Global Commercial Insurance Industry: Key Statistics and Insights in 2024-2032

Summary:

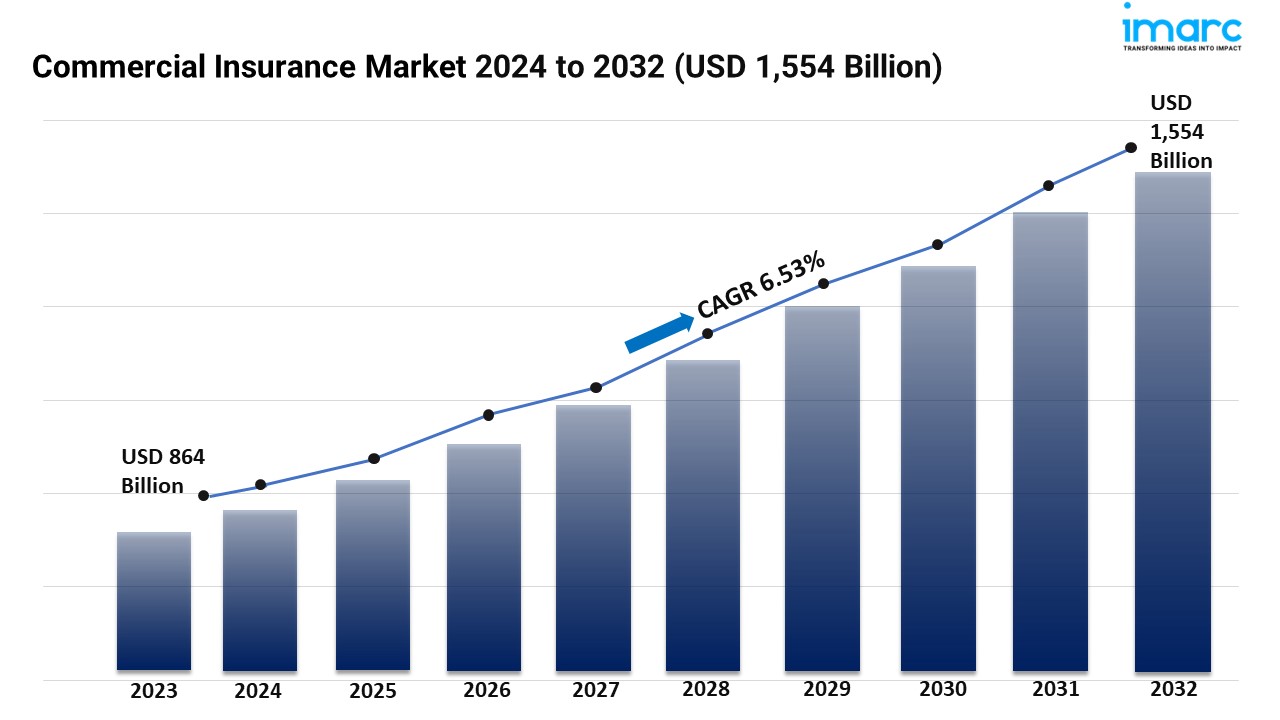

- The global commercial insurance market size reached USD 864 Billion in 2023.

- The market is expected to reach USD 1,554 Billion by 2032, exhibiting a growth rate (CAGR) of 6.53% during 2024-2032.

- North America leads the market, accounting for the largest commercial insurance market share.

- Liability insurance accounts for the majority of the market share in the type segment owing to regulatory changes.

- Large enterprises hold the largest share in the commercial insurance industry.

- Agents and brokers remain a dominant segment in the market as they help clients navigate the intricate landscape of commercial insurance.

- Transportation and logistics represent the leading industry vertical segment.

- The rising business activities and globalization is a primary driver of the commercial insurance market.

- The increasing risk awareness and regulatory requirements are reshaping the commercial insurance market.

Request for a sample copy of this report: https://www.imarcgroup.com/commercial-insurance-market/requestsample

Industry Trends and Drivers:

- Growing Business Activities and Globalization:

The expansion of global trade and business operations has significantly influenced the commercial insurance market. As companies venture into international markets, they encounter new risks associated with foreign regulations, market dynamics, and economic conditions. This globalization necessitates comprehensive insurance coverage to protect against potential liabilities, property damage, and business interruptions. Multinational corporations, in particular, require specialized insurance products tailored to their diverse operations and geographical exposure. Furthermore, as businesses expand, they often increase their asset base, leading to a greater need for insurance to safeguard these investments. This driver is prompting insurers to innovate and offer customized policies that cater to the unique challenges of global operations.

- Rising Risk Awareness:

In today’s dynamic business environment, heightened risk awareness among organizations is a critical driver of the commercial insurance market. Companies are increasingly cognizant of the multifaceted risks they face, ranging from cyber threats to natural disasters and legal liabilities. This awareness is spurred by the rising frequency and severity of incidents that are resulting in substantial financial losses for businesses. As a result, organizations are actively seeking insurance solutions to mitigate these risks and protect their assets. In line with this, insurers are focusing on developing tailored products that address specific risks, such as cyber liability and environmental coverage, making commercial insurance a vital component of risk management strategies for businesses of all sizes.

- Regulatory Requirements:

Regulatory frameworks play a significant role in shaping the commercial insurance market, as many jurisdictions mandate specific types of insurance coverage for businesses. Requirements, such as workers’ compensation, general liability insurance, and professional liability insurance, ensure that companies are financially protected against various risks and can meet their legal obligations. Compliance with these regulations is crucial for businesses to operate legally and avoid hefty fines or penalties. Furthermore, as regulations evolve in response to emerging risks, such as those related to cybersecurity, insurers are developing new products to meet these demands. This driver paves the way for innovative solutions that align with changing legal landscapes.

Buy Full Report: https://www.imarcgroup.com/checkout?id=5295&method=502

Commercial Insurance Market Report Segmentation:

Breakup By Type:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Liability insurance accounts for the majority of shares owing to regulatory changes.

Breakup By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises dominate the market, which can be attributed to the rising need to mitigate potential financial liabilities.

Breakup By Distribution Channel:

- Agents and Brokers

- Direct Response

- Others

Agents and brokers represent the majority of shares as they help clients navigate the intricate landscape of commercial insurance.

Breakup By Industry Vertical:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Transportation and logistics hold the majority of shares on account of the expansion of the e-commerce sector.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to a large market for commercial insurance driven by the increasing focus on risk management practices among businesses.

Top Commercial Insurance Market Leaders:

The commercial insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Allianz SE

- American International Group Inc.

- Aon plc

- Aviva plc

- Axa S.A.

- Chubb Limited

- Direct Line Insurance Group plc

- Marsh & McLennan Companies Inc.

- Willis Towers Watson Public Limited Company

- Zurich Insurance Group Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Other Related Reports By IMARC Group

Wood Pulp Market Size, Growth, and Trends Report 2024-2032

Radar Level Transmitter Market Report 2024 | Growth and Forecast by 2032

Retail Ready Packaging Market Growth, Size, and Trends Forecast 2024-2032

Virtual Reality Headset Market Size, Share, Growth Analysis 2024-2032

Automotive Air Filter Market Trends, Growth, and Forecast 2024-2032

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Media Contact

Company Name: IMARC Group

Contact Person: Elena Anderson

Email: Send Email

Phone: +1-631-791-1145

Address:134 N 4th St.

City: Brooklyn

State: NY

Country: United States

Website: https://www.imarcgroup.com