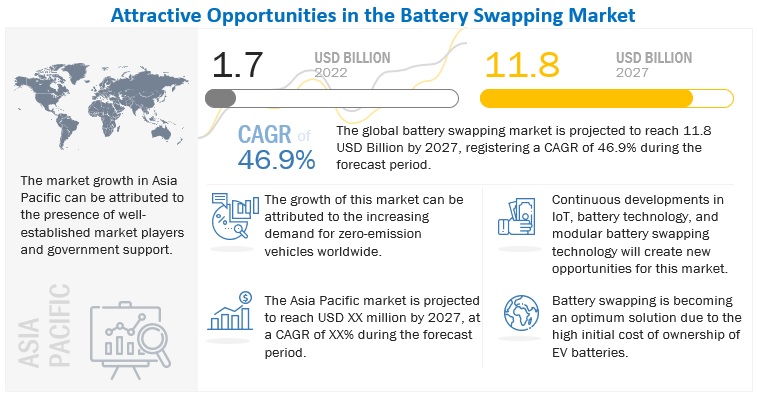

The global Battery Swapping Market is projected to grow from USD 1.7 billion in 2022 to USD 11.8 billion by 2027, at a CAGR of 46.9% during the forecast period.

Battery swapping is an alternative method of powering an electric vehicle and involves exchanging discharged batteries for charged ones. This swap method removes the direct relation between the vehicle and the battery, thus decreasing the initial cost of buying an electric vehicle. Battery swapping is mostly eligible in 2 & 3-wheelers, as these vehicles are integrated with small batteries, which makes it easier to swap the battery in them. Compared to conventional charging, battery swapping saves time, space, and money, especially when the system is used efficiently. Additionally, battery swapping offers sustainable and innovative business models, such as “Battery-as-a-Service” (BaaS), in which a service provider does not charge upfront costs for batteries and offers daily or monthly subscription-based rental plans that allow the EV drivers to swap batteries multiple times a day.

The automated segment is estimated to have significant share of the battery swapping market during the forecast period

Battery swapping requires an electric car that is suitable and has a battery architecture built for the swap. In an automated battery swap station (BSS), customers can not only swap out their electric vehicles but also schedule the battery swap ahead of time to ensure that a battery pack will be available. When a vehicle arrives at the BSS, the process officially begins.

The electric vehicle (EV) is placed in the right place in the right direction in an automated battery swapping station and the vehicle is turned off. In the next step, the EV is lifted with the vehicle lift (as shown in the figure below) and the jack pads are drawn by the lift sheets to offer help in the lifting mechanism. When the vehicle is lifted, the bottom of the vehicle covering the battery is loosened up, giving access to the battery that sits underneath the vehicle. The battery lift is lifted till it touches the underside of the battery pack, which helps in battery removal. When the battery pack is positioned accurately above the lift, the battery removing process starts. Next, battery transport is brought underneath the battery lift. The used battery is brought down by the lift, and this battery is swapped for a new one from a battery rack. This charged battery is then lifted and placed under the vehicle. The battery is again positioned and placed accurately. With all the bolts locked and the underbody cover fixed again, the battery is good to go.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=2482807

Government initiatives and policies for passenger vehicles will drive the battery swapping market

Given that the vehicles in this category make up a sizable portion of the entire fleet and differ significantly from one another, the passenger vehicle segment is likely the broadest and most complicated group. It is hard to identify the optimum answer for every user of passenger vehicles because their needs are so varied from one another. Instead, it is necessary to find the optimal trade-off. Users of large vehicles who frequently travel long distances by car require powerful batteries that ensure good performance and take up a lot more room within the vehicle, as well as very high autonomy levels and fast charging (working on battery cell density is important). On the other hand, city car owners typically travel short distances with their vehicles, thus their priorities are entirely different. To partially charge their vehicles, they primarily need a capillary infrastructure network to cover the city. They also need their vehicles to be light in weight and small, which prevents the use of large and heavy batteries to improve performance.

Battery swapping made a comeback in China as a popular technology to be developed, and in 2020, the Chinese government stepped up efforts to establish uniform standards in the industry. The objective is to standardize the procedure so that it can be performed on any automobile, battery, or system and allow for replacement in just three minutes.

Some of the major players offering battery swapping for passenger vehicles are NIO Power, Gogoro, SUN Mobility, Immotor, and others. Gogoro started out in Taiwan but has since announced several significant alliances that would allow it to expand its battery-swapping network and/or scooter sales into countries like China and India as well as more niche markets like Israel.

The Asia Pacific region is estimated to be the largest market for battery swapping in 2022

Asia Pacific is the largest market for green technologies in the world. The governments in this region are setting renewable energy targets backed by favorable policies such as the Kyoto Protocol. The largest markets for battery swapping in this region are China, India, Taiwan, and Vietnam. Asia Pacific has been the dominant regional market for battery swapping since 2018 due to the increased demand for electric vehicles. Geely, the China-based automobile manufacturer, has set up 39 battery swap stations in China with ambitions to add 200 by 2023 and as many as 1,000 through existing arrangements. Geely’s head of battery swapping, Mr. Yang Quankai, claims that by 2025, there will be 5,000 battery swap stations operating throughout China.

To guarantee battery compatibility among the various cars in the ASEAN region, a regulation for swappable battery design is essential. Lack of regulation at this early stage might lead to a number of incompatible systems or technologies patented by foreign entities, which would prevent the local manufacturing of batteries, charging stations, or even automobiles that could use swappable batteries. Vehicles with swappable batteries will eventually need to use battery swapping protocols that are globally interoperable.

Key Market Players:

The battery swapping market is dominated by players such as NIO Power (China), Gogoro(Taiwan), Immotor (China), Aulton (China), and Sun Mobility (India).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=2482807

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/battery-swapping-market-2482807.html