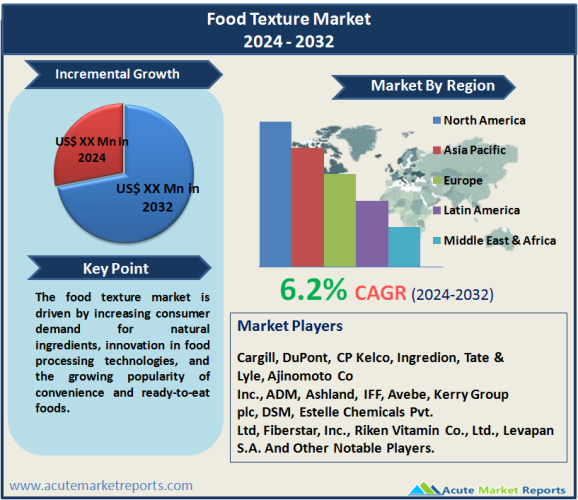

The food texture market is anticipated to expand at a compound annual growth rate (CAGR) of 6.2% during the forecast period of 2024 to 2032. This growth will be propelled by the rising preference of consumers for convenience and ready-to-eat foods, advancements in food processing technologies, and escalated demand for natural ingredients. Notwithstanding the regulatory obstacles about ingredient classification and labeling mandates, the market continues to be vibrant and fiercely competitive, presenting firms with prospects to distinguish themselves using inventive product developments and strategic alliances. The significance of regional differences in market dynamics and consumer preferences is further emphasized by the need to comprehend local trends and adapt strategies accordingly. In the ever-changing food industry, the quality, flavor, and convenience of products will continue to be heavily influenced by texture. This underscores the importance of texture-modifying ingredients in providing exceptional sensory experiences and satisfying consumer demands for convenience.

Key Market Drivers

The Growing Preference of Consumers for Natural Ingredients

The increasing demand for products bearing clean labels and natural attributes has influenced food manufacturers to place greater emphasis on incorporating natural ingredients into their formulations. This phenomenon is especially conspicuous in the food texture industry, where demand is increasing for substances derived from natural sources, including cellulose derivatives, polysaccharides, and pectin. The growing demand from consumers for food items that contain identifiable and minimally processed components is propelling the implementation of natural texture enhancers. For example, the increasing prevalence of plant-based substitutes has generated a surge in the need for gums and carbohydrates procured from sources such as tapioca starch and guar gum. In addition, natural texture ingredients provide functional advantages, including enhanced mouthfeel and stability, which are in line with the health and wellness goals of consumers. Organizations that integrate natural ingredients into their range of products are anticipated to attain a competitive advantage, thereby taking advantage of this rapidly expanding consumer trend.

Access Complete Report with TOC From: https://www.acutemarketreports.com/report/food-texture-market

Developments in Food Processing Technologies

The texture modification industry is undergoing a paradigm shift due to technological advancements in food processing, which empower producers to improve the quality and sensory characteristics of their products. Emerging methodologies including extrusion, microencapsulation, and emulsification have significantly broadened the scope for manipulating textures, thereby enabling the creation of inventive culinary products spanning diverse sectors. These technologies facilitate meticulous regulation of parameters including viscosity, elasticity, and particulate size distribution, thereby empowering manufacturers to customize textures according to the preferences of consumers. An instance of this is the increasing adoption of high-pressure processing (HPP), which is utilized to prolong the shelf life of fresh foods while preserving their texture, thereby satisfying the market’s desire for convenient and minimally processed goods. Furthermore, methodologies such as ultrasound-assisted extraction (UAE) provide a streamlined approach to extracting texture-modifying compounds from natural origins, thereby aiding in the development of clean-label products that exhibit enhanced textural characteristics.

The Expanding Market for Ready-to-Eat and Convenience Foods

The increasing hectic schedules of contemporary consumers have stimulated the market for convenience foods, which require little time to prepare and ingest while on the move. The food texture market has been profoundly affected by this trend, which has increased demand for texture-modifying constituents that improve the gustatory experience of processed and ready-to-eat foods. To enhance the mouthfeel, viscosity, and stability of convenience food items such as ready meals, sauces, and stews, manufacturers are integrating texturizers including inulin, gelatin, and starch. Furthermore, the increasing prevalence of nibbling occasions has generated prospects for enhancing the texture of snack formulations through the incorporation of indulgent, crisp, and crunchy qualities. In response to the changing preferences of consumers for convenient yet indulgent food choices, manufacturers are making greater investments in texture technologies as a means to distinguish their products within a competitive market environment.

Get Free Sample Copy/ For Customization: https://www.acutemarketreports.com/request-free-sample/140274

Market Restraint

Obstacles to Regulation and Labeling Obligations

Notwithstanding the increasing market demand for natural ingredients, the food texture sector encounters obstacles to adherence to regulatory standards and labeling obligations. Food manufacturers are subject to rigorous formulation restrictions to attain specific textures, as a result of governmental regulations concerning the incorporation of stabilizers, emulsifiers, and additives. Moreover, as consumer attitudes toward food additives and synthetic ingredients change, regulatory agencies have implemented more stringent labeling requirements, which require products to prominently display transparent disclosure of texture-modifying agents. Adherence to these regulations presents manufacturers with logistical and formulation obstacles, which may impede the progress of product development and restrict the market expansion of specific texture ingredients. Additionally, the lack of clarity regarding the categorization of specific components as natural or synthetic adds to the difficulty of adhering to regulatory requirements, which substantially hampers the growth of the market.

Segmentation Analysis

By Market Type

Cellulose derivatives surpassed all other categories of texture-modifying ingredients in terms of revenue generation in 2023. This surge can be attributed to the extensive range of applications that cellulose derivatives find in food and beverage formulations. Cellulose derivatives demonstrate a wide range of applications as thickeners, stabilizers, and bulking agents, making them suitable for use in various product sectors including bakery, dairy, and processed foods. In addition to their other advantageous properties (e.g., enhanced texture, moisture retention, and fat replacement), cellulose derivatives satisfy consumer demand for functional and healthier food options. In contrast, throughout the period from 2024 to 2032, inulin exhibited the most substantial compound annual growth rate (CAGR), which can be attributed to its expanding utilization in the realms of functional foods and dietary supplements. The increasing recognition of the digestive health advantages associated with prebiotic fibers has led to a surge in the desire for inulin as a texturizing agent in a wide range of food items, such as baked goods, beverages, and munchies.

Market by Source: According to the market segmentation by source, natural ingredients will emerge as the primary source of revenue in 2023. This finding is consistent with consumer inclinations toward unprocessed and clean-label goods. The widespread use of natural texture ingredients in food and beverage applications can be attributed to the preference of consumers for genuine and nutritious food experiences for these substances, including polysaccharides, pectin, and gelatin. On the contrary, the CAGR for synthetic texture modifiers was greater throughout the projected time frame, propelled by developments in technology and formulations that are economical. Functional advantages provided by synthetic ingredients include improved stability, consistent texture, and extended retail life. These qualities make them attractive to manufacturers who are in search of effective methods to optimize texture. Notwithstanding regulatory scrutiny and consumer skepticism regarding synthetic additives, the market penetration of synthetic texture modifiers, particularly in the processed and convenience food sectors, remains propelled by technological advancements.

Related Reports: https://www.acutemarketreports.com/category/food-service-market

Market by Form: According to the segmentation by form, dried texture ingredients will generate the most revenue in 2023. This is due to their adaptability and simplicity of processing in the food industry. Dry constituents, including cellulose powders, dextrins, and starches, are extensively employed due to their functional attributes, which encompass thickening, binding, and moisture regulation. These ingredients are utilized extensively in the baking, confectionery, and savory industries, where consistency and quality of the product depend on the ability to precisely regulate the texture. In contrast, the segment comprising liquid texture ingredients generated a greater CAGR throughout the forecast, propelled by the increasing need for liquid formulations in condiments, sauces, and beverages. Liquid texturizers provide manufacturers with desired outcomes, including enhanced sensory properties, rapid dispersion, and uniform blending, which appeal to the need for convenient methods of texture modification and product differentiation.

Market by Application: According to the segmentation by application, the confectionary and confectionery products sector will generate the most revenue in 2023. This is primarily due to the extensive utilization of texture modifiers, which serve to improve the quality and sensory appeal of the products. In baked products and confections, texture ingredients such as gums, starches, and hydrocolloids are essential for optimizing texture parameters including mouthfeel, structure, and shelf stability. During the forecast period, the meat and poultry products segment experienced the most substantial compound annual growth rate (CAGR), primarily due to the increasing need for processed meat substitutes and protein products with added value. Texture modifiers, including stabilizers, emulsifiers, and gelling agents, empower producers to enhance the bite, juiciness, and texture of meat substitutes and convenience meat items in response to the changing tastes of consumers who favor plant-based protein alternatives and convenient meal alternatives.

Regarding functionality, thickening agents surpassed all others as the primary source of revenue in 2023. This is primarily due to their wide-ranging utilization in food and beverage formulations, which necessitates the regulation of viscosity and the improvement of texture. To attain intended textural qualities and sensory experiences, thickening agents such as starches, polysaccharides, and cellulose derivatives are employed in a wide range of product categories, including dressings, condiments, soups, sauces, and dairy products. In contrast, emulsifying agents demonstrated the most substantial compound annual growth rate (CAGR) throughout the projected timeframe. This can be attributed to their indispensable function in maintaining the stability of water-in-oil and oil-in-water emulsions within food and beverage systems, thereby guaranteeing consistency, longevity, and the visual attractiveness of the final product. Emulsifiers, including lecithin, mono and diglycerides, and polysorbates, are of utmost importance in emulsion-based formulations such as spreads, dressings, and dairy alternatives, as they serve to prevent ingredient separation, improve mouthfeel, and extend the expiration life of the product. Additionally, there is a growing consumer demand for natural emulsifiers that are sourced from plants, primarily motivated by the desire for sustainable ingredients and clean label credentials. In response to consumer demands for transparent labeling and regulatory obligations, manufacturers are investigating plant-derived substitutes for conventional emulsifiers, including sunflower lecithin and soy lecithin.

Geographic trends in the food texture market are indicative of regional differences in market dynamics, consumer preferences, and dietary practices. The region of North America generated the most revenue in 2023, primarily due to the strong demand for texture-modifying constituents utilized in an extensive variety of food and beverage applications. In conjunction with a significant focus on product innovation and premiumization, the region’s well-established food industry contributed to North America’s market share dominance. Asia-Pacific, on the other hand, is anticipated to develop at the highest CAGR throughout the forecast, due to factors such as rapid urbanization, shifting lifestyles, and rising disposable incomes. The rapidly expanding food and beverage industry in nations such as China, India, and Japan offers significant financial prospects for manufacturers of texture ingredients, specifically in the convenience foods, munchies, and functional beverages sectors. Furthermore, the Asia-Pacific region is witnessing market expansion due to the growing demand for texture-modified products featuring natural ingredients and clean-label formulations, which is fueled by heightened consumer awareness of health and wellness trends.

Within the highly competitive food texture market, several significant participants are employing strategic initiatives to fortify their market standing and take advantage of developing prospects. Prominent corporations including Cargill, DuPont, CP Kelco, Ingredion, Tate & Lyle, Ajinomoto Co Inc., ADM, Ashland, IFF, Avebe, Kerry Group plc, DSM, Estelle Chemicals Pvt. Ltd, Fiberstar, Inc., Riken Vitamin Co., Ltd., and Levapan S.A. employ strategic partnerships, product innovation, and portfolio diversification as active initiatives to attain a competitive advantage within the market. These corporations utilize their substantial research and development capacities to create innovative texture solutions that address changing consumer tastes and market trends. As an illustration, CP Kelco emphasizes augmenting its assortment of clean-label ingredients and plant-based texturizers to satisfy the increasing market demand for environmentally friendly products. In a similar vein, Cargill places significant emphasis on fostering collaborations with food manufacturers to jointly develop texture solutions that are customized to suit particular product applications and regional inclinations. Furthermore, DuPont’s acquisition of International Flavors & Fragrances (IFF) fortifies its market position in the texture ingredients sector, facilitating mutually beneficial collaborations in the areas of product innovation and consumer interaction. In general, the competitive environment of the food texture market is marked by alliances, collaborations, and strategic developments among major participants to sustain market dominance and propel future expansion.

Access All Latest Research Reports: https://www.acutemarketreports.com/market-research-reports

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com