Blister Packaging Industry Category Intelligence

PVC has been the traditional choice in blister packaging for a very long time as it offers low prices and strong durability while maximizing product visibility at the same time. PVC pricing had been stagnant for some time before 2020 and it was generally readily available. However, during the Covid-19 pandemic, the housing market started to gain traction and the construction market continues to buy more PVC, hence the price has increased drastically, making it hard to procure PVC for blister packaging.

One of the leaders in the packaging industry, Amcor has already started working on developing alternatives for PVC in blister packaging. In April 2021, the company announced the customer trials of the world’s first recyclable polyethylene-based thermoform blister packaging named AmSky. It reduces carbon footprint by 70% compared to PVC and other alternatives. PVC makes packaging recycling more difficult or contaminates other materials if consumers attempt to recycle them. Therefore, Amcor’s solution eliminates PVC from the packaging by using a mono-material Polyethylene thermoform blister and lidding film.

Moreover, recent economic and environmental policy changes compel some brands to think and find a PVC alternative for their blister packaging. Polyethylene terephthalate (PET) and recycled polyethylene terephthalate (RPET) are the two major strong alternatives to the traditional PVC blister. It is majorly used in soda bottles and is known for its strong durability and transparency. PET and RPET are most preferable for brands with high sustainability goals as they can be easily recycled.

Blister Packaging Industry Category Intelligence Highlights:

- Blister packaging suppliers are collaborating with regional players to benefit from their knowledge of the local market, and maintain high profit margins, low overhead costs, and their overall competitiveness in the market

- The blister packaging market features a highly fragmented competitive landscape as several small players are entering the market

- Suppliers widely prefer approved provider operating models to reduce risks and improve the potential for value creation

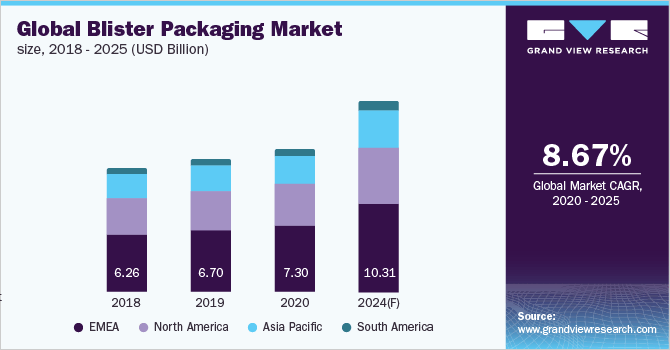

- Increasing demand for pharmaceuticals and consumer goods is fueling the growth of the blister packaging market

- The blister packaging market is fragmented as a higher number of suppliers are present across different regions, which decreases the bargaining power of suppliers.

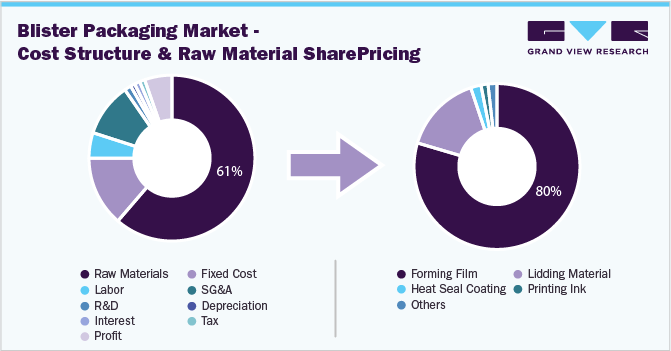

- Forming film, lidding material, heat seal coating, and printing inks are the major components of blister packaging, constituting around 60% of the overall cost.

- S.A. has been a key exporter of raw materials for blister packaging.

Grab your copy, or request for a free sample of the “Blister Packaging Industry Procurement Intelligence Report, published by Grand View Research” for In-depth details regarding supplier ranking and selection, sourcing, and pricing criteria & startegies

Blister Packaging Industry – Pricing and Cost Intelligence Highlights:

Grand View Research has identified the following key cost components for availing blister packaging:

• Raw Materials

• Forming Film

• Lidding Material

• Heat Seal Coating

• Printing Ink

• Others

• Fixed Costs

• Labor

• SG&A

• R&D

• Depreciation

• Interest

• Tax

• Profit

“Raw material is the biggest cost component of blister packaging, accounting for more than 60% of the total cost of manufacturing.”

Blister Packaging Industry – Supplier Intelligence – Capability based ranking & selection criteria with weightage:

Operational capabilities (with weightage) for Supplier Ranking and Selection in Blister Packaging Category:

• Years in Service – 15%

• Geographical Service Presence – 35%

• Employee Strength – 15%

• Revenue Generated – 15%

• Key Clients – 12%

• Certifications – 8%

Functional capabilities (with weightage) for Supplier Ranking and Selection in Blister Packaging Category:

• Technology Type – 40%

• Thermoforming

• Cold Forming

• Thermo Cold Complex Blistering

• Types of Blister Packaging – 60%

• Thermoformable

• Face Seal

• Trapped

• Full Card Blister

• Clamshell

• Skin Packaging

List of Key Suppliers in the Blister Packaging Category

• Amcor Plc

• DOW• WestRock Company

• Sonoco Products Company

• Constantia Flexibles

• Klockner Pentaplast Group

• E.I. du Pont de Nemours and Company

• Honeywell International Inc.

• Tekni-Plex

• Display Pack

Add-on Services provided by Grand View Research Pipeline:

Should Cost Analysis

In the blister packaging procurement intelligence study, we have estimated and forecasted pricing for the key cost components. Raw materials are the largest cost component of blister packaging manufacturing cost. It accounted for more than 60% of the overall cost of manufacturing. Forming film and lidding materials are the key cost driver of raw materials. Forming films are made of PVC and the prices of PVC peaked in 2020, largely due to COVID-19 and subsequent supply chain disruptions. However, prices are expected to stabilize gradually from 2021. Lidding material is majorly made of aluminum, prices of which have been dropping since 2019 but are expected to increase steadily over the next 5 years. Labor cost is the key cost component of overhead costs. Trends of market correction in terms of salary are resulting in the rise of labor wage globally. However, salaries are based on region-centric policies. Therefore, shifting procurement and manufacturing practices to LCC countries could help manufacturers drive down the cost of labor.

Rate Benchmarking

The type of the forming film is one of the most important aspects while analyzing rate benchmarking of blister packaging. In our research, we have compared the rates of six types of forming films including polyvinyl chloride (PVC), polyvinylidene chloride (PVDC), chlorotrifluoroethylene (CTFE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS). By using rate benchmarking analysis, we found that PVDC and CTFE forming films price per unit area is 60%-80% higher than PP, PET, PS, and PVC forming films. PVC forming films offers the lowest price per unit area and it has an 80% better water vapor transmission rate (WVTR) than PVDC, CTFE, and PP forming films. PVC films’ high cost-efficiency ratio in price/unit area makes it most preferable forming film material for blister packaging suppliers.

To gain a comprehensive understanding of the other aspects of rate benchmarking, please subscribe to our services for the complete report.

Salary Benchmarking

Labor is one of the key cost components incurred while offering a product or service. Understanding the pricing structure of salary is important for organizations in selecting the appropriate supplier and building a good negotiation strategy. It is also an important factor in determining whether the category under focus should be outsourced or built in-house.

Our research indicates that Honeywell production managers earn 50-60% higher salaries than production managers from other key industry leaders like Amcor and DoW. However, the YoY increment rate in such companies largely depends on KRAs.

Supplier Newsletter

It is cumbersome for any organization to continuously track the latest developments in their supplier landscape. Our newsletter service helps them remain updated, to avoid any supply chain disruption which they may face, and keep a track of the latest innovations from the suppliers. Outsourcing such activities help clients focus on their core offerings.

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, the total cost of ownership

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best-suited countries for sourcing to minimize supply chain disruption

Browse through Grand View Research’s collection of procurement intelligence studies:

- Supply Chain Insurance Market Procurement Intelligence – The global supply chain insurance market is valued at USD2.5 billion in 2020 and it is expected to grow at a CAGR of 4% from 2020 to 2025 due to the high adoption of supply chain insurance from medium and large-sized organizations across manufacturing, transportation, and logistics, pharmaceuticals, and food & beverages sectors. High anti-dumping duties imposed by the governments in countries such as China, the US, France, Germany, and India are expected to increase the price of exported supply chain insurance. North America is leading the supply chain insurance market with more than 35% revenue share followed by Europe (~30%) and APAC (~25%).

- Waste Management Market Procurement Intelligence – The global waste management market size was estimated at USD 398.6 billion in 2020 and is expected to register a compound annual growth rate (CAGR) of 5% from 2021 to 2027. Key driving factors include strict waste management regulations from various governments, focus on sorting and treatment of different types of waste before disposal, composting of bio-degradable waste, etc.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: www.grandviewresearch.com/pipeline/blister-packaging-market-procurement-intelligence-report