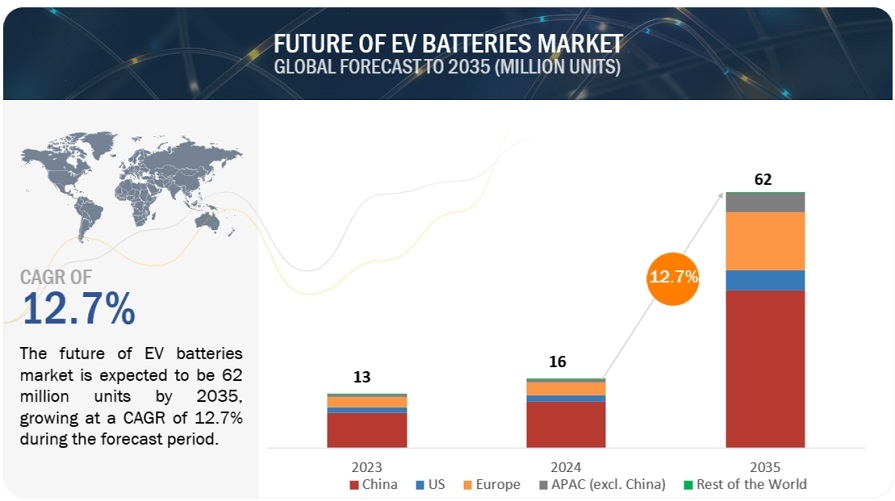

The global future of EV batteries market is projected to grow from 16 million units in 2024 to 62 million units by 2035, at a CAGR of 12.7%.

Higher standard batteries have been introduced due to recent developments in the EV market. Even though new batteries should increase EV performance and range, consumers are still hesitant to pick EVs over internal combustion engine (ICE) vehicles due to a number of issues, including EVs’ short range, lengthy charging times, high cost, and scarcity of charging stations. Consequently, EV battery manufacturers are focusing on creating new batteries with innovative, quick, and rapid charging technologies to overcome these challenges. In addition, advances in manufacturing processes such as automation and creative assembly methods are being made to lower expenses and improve battery production’s scalability. This includes advancements in pack integration, cell assembly, and electrode fabrication. These developments are anticipated to have a lucarative impact on market expansion.

Cylindrical segment is expected to grow at the fastest rate during the forecast period

The cylindrical segment is projected to register the highest CAGR during the forecast period. Durable and long-lasting are two characteristics of cylindrical batteries. Due to their excellent confinement and effective mechanical resistance against internal and external pressures, cylindrical cells are the least expensive to manufacture compared to alternative EV battery types. Manufacturers are starting to use cylindrical batteries as well. Tesla, for instance, uses cylindrical batteries due to their dependability and robustness. The new generation of cylindrical batteries, like the 4680 format pioneered by Tesla, boasts significant improvements in range and efficiency compared to older models.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=243513539

Lithium-ion battery holds the largest share.

Lithium-ion batteries offer good energy density, longer cycles, and a relatively low self-discharge rate compared to other battery technologies. These characteristics make Li-ion batteries properly desirable for the needs of electric vehicles, where power storage, range, and performance are critical. Over the years, various variants of Li-ion chemistries have been developed, like Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC). The outcome was that each of these chemistries had a set of advantages; in general, LFP batteries exhibit a longer cycle life than NMC batteries, making them suitable for extensive and prolonged applications. While NMC batteries offer a higher energy density, allowing them to store more energy. Further, OEMs are developing batteries with advanced technology; for instance, in June 2023, Toyota announced that it aims to launch next-generation lithium-ion batteries in 2026, offering longer ranges and quicker charging. In May 2024, SAIC Motor announced that its all-solid-state battery will be mass-produced in 2026, with an energy density of more than 400Wh/kg.

During the forecast period, Europe holds the 2nd largest share of the future EV batteries market

Various European countries have set a bold goal of reducing 80% of CO2 emissions by 2030-2035 and have created a roadmap. The governments of numerous European countries are also subsidizing EV infrastructure, thereby boosting EV sales and batteries. The increasingly more stringent guidelines related to environmental troubles are propelling key players to test and develop advanced automobiles, intending to further strengthen the market for advanced battery technologies.

European countries also invest heavily in charging infrastructure, easing range issues, and encouraging consumers to adopt electric vehicles. This infrastructure development enhances the future boom of the EV battery market. For instance, in March 2024, Northvolt AB (Sweden) started constructing a battery plant in northern Germany to supply electric cars, capping an intense lobbying effort under newly relaxed European Union state aid rules. Further, in September 2023, Gotion, Inc. (China) announced to build 20 GWh battery plant in Europe by 2026. In addition, Europe has a well-established automotive industry with corporations, including Volkswagen, BMW, and Renault, investing heavily in electric automobile generation.

Key Players

The major players in Future of EV Batteries market include CATL (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), Panasonic Holdings Corporation (Japan), and SK Innovation Co., Ltd. (South Korea). These companies adopted various strategies, such as new product developments and deals, to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=243513539

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/future-of-batteries-market-243513539.html