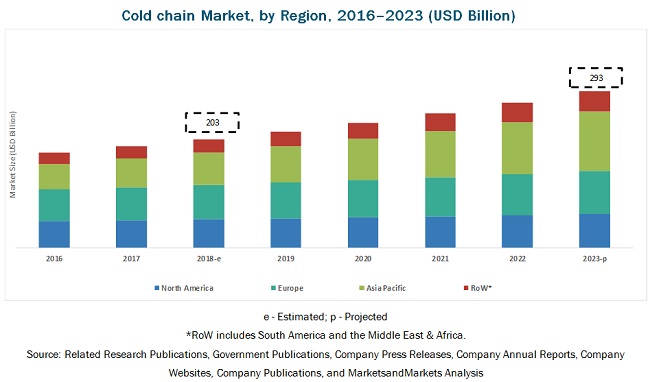

The report “Cold Chain Market by Type (Refrigerated Storage & Transport), Temperature Type (Chilled and Frozen), Application (Dairy & Frozen Desserts; Meat, Fish, and Seafood; Fruits & Vegetables; Bakery & Confectionery), and Region – Global Forecast to 2023″, is estimated to be valued at USD 203 billion in 2018 and is projected to reach a value of USD 293 billion by 2023, growing at a CAGR of 7.6% during the forecast period. The growth of the cold chain market can be attributed to factors such as the growth of international trade of perishable foods, technological advancements in refrigerated storage & transport, government support for the infrastructural development of the cold chain industry, and increase in consumer demand for perishable foods. Additionally, the expansion of organized food retail chains is impacting the growth of the cold chain market positively.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=811

Growth of international trade due to trade liberalization

Globalization has increased due to trade liberalization, advancements in transport infrastructure & communication technologies, and growth of multinational companies in the food retail sector. It has boosted international trade in perishable foods such as dairy & frozen desserts, fruits & vegetables, meat, fish and seafood, and bakery & confectionery products. Every region or country exports food and agricultural products that it produces and imports food products that it is deficient in. This has resulted in almost any fruit, vegetable, or processed food being available at local supermarkets all the year round.

Several forces drive and enhance the trend of perishable commodities trade at the global level. The lowering of tariffs and non-tariff barriers to international trade has encouraged rapid growth of cross-border movement of perishable commodities. Growth of international trade in perishable foods is affected by the following factors:

High energy & infrastructure costs

Ensuring food quality and safety by preventing premature expiry, decay, and spoilage are major priorities for manufacturers, retailers, and consumers. To achieve this, it has become necessary for service providers to invest in modern cold storage facilities, advanced vehicles, and system technologies.

High energy costs are a growing concern for cold chain providers. Energy costs are the highest in North America and Europe, followed by labor costs. In refrigerated storage facilities, traditional florescent light fixtures (which are switched on throughout the year) are used because it is mandatory to do so for a refrigerated storage facility. This leads to loss of energy and high costs.

Due to an increase in the number of refrigerated vehicles in North America and Europe, the main cause of concern for cold chain providers is the rising fuel costs and efficient management of fuel consumption, which depends on the type of product—frozen or chilled—and the delivery route.

In emerging economies, the annual operating costs for cold chain businesses are much higher, per cubic foot. Energy expenses alone account for about 30% of the total expenses of the cold chain industry. The entry barriers in the industry are, therefore, high. In these countries, power deficit is another concern, as this is such an energy-intensive sector. Small players cannot invest in energy back-up systems because capital investment costs escalate.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=811

Asia Pacific is projected to grow at the highest CAGR during the forecast period

Government initiatives in the Asia Pacific region are attempting to help improve the cold chain industry through regulations and subsidies, which is leading to the growth of the cold chain market in the region. For instance, the Indian government is promoting the creation of cold chain facilities through its Scheme for Cold Chain, Value Addition and Preservation Infrastructure and Mega Food Park Scheme. Food sector companies, along with the governments, are also contributing to the industry’s development in the region by creating their own distribution networks with capable refrigerated storage and transport facilities.

Consumers in India and China are increasingly shifting towards fast food and convenience foods, which is fueling the growth of supermarkets and quick-service restaurants. This is boosting the sales of consumer-ready frozen foods such as ice creams and frozen desserts, frozen fruits & vegetables, seafood, and meat. To maintain the shelf life of perishable foods, manufacturers and retailers of perishable foods demand refrigerated storage and transport facilities.

Food sector companies, along with the governments, are also contributing to the development of the refrigerated transport market in the Asia Pacific region by creating their own distribution networks with capable refrigerated transport facilities.

This report includes a study on the marketing and development strategies, along with a study on the service offerings of the leading companies operating in the cold chain market. It includes the profiles of leading companies such as Americold Logistics (US), Preferred Freezer (US), Burris Logistics (US), Lineage Logistics (US), and Nichirei Logistics (Japan). Other key players include Swire Cold (Australia), AGRO Merchants (Netherlands), Kloosterboer (Netherlands), and Interstate Cold Storage (US).

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Shelly Singh

Email: Send Email

Phone: 1-888-600-6441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/cold-chains-frozen-food-market-811.html