Cyber Security Industry Overview

The global cyber security market size was valued at USD 184.93 billion in 2021 and is projected to reach USD 500.70 billion by 2030, registering a CAGR of 12.0% from 2022 to 2030.

The increasing number of cyber-attacks with the emergence of e-commerce platforms, deployment of cloud solutions, and proliferation of smart devices are some of the factors driving the growth market. Cyber threats are anticipated to evolve with the increase in usage of devices with intelligent and IoT technologies. As such, organizations are expected to adopt and deploy advanced cyber security solutions to detect, mitigate, and minimize the risk of cyber-attacks, thereby driving the market growth.

Gather more insights about the market drivers, restrains and growth of the Global Cyber Security market

Cyber security experienced a slight dip in 2020 due to the closure of several organizations during the first and second quarters of 2020. However, the market started recovering by the end of the second quarter owing to several firms deploying cyber security solutions with the implementation of remote working culture. Employees used personal devices for business work while connecting through private Wi-Fi or anonymous networks, putting the company’s security at risk. As such, several organizations adopted cyber security solutions the manage and secure the increased number of endpoint devices while also getting protection from network threats.

The cyber security market is expected to continue its growing post-pandemic due to the hybrid working trend that is anticipated to stay over the future. Several employees are expected to continue working from home or remote premises with the increasing BYOD trend. According to data published by Nine2FiveJobSearch.com, before the pandemic, 29% of the U.S. workforce had an option of working from home on a part-time basis, which increased to 50% of the workforce working from home in 2020. The risk of cyber-attacks is expected to grow with the emerging BYOD and hybrid working trend, which is expected to drive the adoption of cyber security solutions and fuel market growth.

Several organizations incur significant losses in terms of loss of revenue, brand reputation, unplanned workforce reduction, and business disruptions due to data breaches. Companies have to spend a considerable amount of money to recover from these losses and mitigate the risks evolving from data breaches. According to a report published by IBM in 2021, the average cost of data breaches for an organization amounted to USD 4.87 million, an increase of 10% over 2020. As such, organizations are engaged in deploying advanced cyber security solutions to detect cyber threats and provide a response, thereby helping in cutting down data breach costs.

Cyber security companies are engaged in developing security solutions with AI that helps organizations automate their IT security. Such solutions enable automated threat detection and remediation, allowing IT professionals to reduce the efforts and time required to track malicious activities, techniques, and tactics. These solutions offer real-time monitoring and identification of new threats while also responding autonomously. This helps the security teams analyze the filtered breach information and detect and remediate cyber-attacks faster, thereby reducing security incident costs.

Cyber Security Market Segmentation

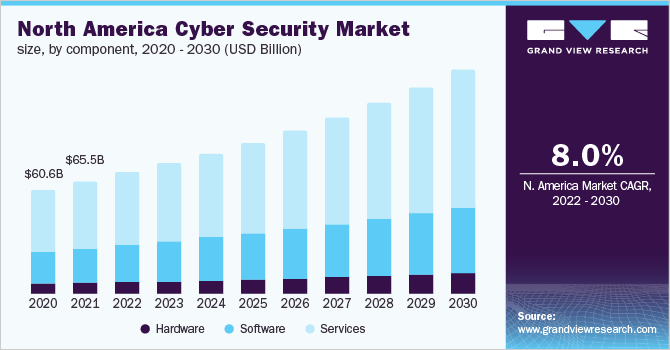

Based on the Components Insights, the market is segmented into Hardware, Software and Services.

- The hardware segment is expected to register the highest growth over the forecast period due to several organizations engaged in implementing cyber security platforms and upgrading their existing ones.

- Security vendors are involved in developing cyber security solutions with artificial intelligence and machine learning-based capabilities, which require high-end IT infrastructure.

- The services segment accounted for the largest revenue share in 2021, contributing more than 50% of the overall revenue.

Based on the Security Type Insights, the market is segmented into Endpoint, Cloud, Network, Application, Infrastructure, Data Security and Others.

- The infrastructure protection segment accounted for the largest revenue share in 2021, contributing more than 25% of the overall revenue.

- The cloud security segment is expected to exhibit the highest growth in the forecast period owing to the increasing adoption of cloud-based solutions by enterprises due to its cost-effectiveness and the convenience of working with cloud-based platforms.

- The high market share is attributed to the rising number of data center constructions and the adoption of connected and IoT devices.

Based on Solution Insights, the market is segmented into Unified Threat Management (UTM), IDS/IPS, DLP, IAM, SIEM, DDoS, Risk and Compliance Management and others.

- The IAM segment accounted for the largest revenue share in 2021, contributing more than 25% of the overall revenue.

- The IDS/IPS segment is expected to exhibit the highest growth in the forecast period due to the increasing need for real-time monitoring and identifying threats across the networks.

Based on Service Insights, the market is segmented into Professional and Managed services.

- The professional services segment held the highest market share of the overall market in 2021 and is expected to maintain its dominance over the forecast period.

- The managed services segment is expected to register the highest growth rate of more than 10% over the forecast period.

Based on the Deployment Insights, the market is segmented into Cloud-based and On-premises

- The cloud-based segment is expected to register the highest growth rate of more than 10% over the forecast period.

- The on-premises segment held the highest market share of the overall market in 2021 and is expected to maintain its dominance over the forecast period.

Based on the Organization Size Insights, the market is segmented into SMEs, Large Enterprises

- The SMEs segment is expected to register the highest growth rate of more than 11% over the forecast period.

- The large enterprise segment held the highest market share of the overall market in 2021 due to the increase in spending on IT infrastructure by these organizations.

Based on the Application Insights, the market is segmented into IT & Telecom, Retail, BFSI, Healthcare, Defense/ Government, Manufacturing, Energy, and others

- The defense/government segment held the highest market share of more than 20% of the overall market in 2021.

- The healthcare segment held the highest revenue share of the overall market in 2021.

Based on the Cyber Security Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- Asia Pacific is expected to register the fastest growth, at a CAGR of more than 15%, over the forecast period. The growth of this region can be attributed to the high deployment of cloud technologies, the proliferation of IoT devices, and the increasing number of data center constructions.

- North America held the high market share, followed by Europe, in 2021. The early availability and adoption of new technologies have contributed to the growth of the North American market over the past years.

Browse through Grand View Research’s Technology Industry Related Reports.

- Cloud Security Market– The global cloud security market size was valued at USD 4.88 billion in 2016. It is expected to rise at a CAGR of 13.9% over the forecast period. Cloud computing security also known as cloud security incorporates all plans, policies, and their execution controls essential to safeguard and protect application data, infrastructure as well as compliance adherence associated with cloud.

- IoT Device Management Market – The global IoT device management market size was pegged at USD 605.9 million in 2016 and is expected to expand at a 28.3% CAGR over the forecast period. Growing emphasis on increasing operational efficiencies and managing connected devices is anticipated to drive market growth. Major players in the IoT industry are undertaking various initiatives, such as the formation of Open Mobile Alliance (OMA), for standardizing protocols. This has also helped boost the growth of the industry.

Market Share Insights:

- August 2021: Palo Alto Networks introduced an upgraded version of its Cortex XDR platform. The new version is expected to expand the investigation, monitoring, and detection capabilities, thereby offering broader and enhanced protection to the security operation center (SOC) teams.

- July 2021: To expedite DevSecOps, Fortinet, Inc. purchased application security innovator Skenai. Sken.ai offers comprehensive testing for all major languages and frameworks, as well as all types of scans (SAST, DAST, SCA, Secrets, and more). Machine learning (ML) is used by Sken.ai to correlate and assign a security risk level to each vulnerability discovered across multiple scan kinds and apps.

Key Companies Profile:

The market is characterized by the presence of several players offering differentiated security solutions with advanced features. Players in the cyber security space are engaged in introducing products with artificial intelligence and machine learning capabilities, which help organizations automate their IT security.

Some prominent players in the global cyber security market include

- Cisco Systems, Inc.

- Palo Alto Networks

- McAfee, Inc.

- Broadcom

- Trend Micro Incorporated

- CrowdStrike

- Check Point Software Technology Ltd.

Order a free sample PDF of the Cyber Security Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: www.grandviewresearch.com/industry-analysis/cyber-security-market