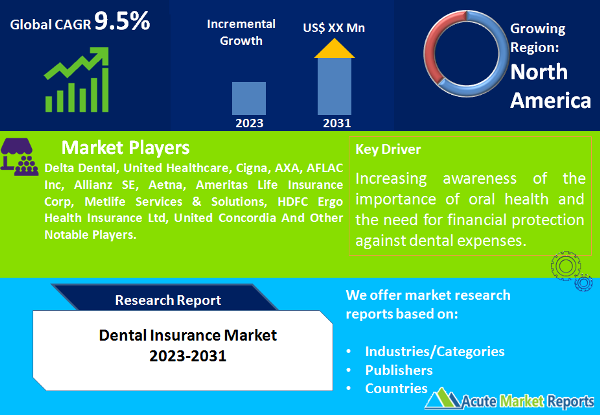

The dental insurance market is of paramount importance in guaranteeing that families and individuals have access to dental care. During the period from 2023 to 2031, the dental insurance market is anticipated to expand at a CAGR of 9.5%, propelled by rising consumer awareness regarding the significance of oral health and the necessity for affordable safeguards against dental expenditures. In conclusion, the dental insurance market is anticipated to sustain its expansion due to the aging population’s rising dental care demands, expanding coverage options, and heightened awareness of oral health. Restricted coverage continues to be an issue in specific regions. Additionally, geographic trends and market segmentation by type and scope influence the dynamics of the industry. Revenues are projected to increase from 2022 to 2031 as key participants consistently employ customer-centric strategies and innovation to sustain their competitive advantage. Anticipated trends in the market for the years 2023 to 2031 include further developments in coverage options and geographic expansion.

The dental insurance market expanded substantially in 2022 as a result of increased recognition of the significance of oral health. More families and individuals came to understand the importance of routine dental examinations and remedies. Dental insurance cost-effectively facilitated access to these services, thereby contributing to the expansion of the market. From 2023 to 2031, this trend is anticipated to persist, as dental health continues to be a major concern for many.

Increasing flexibility in dental insurance plans and expanding coverage options also contributed to the market’s growth. Dental Preferred Provider Organisations (DPPO), Dental Health Maintenance Organisations (DHMO), Dental Indemnity Plans, and additional novel schemes were implemented by insurers. Enrollments increased as a result of the ability of individuals to select plans that matched their financial constraints and personal preferences. During the forecast period, the demand for diverse coverage options is anticipated to contribute to a substantial CAGR.

Browse for report at : https://www.acutemarketreports.com/report/dental-insurance-market

An additional influential factor was the aging population and the corresponding rise in their requirements for dental care. Generally, the demand for complex dental procedures, implants, and prostheses, increases as the population ages. Popularity increased in 2022 for dental insurance plans that address these particular requirements, which are projected to grow at a rapid CAGR from 2023 to 2031.

Notwithstanding its expansion, the dental insurance market is confronted with a constraint about restricted coverage in specific geographical areas. Certain regions encountered difficulties in offering comprehensive dental insurance coverage to their residents in 2022 as a result of regulatory restrictions or a scarcity of dental care providers. It is anticipated that the constraint of addressing these coverage limitations will persist between 2023 and 2031, thereby requiring endeavors to broaden the availability of dental insurance.

By coverage, the dental insurance market can be divided into numerous submarkets, such as Dental Preferred Provider Organisations (DPPO), Dental Health Maintenance Organisations (DHMO), and Dental Indemnity Plans. The maximum revenue in 2022 was ascribed to DHMO plans, a category recognized for its economic coverage. Except this, Dental Indemnity Plans are anticipated to grow at the highest CAGR from 2023 to 2031. These plans provide an extensive range of dental procedures and enhanced flexibility, rendering them an appealing option for a considerable number of consumers.

An additional critical determinant of segmentation pertains to the classification of dental services that are insured, which can be delineated as Major, Basic, or Preventive. Major dental services – which involve complex and expensive procedures – generated the most revenue in 2022. On the other hand, preventive dental services are anticipated to grow at the maximum CAGR from 2023 to 2031. People have placed a greater emphasis on preventive care as they have come to understand the advantages of early intervention and maintenance.

Access a Free Sample Copy From https://www.acutemarketreports.com/request-free-sample/140017

Diverse trends are observed in the dental insurance market concerning geography. North America exhibited the greatest revenue percentage in 2022 as a result of its aging population and firmly established dental insurance industry. From 2023 to 2031, the Asia-Pacific region is anticipated to have the highest CAGR due to the continued expansion of dental coverage and insurance coverage accessibility in emerging markets.

Competition abounds among major participants in the dental insurance industry, including Delta Dental, United Healthcare, Cigna, AXA, AFLAC Inc, Allianz SE, Aetna, Ameritas Life Insurance Corp, Metlife Services & Solutions, HDFC Ergo Health Insurance Ltd and United Concordia. Consistently, these organizations have made investments to improve their customer service, expand their coverage options, and expand their network of dental care providers. Significant revenues were generated in 2022, and it is anticipated that the strategic investments in place will sustainably generate favorable returns between 2023 and 2031. To ensure a comprehensive network, key strategies include customizing coverage options, enhancing the customer experience, and forming partnerships with dental care providers.

Other Popular Reports https://www.acutemarketreports.com/category/healthcare-it-market

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com