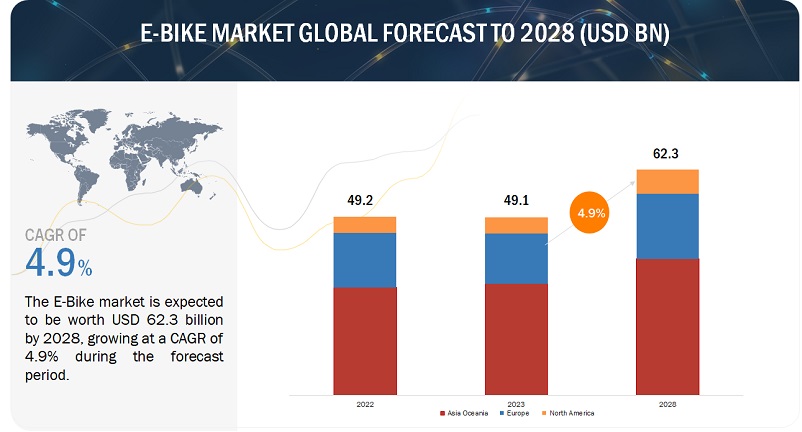

The global E-Bike market is projected to grow from USD 49.1 billion in 2023 to USD 62.3 billion by 2028 at a CAGR of 4.9%. The e-bike industry has declined in 2023 in some regions due to economic uncertainty, supply chain disruptions, and price competition due to intense competition. However, these are temporary challenges, and the market would remain positive in the long-term outlook. Though the e-bike market in other regions hasn’t shown any decline, the market has shown steady growth. Reasons such as growing environmental concerns, government support such as dedicated lanes or incentives, technological advancements, and changing consumer preferences would drive the market in the long run. Increasing inclination towards multi-modal transportation would also drive the market for e-bikes in the coming years.

Lithium-ion is expected to be the most preferred battery chemistry in e-bikes during the forecast period.

The E-Bikes with lithium-ion batteries are estimated to account for the largest share of e-bikes due to the various benefits offered by these batteries, such as better lifecycle, high energy density, wide operating temperatures, and more power-to-weight ratio than other battery types. These batteries have also shown a sharp decline in prices in recent years. Lithium-ion battery prices have declined by almost 90% in the last few years. Increased competition in the market has put pressure on manufacturers to reduce costs to remain competitive. With the growth of the E-Bike industry, the lithium-ion battery market is expected to grow and explore this new technology. In 2019, the output of high-end products such as lithium-ion battery E-Bikes stood at nearly 5 million units, accounting for ~14% of total E-Bike output in China. The efforts of manufacturers to produce lightweight E-Bikes have also resulted in the higher adoption of lithium-ion batteries.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=110827400

City/Urban bikes are expected to be the largest e-bike applications during the forecast period.

The city/urban e-bikes are primarily used for daily commutes in metro areas; these are low-step frame bicycles designed for gentle terrain and trips around cities and urban areas. The price range of city/urban e-bikes ranges between USD 1,500 and USD 5,000, depending on their features. China, Japan, India, and South Korea in Asia Oceania face traffic congestion due to high population and vehicle density. Government policies and rebates are driving the market of city/urban E-Bikes. Mountain/trekking and Cargo bikes are expected to show faster growth in coming years. Pedego (City commuter), Rad Power Bikes (Rad City 5 plus), and Vanmoof S3 are some top-selling city E-Bikes.

Asia-Oceania is estimated to be the largest e-bike market.

Asia-Oceania is the largest e-bike market in terms of production and sales. China is the largest e-bike market in Asia-Oceania as well as globally. City/Urban segment is expected to lead the e-bike market in this region, whereas Cargo and Trekking e-bikes are expected to grow fastest over the forecast period. Despite declining sales in 2022-2023, the Chinese e-bike market will still dominate the e-bike market in Asia-Oceania.

The demand for mountain and trekking bikes is increasing due to their robustness and better performance. Japan is the second-largest market for e-bikes in the Asia-Oceania region. The country caters only to Class-I e-bikes, which can be ridden on streets, bike lanes, multi-use bike paths, and roads. In India, e-bikes cater to Class-I and Class-II e-Bikes with 25 km/h to 45 km/h speeds and 250-watt motors. The e-bike market in India is at a nascent stage. The e-bike market in South Korea is growing due to increased consumer health consciousness, high traffic congestion, and government initiatives to promote cycling to reduce carbon emissions. In Australia, Mountain/trekking has the highest market share in terms of volume and value during the forecasted period for the e-bikes market. Yamaha Motor Corporation, Panasonic Corporation, Shimano, Yoku, Phylion, and Yadea are some Asian battery suppliers contributing to the Asian e-bike market. Considering all this, Asia Oceania is the largest city/urban e-bike market.

The e-bike industry in Taiwan has strengthened with growth over the years, particularly in 2022, as per the statement of the Taiwan Bicycle Association in March 2022. Taiwan is more into the manufacturing and exporting of e-bikes globally. Taiwan has become a major hub for the export of e-bikes and related components due to Europe’s anti-dumping policy and the trade war between the US and China. The Netherlands, the US, Germany, the UK, Spain, Italy, Denmark, Switzerland, Belgium, and France were the top 10 export destinations of e-bikes for Taiwan between 2020 and 2022. In 2022, the export of Taiwan-made e-bikes to the US and UK experienced a noticeable decline. This trend was evident as early as August 2022, when the initial double-digit export growth between January and April slowed to a mere 1.17%. By the end of the year, the overall export volume to the US and UK had further diminished, with Europe becoming the primary destination for Taiwan’s e-bike exports.

Key Market Players

Major players operating in the e-bike market are Accell Group NV (Netherlands), Pon Bike (Netherlands), Giant Manufacturing Co. Ltd (Taiwan), Yamaha Motor Company (Japan), Merida Industry Co. (Taiwan), and Specialized Bicycle Components Inc. (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=110827400

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-bike-market-110827400.html