Overview

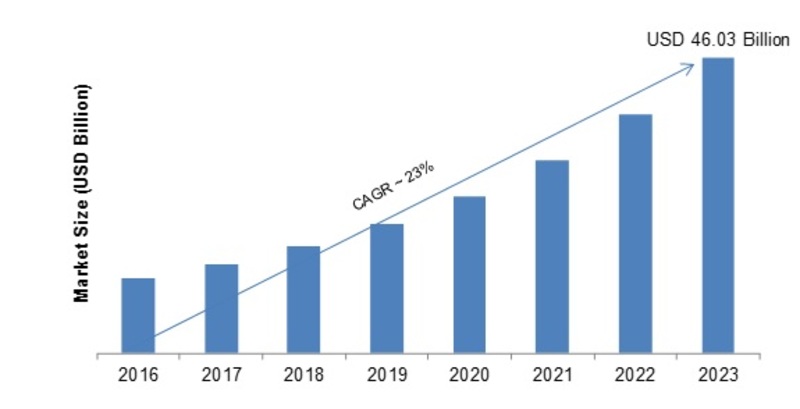

Financial cloud solutions are increasingly relied upon to drive financial operations and optimise business processing. Financial cloud solutions enable companies to pitch ideas to potential clients in an effective manner and thereby improve customer relationship. Market Research Future (MRFR) reports that the global financial cloud market is expected to grow to more than USD 46 Bn by the year 2023 up from USD 16.55 Bn, reflecting 22.7% CAGR during the assessment period (2018-2023).

Rapid digitisation worldwide coupled with rising demand for financial services has created substantial opportunities for financial IT solutions. The need for solutions that can aid in building and maintaining robust IT infrastructure is more than ever before. Financial cloud is witnessing a fast adoption across banking, insurance and other financial services. Financial cloud services offer a 360-degree visibility to users into their financial products. These services come with a slew of benefits enabling user to make informed-decisions.

By adoption cloud technologies, financial institutes are able to deliver s seamless experience to clients. Moreover, its help bankers to work faster and more efficiently as well as develop superior client engagement. The banking sector in expected to present attractive application opportunities for financial solution in the forthcoming years. Nonetheless, lack of expertise and high initial cost somewhat hinders the adoption, especially in small and medium-sized enterprises (SMEs). This in turn remains a major market impediment.

Request Free Sample @ https://www.marketresearchfuture.com/sample_request/7492

Segmental Analysis

The segmental analysis of the market has been conducted based on organization size, component, sub-industry, cloud type and region.

On the basis organization size, key segments include small and medium-sized enterprises and large enterprises. On the basis of component, key segments include service and solution. Solutions segment covers wealth management, security, customer management, financial forecasting and analytics and others. The service segment covers managed services and professional services. On the basis of sub-industry, key segments include insurance and banking and financial services. The banking and financial services segment is to remain highly attractive during the forecast period. Financial cloud is witnessing a fast uptake in banking and financial institutes. The banking and financial services segment is expected to witness a healthy growth over in the forthcoming years. On the basis of cloud type, key segments include private cloud and public cloud.

Regional Analysis

On the basis of region, the Financial Cloud Market has been segmented into Europe, the Middle East & Africa (MEA), North America, Asia Pacific (APAC) and South America. North America is expected to remain at the forefront of global financial cloud market. During the review period, countries such as Canada and the US are expected make healthy contribution to the North America market in terms of revenue. Presence of a vast BFSI sector makes North America an important market for financial cloud. Other factors such as increased demand for wealth management services and rapid digitization are also influencing the market growth in the region. Whereas, the APAC financial cloud market is anticipated to the higher CAGR during the forecast period. The market growth in the region is driven by the growth of banking and insurance businesses in countries such as China and India.

Competition Analysis

Some of the leading companies mentioned in MRFR’s report include Oracle Corporation (US), IBM Corporation (US), Huawei Technologies Co., Ltd. (China), Amazon Web Services, Inc. (US), Beeks Financial Cloud Group plc (UK), FIS (US), SS&C Technologies, Inc. (US), Salesforce.com, inc. (US), Microsoft Corporation (US), Temenos Headquarters SA (Switzerland), Google LLC (US), Fiserv, Inc. (US), Capgemini (France), SAP SE (Germany) and Infosys (India).

LIST OF TABLES

Table 1 Global Financial Cloud Market, By Region, 2018-2023

Table 2 North America Financial Cloud Market, By Country, 2018-2023

Table 3 Europe Financial Cloud Market, By Country, 2018-2023

Table 4 Asia-Pacific Financial Cloud Market, By Country, 2018-2023

Table 5 Global Financial Cloud Market, By Component, By Region, 2018-2023

Continued……

Check Discount @ https://www.marketresearchfuture.com/check-discount/7492

LIST OF FIGURES

FIGURE 1 Global Financial Cloud Market: Segmentations

FIGURE 2 Forecast Methodology

FIGURE 3 Porter’s Five Forces Analysis Of Global Financial Cloud Market

FIGURE 4 Value Chain Of Global Financial Cloud Market

FIGURE 5 Share Of Global Financial Cloud Market By Country, 2017

Continued……

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

In order to stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members

Media Contact

Company Name: Market Research Future

Contact Person: Abhishek Sawant

Email: Send Email

Phone: +1 646 845 9312

Address:Market Research Future Office No. 528, Amanora Chambers Magarpatta Road, Hadapsar

City: Pune

State: Maharashtra

Country: India

Website: https://www.marketresearchfuture.com/reports/financial-cloud-market-7492