The COVID-19 pandemic has increased the adoption of decentralized clinical trials due to its critical benefits of contactless virtual trials and improving the patient and physician experience. Clinical trial sponsors are continuously trying to make clinical trials faster and improve the experience for patients and physicians. A decentralized trial has emerged as a critical solution. It involves bringing an increasing proportion of a trial’s activities to the patients instead of using the traditional method of bringing patients to a trial site. As health-system resources became consumed by COVID-19-related care and travel became limited by physical distancing, patients’ access to trial sites was reduced by 80%. The number of monthly trials declined by 50% from January 2020 to April 2020, and 60% of CROs reported a significant reduction in trial activities in May 2020. In the face of such disruption, sponsors mobilized rapidly to preserve the continuity of care and data integrity, by adopting remote consent and patient monitoring, videoconference assessments, and at-home phlebotomy.

Many big CROs have already started adopting decentralized clinical trials. Parexel is leading the trend with more than 160 decentralized clinical trials and implemented around 200 remote patient engagement strategies (patient recruitment and retention platforms, e-visits/video dosing regimens, and patient insight projects) incorporated into trials.

Contract Research Organization Industry Category Intelligence Highlights:

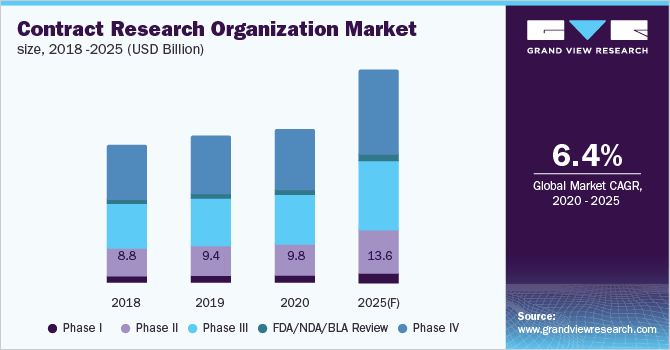

- Increasing outsourcing of clinical research by pharmaceutical companies to reduce R&D expenditure is aiding to the growth of CRO market

- The global CRO industry is moving toward consolidation, with many large corporations striking strategic partnerships with mid-sized or small-sized companies to leverage their regional clinical research capabilities

- Though the Cost Transparency is lower, the Cost Plus Pricing Model is offered by the suppliers to maximize profits with fewer management complexities

- APAC is the leading sourcing destination of clinical research outsourcing services due to its dynamic population characteristics and low service cost

- Large CROs are collaborating with smaller regional CROs to benefit from their knowledge of the local market, and maintain high profit margins, low overhead costs, and their overall competitiveness in the market

- The CRO Market is moving toward consolidation due to increasing numbers of mergers and acquisition

- Suppliers widely prefer approved provider operating models to reduce risks and improve the potential for value creation

Grab your copy, or request for a free sample of the “Contract Research Organization Industry Procurement Intelligence Report, published by Grand View Research” for In-depth details regarding supplier ranking and selection, sourcing, and pricing criteria & strategies

Contract Research Organization Industry Cost Intelligence Highlights:

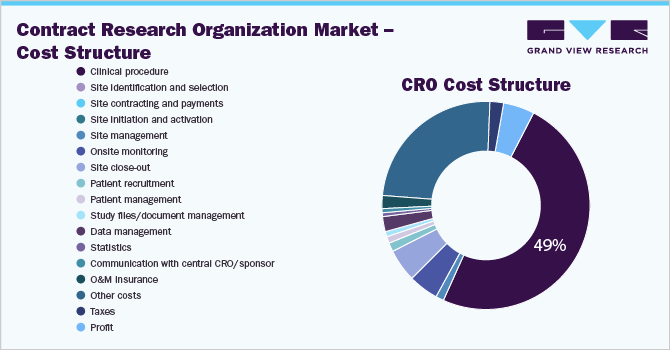

Grand View Research has identified the following key cost components for availing CRO services:

- Clinical procedure

- Regulatory affairs

- Drug safety management

- Drug logistics

- Biological sample logistics

- Clinical supplies logistics

- Medical writing

- Project management

- Quality control

- Pass-through costs

- Site identification and selection

- Site contracting and payments

- Site initiation and activation

- Site management

- Onsite monitoring

- Site close-out

- Patient recruitment

- Patient management

- Study files/document management

- Data management

- Statistics

- Communication with central CRO/sponsor

- O&M insurance

- Other costs

- Taxes

- Profit

Clinical procedure is the major cost component of a CRO, accounts for more than 45% of the total cost of service.

List of Key Suppliers in the Contract Research Organization Industry

- Covance (Lab. Corp.)

- IQVIA

- Syneos Health

- Parexel

- PRA Health Sciences

- PPD

- Charles River

- ICON

- Wuxi AppTec

- MedPace

Contract Research Organization Industry Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process.

In the CRO Category Intelligence study, we have estimated and forecasted pricing for the key cost components while availing services from CROs. Clinical procedures (Drug logistics, medical writing, project management, quality control, drug safety management, etc.) are the largest cost component of CRO services. It accounted for more than 50% of the overall cost of CRO services. The cost of clinical procedure services is majorly driven by the salary of key personnel and therapeutic area. For instance, clinical procedure cost of the respiratory system and oncology is 60% -80% higher than dermatology and anti-infective therapeutic areas.

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier.

The geographic location where the clinical trial is been conducted plays a major role while analyzing the rate benchmarking of a CRO service. In our research, we have analyzed the rates of oncology clinical trials, as it is the most common type of clinical trial across the globe. For instance, breast cancer phase 3 clinical trial cost in India and China is 90% lower than the clinical trial cost of the U.S and the U.K. Conducting clinical trials via CRO in Western European and North American countries needs double the cost of conducting clinical trials in APAC. However, for the clinical trial of critical diseases, the trial majorly happens in developed countries of Western Europe and North America, as the APAC region lacks the number of skilled professionals to conduct these types of clinical trials.

To gain a comprehensive understanding of the other aspects of rate benchmarking, please subscribe to our services for the complete report.

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Our research indicates that Principal Investigators and Clinical Research Co-coordinators of IQVIA earn 10%-15% higher salaries than Principal Investigators and Clinical Research Co-coordinators of Covance and Syneos Health. However, Syneos Health and Covance have a 10% YoY increment compare to IQVIA’s 7%-8%. We have also found that IQVIA and Covance offer 36% higher bonuses to principal investigators compare to Syneos Health.

Supplier Newsletter

It is cumbersome for any organization to continuously track the latest developments in their supplier landscape. Our newsletter service helps them remain updated, to avoid any supply chain disruption which they may face, and keep a track of the latest innovations from the suppliers. Outsourcing such activities help clients focus on their core offerings.

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Browse through Grand View Research’s collection of procurement intelligence studies:

Sugar Processing Market Procurement Intelligence – The global sugar processing market was valued at 166 million MT in 2020 and it is expected to grow at a CAGR of ~2% from 2021 to 2027 to cross 200 million MT in terms of volume in 2027. The growth of the market is majorly driven by the high demand generated from the food and beverages industry.

Vitamins and Dietary Supplements Market Procurement Intelligence – The global vitamin and dietary supplements market is expected to exhibit a CAGR of 4.9% from 2020 to 2025 with capsules and tablets being the most consumable dosage form of supplements. Powder is expected to emerge as the fastest-growing dosage form from 2020 to 2025 with a projected CAGR of 6.4% from 2020 to 2025.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/pipeline/contract-research-organization-market-procurement-intelligence-report