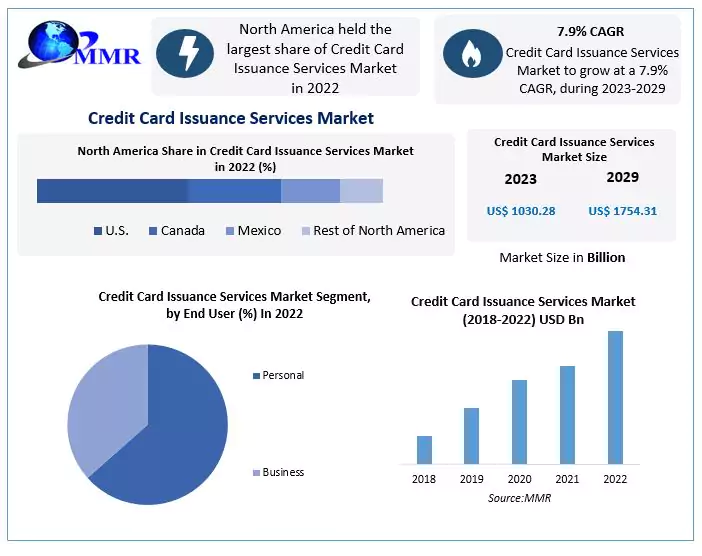

Pune, 2, May, 2023: As per Maximize Market Research, a global business research and consultancy firm, the total global market for “Credit Card Issuance Services Market” was USD 1030.28 Bn in 2022 and is expected to grow at a CAGR of 7.9 percent over the forecast period to reach USD 1754.31 Bn by 2029.

Credit Card Issuance Services Market Report Scope and Research Methodology

The Credit Card Issuance Services Market report provides a qualitative and quantitative analysis of market size, price, demand, mergers and acquisitions, supply chain, investment and expansion plans by key competitors, and predictions. The detailed analysis of segments provides clear information on the Credit Card Issuance Services Market potential. The analysis provides investors with a full insight into the Credit Card Issuance Services industry’s future, as well as the elements that are expected to affect the market positively and negatively. For the competitive analysis, the report includes the market leaders, followers and new entrants in the Credit Card Issuance Services Industry with information on strategies, revenue, partnership, joint ventures, etc. The bottom-up approach was used to estimate the regional and global Credit Card Issuance Services Market size. To gather the data for the Credit Card Issuance Services Market report, primary and secondary research methodologies were used. To provide the strengths and weaknesses of the Credit Card Issuance Services’ key players, the SWOT analysis was used. PESTLE was employed to present the potential impact of the macroeconomic and micro-economic factors affecting the Credit Card Issuance Services industry.

Credit Card Issuance Services Market Dynamics

The market growth is majorly driven by the increasing demand for credit card services in developing countries. The profit share of credit card issuers is also increasing in the market because of their creation of new revenue stream from affiliate marketing and by evaluating in-organic growth. The favourable government initiatives for the digitalization of financial services are expected to drive the market growth during the forecast. The factors that are hampering the market growth are the increase in credit card frauds across the world and high-interest rates on credit cards.

Get a Sample Copy of the Report: https://www.maximizemarketresearch.com/request-sample/186182

Credit Card Issuance Services Market Regional Insights

The North America region dominated the global Credit Card Issuance Services market in 2022 and is expected to grow at a high rate during the forecast period. This growth of the market is attributed to the consumer price index and high competition.

The Credit Card Issuance Services Market in the Asia Pacific region is expected to grow at a high rate during the forecast. The regional market is growing mainly because of developing e-commerce and rising credit card awareness among developing nations.

Credit Card Issuance Services Market Segmentation

By Type

- Consumer Credit Cards

- Business Credit Cards

By Issuers

- Banks

- Credit Unions

- NBFCs

By End User

- Personal

- Business

Credit Card Issuance Services Key Players include:

- Fiserv Inc.

- Marqeta Inc.

- Stripe Inc.

- Giesecke+Devrient GmbH

- Entrust Corporation.

- GPUK LLP.

- Nium Pte. Ltd.

- Fis

- Thales

- American Express Company

- SBI

- IDFC Bank

- HDFC Bank

- Standard Chartered

- CITI Bank

- VISA

- CHASE

- Capital One

- Discover Bank

- Wells Fargo

Table of Content for Credit Card Issuance Services Market

- Global Credit Card Issuance Services Market: Research Methodology

- Global Credit Card Issuance Services Market: Executive Summary

- Market Overview and Definitions

- Introduction to Global Market

- Summary

- Key Findings

- Recommendations for Investors

- Recommendations for Market Leaders

- Recommendations for New Market Entry

- Global Credit Card Issuance Services Market: Competitive Analysis

- MMR Competition Matrix

- Market Structure by region

- Competitive Benchmarking of Key Players

- Consolidation in the Market

- M&A by region

- Key Developments by Companies

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Market Dynamics

- PORTERS Five Forces Analysis

- PESTLE

- Regulatory Landscape by region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- COVID-19 Impact

- Global Credit Card Issuance Services Market Segmentation

- Global Market, by Type (2022-2029)

- Global Market, by Issuers (2022-2029)

- Global Market, by End-Users (2022-2029)

- Regional Credit Card Issuance Services Market (2022-2029)

- Regional Market, by Type (2022-2029)

- Regional Market, by Issuers (2022-2029)

- Regional Market, by End-Users (2022-2029)

- Regional Market, by Country (2022-2029)

- Company Profile: Key players

- Company Overview

- Financial Overview

- Global Presence

- Capacity Portfolio

- Business Strategy

- Recent Developments

Get the Sample PDF of Report: https://www.maximizemarketresearch.com/request-sample/186182

Key questions answered in the Credit Card Issuance Services Market are:

- What was the Credit Card Issuance Services Market size in 2022?

- What is the expected Credit Card Issuance Services Market size by the end of the forecast period?

- What are the Credit Card Issuance Services Market segments?

- Which segment of the Credit Card Issuance Services Market is expected to grow at a high rate?

- What are the factors driving the growth of the Credit Card Issuance Services Market?

- What growth strategies are the players considering to increase their presence in Credit Card Issuance Services Market?

- Who are the leading companies and what are their portfolios in Credit Card Issuance Services Market?

- What are the major challenges that the Credit Card Issuance Services Market could face in the future?

- Who held the largest Credit Card Issuance Services market?

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2022)

- Past Pricing and price curve by region (2018 to 2022)

- Market Size, Share, Size & Forecast by different segment | 2023−2029

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Market Segmentation – A detailed analysis by Type, Issuers, End-Users and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

Maximize Market Research is leading Information Technology & Telecommunication research firm, has also published the following reports:

Secure Digital Card Market – The market size is expected to reach USD 13.9 billion by 2029 at a CAGR of 5.7 percent during the forecast period. The market is expected to be driven by the increasing adoption of digital services.

Cardless ATM Market – The market size is expected to reach USD 5.16 billion by 2029 at a CAGR of 10.5 percent during the forecast period. The market is expected to be driven by the increasing penetration of smartphones.

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical Film Type, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical Film Types and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, Film Typeion and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

Media Contact

Company Name: MAXIMIZE MARKET RESEARCH PVT. LTD.

Contact Person: Geeta Yevle

Email: Send Email

Phone: +91 9607365656

Address:3rd Floor, Navale IT Park, Phase 2, Pune Banglore Highway, Narhe,

City: Pune

State: Maharashtra

Country: India

Website: https://www.maximizemarketresearch.com/market-report/credit-card-issuance-services-market/186182/