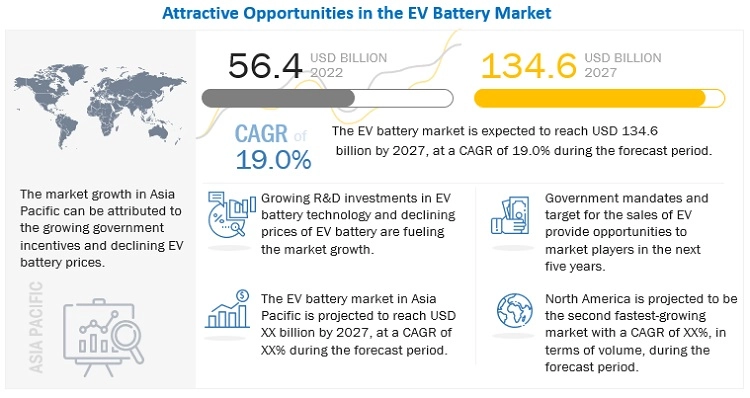

The global EV Battery Market is projected to grow at a CAGR of 19.0% from USD 56.4 billion in 2022 to USD 134.6 billion by 2027. The base year for the report is 2021, and the forecast period is from 2022 to 2027. The automotive industry places a strong emphasis on efficiency, emission-free propulsion, and cutting-edge technologies as a result of the government’s increasingly strict regulations regulating emissions created by vehicles. In the upcoming years, it is anticipated that the market for EV batteries would grow due to the rising popularity of electric vehicles and enhanced network, charging technology, and capacity infrastructure across various nations.

In the EV Battery Market, by material type, the lithium segment is expected to capture the largest market share during the forecast period. Alongside the expansion of existing facilities, large-scale projects are being planned and implemented in other countries, such as Canada, Europe and other regions. In addition, Asian battery manufacturers such as CATL (China), Samsung SDI (South Korea) in particular have secured large quotas by entering into long-term supply contracts and acquiring stakes in companies.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=100188347

In the EV Battery Market, by propulsion, the BEVs segment is projected to lead during the forecast period. BEVs have an increasing demand due to concerns about emission reductions worldwide. Due to the low availability of charging stations and the high cost of EV batteries, BEVs had a low demand. However, the demand for BEVs has been rising significantly due to the decreasing cost of EV batteries at a fast and steady rate coupled with increasing EV range and a growing EV charging network worldwide Some new EVs launched in 2021, and upcoming in early 2022 include Aspark Owl, Audi A6 e-Tron, Audi Q4 e-Tron, BMW i4, BMW iX, Cadillac Lyriq, Chevrolet Silverado Electric, Hyundai Ioniq 5, Kia EV6, Lucid Air, Mazda MX-30, Mercedes Benz (EQA, EQB, EQC, EQE, EQS), Nissan Ariya, Tesla Cybertruck, Tesla Roadster, Volkswagen ID Space, Volvo C40 recharge, Volvo C30 recharge, etc.

As the largest market for EV batteries during the projection period, Asia Pacific offers a substantial scope for growth. Along with leading manufacturers like Panasonic, LG Chem, Samsung, and CATL, the region is also home to other OEMs that are reshaping the global EV market. In the Asia Pacific, Japan also had a significant impact on battery technology. The Japanese EV battery industry is anticipated to expand thanks to developments in technology like BEVs and PHEVs. Regulators and industries bodies in Japan are aiming for a tenfold increase in domestic global battery output capacity to 600 GWh by 2030 as it has lost considerable market share to competitors from China and South Korea. OEMs have also joined the race by entering battery manufacturing and are focusing on sold state batteries. Honda is developing its own solid-state batteries, which are estimated to be in the market in between 2025-2030.

In Asia-Pacific China is estimated to lead the EV Battery Market. The country has been a frontrunner in EV adoption and has major battery manufacturers such as CATL and BYD that are market leaders in battery manufacturing. CATL offers Lithium-ion batteries, Lithium polymer batteries, Fuel cells, Battery modules for EVs among several others. It has supply contracts with major OEMs such as Tesla (US), Honda (Japan), Hyundai (South Korea), Volvo (Sweden) and others. In May 2022 CATL partnered with European leading electric bus manufacturer Solaris to promote electrification of city transportation in Europe. CATL will be supplying lithium iron phosphate (LFP) batteries equipped with novel Cell to Pack (CTP) technology to Solaris to power its bus models. Similarly, in December 2021 SsangYong and BYD have signed a technological partnership contract for development of electric vehicle batteries and manufacturing of battery packs.

During the forecast period, Europe is anticipated to be the second-largest EV Battery Market. The European region has seen major network expansion by major battery producers, which has contributed to the enormous growth of EVs and batteries. Manufacturers including Renault, Audi, BMW, Mercedes, and others are based in the area. By 2030–2035, Europe has set an extremely aggressive goal of cutting CO2 emissions by 80%, and has developed a plan to achieve it. Governments in several European nations are funding the infrastructure for electric vehicles, and the long-term emphasis is anticipated to remain on electric vehicles.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=100188347

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-vehicle-battery-market-100188347.html