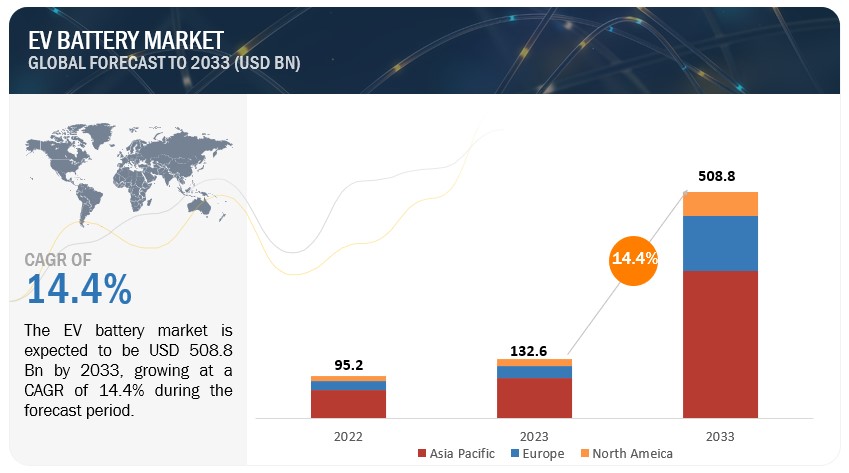

The global EV battery market size was valued at USD 132.6 billion in 2023 and is expected to reach USD 508.8 billion by 2033, at a CAGR of 14.4%, during the forecast period 2023-2033. Increased awareness about environmental concerns and the desire for sustainable transportation options are driving consumer interest in electric vehicles. Longer battery life, faster charging times, and increased driving ranges are influencing consumer decisions. Additionally, Innovations in battery technology, such as advancements in lithium-ion batteries, solid-state batteries, and other emerging technologies, drive efficiency, range, and cost-effectiveness, making EVs more appealing to consumers. Prominent automakers are investing heavily in electric vehicle technology and are pledging to transition their fleets to electric. This commitment to EVs pushes battery development and market growth.

“Cylindrical segment is expected to grow at the fastest rate during the forecast period.”

The cylindrical segment is projected to register the highest CAGR during the forecast period. Cylindrical batteries are known for their durability and robustness. Compared to the other EV battery formats, cylindrical cells are the least expensive to manufacture because their casing allows for superior containment and provides efficient mechanical resistance from both external and internal stresses. According to Laserax, on average, EVs with cylindrical cells have between 5,000 and 9,000 cells. This is in stark contrast with pouch cells, which only have a few hundred cells, and an even lower number in prismatic cells. OEMs are also adopting cylindrical battery form for example, Tesla chooses to use cylindrical batteries because of their reliability and durability. Also, in January 2023, General Motors considered using cylinder batteries over pouches for EVs.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=100188347

“Negative electrode segment to hold largest market share during the forecast period.”

The negative electrode in an EV battery plays a crucial role in its performance and longevity. It is responsible for storing lithium ions during charging and releasing them during discharge. The energy density of the negative electrode material determines the amount of energy that can be stored in a battery. Higher energy density leads to longer range and less frequent charging. However, with rising battery demand, the negative electrode is expected to be the most important lithium-ion battery component. The negative electrode, also known as the anode, plays a critical role in the performance of lithium-ion batteries. It is responsible for storing and releasing lithium ions during the charging and discharging process. The ideal anode material should have high energy density, high power density, long cycle life, and good safety. The anode is responsible for enabling electric currents to flow through the external circuit while allowing reversible absorption and emission of lithium ions released from the cathode. When the battery is being charged, lithium ions are stored in the anode. A negative electrode is also known as an anode in lithium-ion batteries. Hitachi Chemical, BTR, Shanshan Technology, JFE, Mitsubishi Chemical Holdings, and Nippon Carbon are among the Asian companies that produce anode materials. Nanocomposite tin/carbon/cobalt alloys and silicon-carbon composites are two major advancements in negative electrode materials.

“North America to be the prominent growing market for EV battery during the forecast period.”

North America’s automobile industry is among the most advanced in the world. Due to the presence of major commercial automotive manufacturers such as Tesla, Proterra, MAN, and NFI Group, the region is known for cutting-edge R&D, innovations, and technological developments in EVs. These companies are investing in building and expanding battery manufacturing facilities in North America. These facilities aim to produce lithium-ion batteries and other advanced battery technologies to cater to the rising demand for electric vehicles. In North America, the US has long been a technology pioneer, and has the largest EV battery market in North America. In the North American EV market, top EV battery providers and startups have teamed with OEMs. For instance, GM has teamed with LG Chem. Stellantis, on the other hand, has teamed up with Samsung SDI to develop EV batteries. Also, Ford is collaborating with SK Innovation. Tesla manufactures its own EV batteries. All of these corporations are collaborating to establish manufacturing centers in the US. Moreover, Various federal and state-level policies and incentives are encouraging EV adoption and the development of the EV battery market. This includes tax credits for EV purchases, investments in charging infrastructure, and funding for research and development in battery technology. Additionally, OEMs are expanding their attention on launching electric trucks, vans, and buses; the North American EV battery market is likely to increase dramatically. Rising demand for zero-emission freight and public transportation fleets is also predicted to drive growth in the North American EV battery market.

Key Market Players:

The EV battery market is dominated by established players such as CATL (China), LG Energy Solution Ltd. (South Korea), BYD Company Ltd. (China), Panasonic Holdings Corporation (Japan), and SK Innovation Co., Ltd. (South Korea).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=100188347

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-vehicle-battery-market-100188347.html