Accessing capital for growth and innovation in today’s fast-changing business world is critical to growth. Traditional lending avenues often pose barriers for female-owned businesses; online business loans provide much-needed equitable support that enable female entrepreneurs to compete successfully within highly competitive marketplaces.

Women-Only Online Business Loans Provide Advantages:

Access: Business loans for women entrepreneurs with easy and accessible funding solutions for expanding companies that need additional capital to expand operations, launch new products or meet unexpected obstacles. They boast fast application processing times and approval processes which make these loans ideal for startups or expanding businesses seeking an extra injection of funds to support expansion or overcome unexpected hurdles.

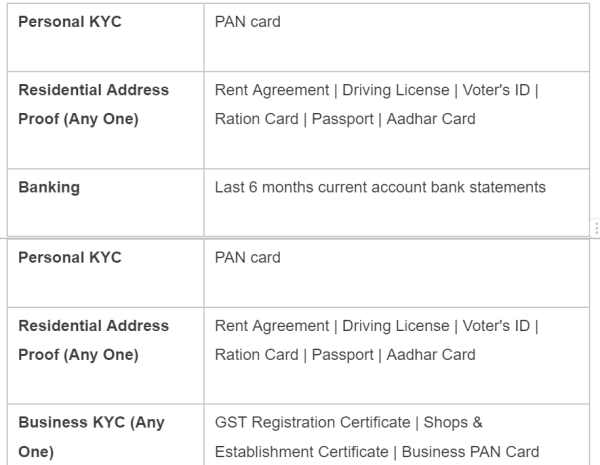

Documents Required for Business Loan for Women

Flexibility: Online lenders provide more tailored terms and repayment plans tailored specifically for women-owned businesses than traditional lending institutions can. From short-term loans for seasonal expenses or longer-term investments in growth initiatives, women entrepreneurs will surely find financing that matches their vision of business success.

Empowerment: Online business loan enable women entrepreneurs to take control of their financial future and pursue entrepreneurial ventures with pride, by giving access to capital without traditional banking restrictions – creating an atmosphere of empowerment and inclusivity within business communities.

Support and Resources: In addition to capital, many online lenders also provide resources and support services specifically targeted towards women entrepreneurs’ success. Ranging from financial education programs and mentorship services through to networking events and business development resources – they take steps to foster growth while assuring long-term viability of women-owned enterprises.

At a time when businesses must compete effectively for growth and innovation in an ever-evolving business landscape, accessing capital remains crucial to growth and innovation. Unfortunately, traditional lending avenues often present significant barriers for female entrepreneurs competing effectively within highly competitive markets – but online business loans offer equitable support that empower women-owned companies to prosper and succeed.

Online business loans offer women entrepreneurs access to much-needed capital quickly. Their accessibility makes these loans ideal for expanding operations, launching products or overcoming unexpected hurdles; giving female entrepreneurs the financial backing needed for growth and innovation.

Online lenders provide greater flexibility than traditional institutions can match; with tailored terms and repayment plans tailored specifically for women-owned businesses’ unique needs and challenges. From short-term funding for seasonal expenses or long-term growth initiatives to providing women entrepreneurs with financial tools that fit with their vision of success.

Online business loans provide women entrepreneurs with financial independence. By bypassing traditional banking restrictions, these loans foster an atmosphere of empowerment and inclusion within business communities – giving women pride of ownership to pursue entrepreneurial ventures knowing that they have all of the support and resources necessary for success.

Further, many online lenders go above and beyond by providing additional resources and support services tailored specifically for women entrepreneurs. From financial education programs and mentorship services, networking events and business development resources – these platforms take proactive measures to foster growth and ensure long-term sustainability of women-owned enterprises.

Overall, online business loans represent a transformative tool in helping women entrepreneurs thrive and level the playing field within the business world. Thanks to their accessibility, flexibility, empowerment features, support features and accessibility features – these loans give female entrepreneurs access to financing their entrepreneurial dreams for long-term success. From new venture creation or expansion purposes alike – women entrepreneurs should strongly consider taking advantage of online business loans tailored specifically towards them and taking full advantage of what can unleash their full potential and make meaningful contributions within this dynamic landscape.

Conclusion:

Online business loans provide women entrepreneurs with an indispensable means of accessing capital needed to compete successfully in today’s highly-competitive business landscape. By offering accessibility, flexibility, empowerment and support features they level the playing field while cultivating an inclusive and diverse culture among entrepreneurs. Whether launching from scratch or expanding existing ventures – women entrepreneurs should strongly consider availing themselves of online business loans tailored specifically for female entrepreneurs when fulfilling their entrepreneurial dreams.

Media Contact

Company Name: Flexiloans

Email: Send Email

Country: United States

Website: https://flexiloans.com/business-loan