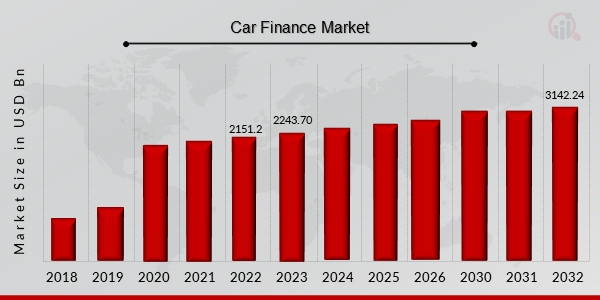

In 2022, the Car Finance Market was valued at $2,151.2 billion. It is expected to grow from $2,243.70 billion in 2023 to around $3,142.24 billion by 2032. This growth indicates a CAGR of about 4.30% during the forecast period from 2023 to 2032.

The car finance market plays a crucial role in the automotive industry, providing consumers with the financial means to purchase vehicles. This market encompasses various financing options, including loans, leases, and financing through dealerships. As the automotive landscape evolves, so too do the financing solutions available to consumers, driven by technological advancements and changing consumer preferences.

Current Trends

Key trends in the car finance market include the increasing adoption of digital financing platforms, the rise of flexible financing options, and the growing popularity of electric vehicle (EV) financing. Additionally, the impact of economic factors, such as interest rates and inflation, is influencing consumer financing decisions.

Market Drivers

Several factors are driving the growth of the car finance market:

1. Increasing Vehicle Sales

As the demand for vehicles continues to rise, the need for financing options becomes more critical. Consumers are looking for accessible and affordable ways to finance their vehicle purchases, driving growth in the car finance market.

2. Technological Advancements

The rise of digital technology has transformed the car finance landscape. Online platforms and mobile applications allow consumers to apply for financing, compare rates, and manage their loans conveniently, making the financing process more accessible.

3. Flexible Financing Options

Consumers are increasingly seeking flexible financing solutions, such as leasing and subscription models. These options cater to varying consumer needs and preferences, providing alternatives to traditional car ownership.

4. Economic Factors

Interest rates, inflation, and economic conditions significantly impact consumer financing decisions. Lower interest rates can encourage borrowing, making it easier for consumers to finance vehicle purchases.

Get Free Sample Report for Detailed Market Insights; https://www.marketresearchfuture.com/sample_request/18852

Key Companies

The car finance market is characterized by various players, including banks, credit unions, and automotive finance companies. Key companies include:

1. Ford Credit

Ford Credit provides financing solutions for Ford customers, offering a range of options, including retail installment contracts and leasing solutions. The company focuses on enhancing the customer experience through digital solutions.

2. Toyota Financial Services

Toyota Financial Services offers financing and leasing options for Toyota customers, helping to facilitate vehicle purchases while providing competitive rates and flexible terms.

3. GM Financial

GM Financial supports General Motors customers with various financing solutions, including loans and leases. The company aims to enhance customer satisfaction by providing tailored financing options.

4. Ally Financial

Ally Financial is a leading provider of automotive financing solutions, offering a wide range of products for both consumers and dealers. The company focuses on digital innovation to streamline the financing process.

Market Restraints

Despite its growth potential, the car finance market faces several challenges:

1. Economic Uncertainty

Fluctuating economic conditions can impact consumer confidence and borrowing behavior. Economic downturns may lead to decreased vehicle sales and increased loan defaults.

2. Regulatory Challenges

The car finance market is subject to various regulations that can affect lending practices and interest rates. Compliance with these regulations can create challenges for financial institutions.

3. Competition from Alternative Financing Sources

The rise of alternative financing options, such as peer-to-peer lending and fintech solutions, is increasing competition in the car finance market. Traditional lenders must adapt to remain competitive.

Market Segmentation Insights

The car finance market can be segmented based on various factors:

1. Financing Type

- Loans: Traditional auto loans provided by banks or credit unions.

- Leasing: Short-term financing options allowing consumers to use a vehicle without purchasing it outright.

- Subscription Services: Flexible financing models that offer access to a vehicle for a monthly fee, often including maintenance and insurance.

2. Consumer Type

- Individual Consumers: Private buyers seeking financing for personal vehicles.

- Commercial Consumers: Businesses looking to finance fleets or commercial vehicles.

3. Geographic Regions

- North America: A significant market driven by high vehicle ownership rates and diverse financing options.

- Europe: Known for its strong leasing market and increasing adoption of electric vehicle financing.

- Asia-Pacific: Rapidly growing due to rising disposable incomes and increasing vehicle sales, particularly in countries like China and India.

You can buy this market report at; https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=18852

Future Scope

The car finance market is poised for significant growth, with several emerging trends and opportunities:

1. Digital Transformation

The continued shift towards digital financing platforms will enhance the customer experience, making it easier for consumers to access financing options and manage their loans online.

2. Growth of Electric Vehicle Financing

As electric vehicles gain popularity, specialized financing options tailored to EV buyers will emerge. Financial institutions may offer incentives for purchasing electric vehicles, such as lower interest rates.

3. Integration of Data Analytics

The use of data analytics in the car finance market will enable lenders to assess credit risk more effectively, personalize financing offers, and improve decision-making processes.

4. Sustainable Financing Solutions

With the growing emphasis on sustainability, financial institutions may develop green financing options that promote eco-friendly vehicle purchases and support sustainable practices.

The car finance market is evolving rapidly, driven by increasing vehicle sales, technological advancements, and changing consumer preferences. While challenges such as economic uncertainty and regulatory pressures exist, the potential for innovation and growth is substantial. As the market adapts to new trends and consumer demands, the car finance sector is expected to play a pivotal role in shaping the future of automotive ownership and financing.

Top Trending Reports:

Mobile Car Wash And Detailing Market

About Market Research Future

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Media Contact

Company Name: Market Research Future

Contact Person: Media Relations

Email: Send Email

Country: United States

Website: https://www.marketresearchfuture.com