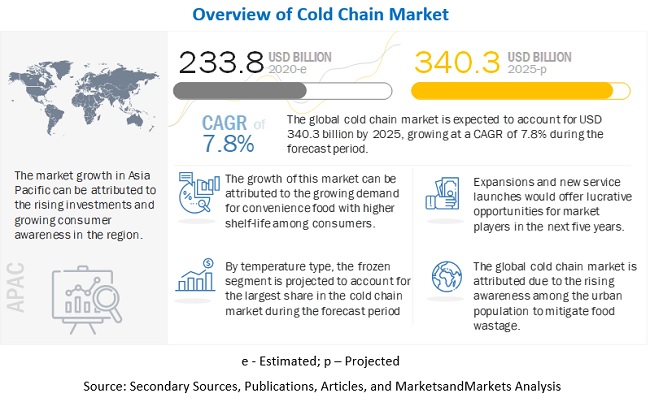

According to MarketsandMarkets, the “Cold Chain Market by Application (Fruits & Vegetables, Dairy & Frozen Desserts, Fish, Meat & Seafood, Bakery & Confectionery), Temperature Type (Frozen, Chilled), Type (Refrigerated Transport, Refrigerated Warehousing), Region – Global Forecast to 2025″, size is estimated to be valued at USD 233.8 billion in 2020 and projected to reach USD 340.3 billion by 2025, recording a CAGR of 7.8%, in terms of value. Rising consumer awareness towards the need to reduce food waste, combined with rising consumer demand for convenience foods and beverages with longer shelf lives, has boosted the global cold chain market. Governments of numerous countries have been bolstering the infrastructure investment of the cold chain, pre-cooling facilities, refrigerated storage and transport, packaging, and information management systems which has been augmenting the cold chain market growth.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=811

Opportunities: Growth in the organized retail sector

The development of retail channels and chains in the form of supermarkets, hypermarkets, and convenience stores is a major factor driving the growth of the cold chain market. Also, retail chains have developed to an extent where some of the producers have their own in-house refrigerated warehousing facilities. Large food retail chains such as Walmart, Tesco, Spar, and 7-Eleven are expanding their outlets in developed countries such as the UK, Germany, and the US, and in emerging markets such as China, Brazil, and Argentina. For instance, Walmart is the largest American multinational retail corporation with over 11,000 stores across 27 countries. It has a large fleet for the transportation of perishable goods and an effective distribution network. It also hires 3PL refrigerated warehousing service providers to transport perishable foods to its retail outlets efficiently. The emergence of such large retailers and their expanding operations in international trade are creating growth opportunities for the refrigerated warehousing and refrigerated transportation market. Governments in many nations are taking initiatives to reduce food and agricultural waste by framing food wastage policies and supporting food-related industries, such as the cold chain industry.

By temperature type, the chilled segment is projected to grow with the highest CGAR in the forecasted period

Chilled products going through the cold chain involves chilling the products by reducing the food temperatures to below ambient temperatures, but above –1°C. Chilling food products between 0°C to +5°C is an effective tool for preserving food for shorter durations. It is because it retards many of the microbial, physical, chemical, and biochemical reactions that lead to food spoilage and deterioration. The use of chilling to slow down the rate of growth of microorganisms reduces food spoilage and improves food safety and quality. The Asia Pacific region is the dominant market for chilled cold chain, with a share of 31.5 % in 2019.

By application, dairy & frozen desserts segment is projected to account for the largest share in the cold chain market by form during the forecast period

The prime concern with transporting dairy and frozen desserts is constant temperature control, dust, and exposure to sunlight. Cold chain transportation services help overcome these problems by ensuring low temperatures (-18°C to 4°C) or (-0.4°F to 39.2°F) to extend their shelf-life. Milk and dairy products have been associated with foodborne illnesses for centuries. They are one of the most regulated foods. Cold chain logistics are essential for maintaining the quality of dairy products. The cold chain ensures that low temperature is maintained, as required by dairy products, throughout the supply chain.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=811

The Asia Pacific region is the largest in the cold chain market during the forecast period.

The growth of the cold chain market is expected to be a key contributor in the rise of international trade of perishable products. Several countries are becoming the key importers and exporters of perishable food products. In emerging economies, such as China and India, governments are also extending support for infrastructure development in the cold chain industry. For instance, in 2010, the Chinese National Development and Reform Commission (NDRC) prepared a development plan for Cold Chain Logistics for Agricultural Products. It identifies key projects and will provide lucrative growth opportunities for manufacturers in the cold chain market. The major challenge faced by the Asia Pacific region is the lack of an integrated supply chain from farm to fork. Infrastructure and setup have been one of the major challenges in the implementation of cold chain for seafood in Asian countries. Governments in the region have been initiating the required steps to improve the cold chain industry.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Americold Logistics (US), Lineage Logistics Holdings (US), Nichirei Corporation (Japan), Burris Logistics (US), Agro Merchants Group (US), Kloosterboer (Netherlands), United States Cold Storage (US), Tippmann Group (US), VersaCold Logistics Services (Canada), Henningsen Cold Storage Co. (US), Coldman (India), Congebec Inc. (Canada), Conestoga Cold Storage (Canada), NewCold (Netherlands), Hanson Logistics (US), Confederation Freezers (Canada), Seafrigo (France), Trenton Cold Storage (Canada), Merchants Terminal Corporation (US), and Stockhabo (Belgium).

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the “Growth Engagement Model – GEM”. The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write “Attack, avoid and defend” strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, “Knowledgestore” connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/cold-chains-frozen-food-market-811.html