarket Rim Size Outlook (Revenue, USD Billion, 2014 – 2025)

-

13 – 19 inches

-

19 – 21 inches

-

21 inches and above

Automotive Wheels Aftermarket Distribution Channel Outlook (Revenue, USD Billion, 2014 – 2025)

-

Retailers

-

W&D

Automotive Wheels Aftermarket Regional Outlook (Revenue, USD Billion, 2014 – 2025)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

List of Key Players of Automotive Wheels Aftermarket

• RONAL Group

• BORBET Gmbh

• Enkei Corporation

• AEZ Leichtmetallräder GmbH

• Beyern Wheels

Have Any Query? Ask Our Experts for More Details on Report: https://www.grandviewresearch.com/inquiry/6988/ibb

Browse Related Report @

Automotive Aftermarket – https://www.grandviewresearch.com/industry-analysis/aftermarket-automotive-parts-market

Explore the BI enabled intuitive market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research is a market research and consulting company based in the State of California with headquarters in San Francisco. The company offers consulting services tailored for business organizations to assist them with understanding and exploring their potential on a large scale. At the same time, Grand View Research caters to the individual research needs to provide a customized research service.

Grand View Research is fully committed to offer the best research services in the Industry. Our dedicated team of experienced analysts offer full capability and potential to precisely understand your research needs.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/automotive-wheels-aftermarket