According to a report, “COVID-19 Diagnostics Market Size, Share & Trends Analysis Report By Product, By Sample Type (Oropharyngeal & Nasopharyngeal Swabs, Blood, Urine), By Technology (PCR, ELISA, POC), By End Use, And Segment Forecasts, 2020 – 2027”, published by Grand View Research, Inc., COVID-19 is an infectious disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), with the incubation period of SARS-CoV-2 ranging from 2 to 14 days. The world has become well aware of this pandemic that planted its roots in China in December 2019. However, the first serious implications of coronavirus were recognized in late February to early March this year, when the number of cases shot up globally. Promptly, the scientific community and medical researchers swung into action to develop a vaccine that could eliminate, or at the least suppress, the virus. Many pharmaceutical giants joined in through contribution and donations in the research work, teaming up with other competitors in order to have the best brains behind drug development, and holding clinical trials.

The pandemic has presented many challenges and opportunities to the scientific and medical communities globally, with pharma companies and Universities striving to bring forth different types of diagnostics, while there has also been an unprecedented need to approve them at a faster rate by federal agencies, along with the constant pressure to produce test kits in a very short amount of time due to the high demand globally. The global industry for COVID-19 diagnostics is anticipated to show a very rapid growth in the near future. An important aspect of containing the pandemic at the earliest has been mass testing, which ensures that proper measures can be implemented in that region before the virus spreads at an uncontrollable pace. Countries such as Germany, Iceland, New Zealand are examples of successfully controlling the pandemic through high testing rates. For example, Germany carried out mass testing of 500,000 citizens at average per week in March 2020, when many countries were still coming to terms with the outbreak. Thus, government resolve and action to combat and contain the pandemic has played an important role in developing the COVID-19 diagnostics market.

Another important factor developing the market has been the large-scale funding and the exploration of novel molecular technologies such as CRISPR, which have been instrumental in encouraging industry participants to go all out in developing solutions. CRISPR, which is a gene editing technology, enables the detection of SARS-CoV-2 genes via a protein named CRISPR-Cas12. More recently, bioengineers at the Stanford University, in collaboration with the Department of Energy’s Lawrence Berkeley National Laboratory, developed PAC-MAN, which combines a guide RNA with the virus-killing enzyme Cas13.

“Would you Like/Try a Sample Report” Click the link below: https://www.grandviewresearch.com/industry-analysis/covid-19-diagnostics-market/request/rs1

Additionally, artificial intelligence is expected to come to the aid of researchers and medical teams in the efficient diagnosis of the disease, thus further amplifying market growth; however, experts have warned that an improper implementation will cause worsening of the situation, and machine learning tools will need to constantly evolve to have a firm grip on the situation. Along with this, funding and investments received from public and private sources are also expected to boost the industry players. For example, in the US, the CDC, by using funds from the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020, awarded $631 million to 64 jurisdictions through the existing Epidemiology and Laboratory Capacity for Prevention and Control of Emerging Infectious Diseases (ELC) cooperative agreement.

The global COVID-19 diagnostics market has been segmented on the basis of product, sample type, technology and end-use. Based on product, the market is classified into instruments, and reagents and kits. The latter segment is expected to dominate the market, being critical components in COVID testing. The segment has a huge scope in coming months, with many nations ramping up their testing, as directed by WHO. With regards to the US, to combat the shortage of reagents, the FDA has granted Emergency Use Authorization (EUA) to various COVID-19 detection tests, thus creating a very positive market for competitors.

In terms of sample type, oropharyngeal & nasopharyngeal swabs, blood and urine are the major segments. While the oropharyngeal and nasopharyngeal swabs segment leads the market, on account of being the preferred choice for sample collection by the CDC, the blood sample segment is expected to gain traction in research and molecular studies over the coming months.

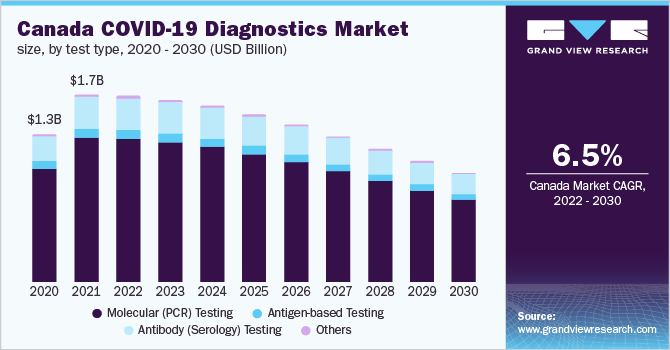

The major technological segments in the market include Polymerase Chain Reaction (PCR), Antibody or Enzyme-Linked Immunosorbent Assay (ELISA), Serology, and Portable or Point-of-Care (POC), among others. With the majority of COVID-19 detection tests relying on Reverse Transcriptase Polymerase Chain Reaction (RT-PCR) for quantification of RNA in patient samples, the PCR segment is expected to dominate the market over the coming months. POC tests are also expected to gain prominence in the near future, with companies validating and developing rapid POC immunodiagnostic tests to facilitate decentralized testing.

Recent Developments:

- While many of the developed economies across the globe, excluding US, have been by-and-large successful in containing the spread of the pandemic, developing nations are frantically trying to catch up to an optimal testing scenario. The African region, as well as many developing and underdeveloped economies in Southeast Asia, are looking for tie-ups with domestic and international organizations in order to provide testing facilities to their citizens. For example, a number of states in India have been unsuccessful in increasing the level of testing, and thus there is a good growth opportunity for companies.

- In April 2020, Abbott launched a serology (antibody) test for coronavirus across US hospitals, which helps to detect the IgG antibody to SARS-CoV-2. This has been used on Abbott’s ARCHITECT i1000SR and i2000SR laboratory instruments, which can run up to 100-200 tests an hour. The supply of the test has been done globally, with India beginning to receive the supply in the second half of June 2020.

- FDA expanded the EUA (Emergency Use Authorization) for Thermo Fisher Scientific’s COVID-19 diagnostic tests (multiplex real-time PCR test) in May 2020, which enabled bringing of more instruments on line, enhancing workflow flexibility, and simplifying the methods to increase throughput and allow more labs to run tests.

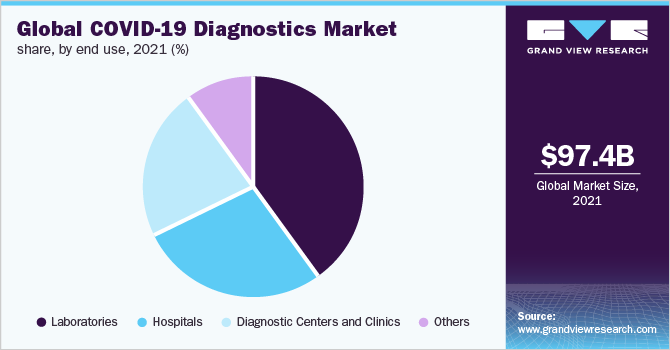

End-Use Insights

Laboratories segment is estimated to account for the largest revenue share of 40% in 2020. The laboratories are constantly increasing their testing capacities to address the rising demand. Moreover, private laboratories are also inclined toward coronavirus testing. As reported in April 2020, Orchard Laboratories is the first private laboratory in Michigan, U.S., to offer rapid COVID-19 testing by using RT-PCR technology. Initially, it would conduct 400 tests per day.

Have Any Query? Ask Our Experts for More Details on Report: https://www.grandviewresearch.com/inquiry/450223/ibb

Moreover, laboratories have leveraged high-throughput technologies to process a large volume of coronavirus tests accurately and rapidly. This is propelled by robust reimbursement policies implemented effectively in the developed economies. For instance, the Centers for Medicare & Medicaid Services (CMS) has doubled the Medicare reimbursement rate for high-molecular tests pertaining to COVID-19 detection.

Government authorities and companies are undertaking efforts to develop tests that can be specifically deployed in diagnostics centers, clinics, or physician’s offices. The FDA has recently approved decentralized testing platforms to diversify testing capabilities across clinics. For instance, Abbott’s ID NOW platform is highly implemented in urgent-care clinics and doctors’ offices in the U.S. The small size makes it portable and, thus, its use would not be limited to only hospital settings.

COVID-19 Diagnostics Market Segmentation

Grand View Research has segmented the global COVID-19 diagnostics market on the basis of product, sample type, technology, end use, and region:

COVID-19 Diagnostics Product Outlook (Revenue, USD Million, 2020 – 2027)

-

Instruments

-

Reagents & Kits

COVID-19 Diagnostics Sample Type Outlook (Revenue, USD Million, 2020 – 2027)

-

Oropharyngeal & Nasopharyngeal Swabs

-

Blood

-

Urine

-

Others

COVID-19 Diagnostics Technology Outlook (Revenue, USD Million, 2020 – 2027)

-

Polymerase Chain Reaction (PCR)

-

Antibody or Enzyme-Linked Immunosorbent Assay (ELISA)

-

Serology

-

Portable or Point-of-Care (POC)

-

Others

COVID-19 Diagnostics End-Use Outlook (Revenue, USD Million, 2020 – 2027)

-

Laboratories

-

Hospitals

-

Diagnostic Centers and Clinics

-

Research Institutes

COVID-19 Diagnostics Regional Outlook (Revenue, USD Million, 2020 – 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East Africa (MEA)

-

South Africa

-

Saudi Arabia

-

List of Key Players of COVID-19 Diagnostics Market

-

F. Hoffman-La Roche Ltd.

-

Thermo Fisher Scientific, Inc.

-

Perkin Elmer, Inc.

-

Neuberg Diagnostics

-

1drop Inc.

-

Veredus Laboratories

-

ADT Biotech Sdn Bhd

-

altona Diagnostics GmbH

-

bioMérieux SA

-

Danaher

-

Mylab Discovery Solutions Pvt Ltd.

-

ALDATU BIOSCIENCES

-

Quidel

-

Quest Diagnostics

-

Hologic Inc

-

Laboratory Corporation of America Holdings

-

Luminex Corporation

-

Cepheid

-

Abbott

Request for Customization : https://www.grandviewresearch.com/request-for-customization/450223/rfc1

Explore the BI enabled intuitive market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/covid-19-diagnostics-market