Gene Therapy Industry Overview

The global gene therapy market size was valued at USD 2.26 billion in 2020 and is expected to reach USD 10.0 billion by 2028, growing at a compound annual growth rate (CAGR) of 20.4% from during forecast period.

The expanding arena of advanced therapies and gene delivery technologies has created an increasingly competitive dynamic where a substantial number of market players are engaged in the commercialization of their gene therapy products. Therapy developers are investing in collaboration/mergers and acquisition deals as a viable strategy to enhance in-house expertise and strengthen product pipelines. These factors are expected to boost the market growth. Although the high prices of currently available therapies incentivize therapy development, it limits accessibility and can result in market withdrawals due to the lack of economic viability of the products.

Gather more insights about the market drivers, restrains and growth of the Global Gene Therapy Market

Thus, several payment models, such as financial-based agreements and health outcomes-based agreements, have been introduced or suggested to increase the accessibility and market survival of therapies. These models have significantly impacted the adoption of therapies in the market. Currently, the world is trying to mitigate the adverse impact of the SARS-CoV-2 pandemic to restore the revenue flow in markets. The cell and gene therapy sector has been impacted to a considerable extent. Since many universities have shut down and halted all non-essential research & enrollment processes for clinical trials, progress in the ongoing R&D has been slow.

However, several initiatives have been undertaken by biopharma companies to gain a competitive edge in the market. Companies are adopting various market entry strategies, such as biopharma facility expansions, collaborations with other key stakeholders, and development with Contract Manufacturing Organizations (CMOs). For instance, in March 2020, Univercells launched Exothera, a viral vector CDMO that serves cell and gene therapy developers.

The delay in commercialization of Zynteglo due to the pandemic has impeded the market growth to a considerable extent. On the other hand, in July 2020, Novartis received the EMA approval for its two European sites for commercial manufacturing of CAR-T therapies. Furthermore, Kite, a Gilead Company, received the U.S. FDA approval for its Tecartus, a CAR T treatment for patients with relapsed or refractory mantle cell lymphoma. These approvals depict the continued momentum of the new area of medicine in this segment.

Gene Therapy Market Segmentation

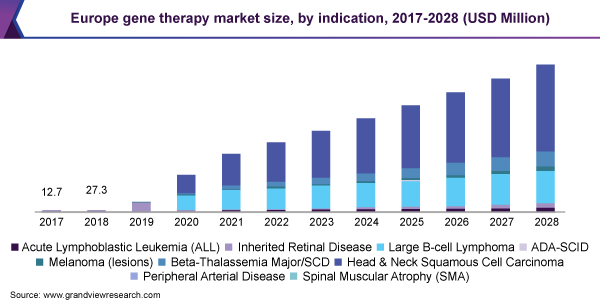

Based on the Indication Insights, the market is segmented into acute lymphoblastic leukemia (ALL), inherited retinal disease, large b-cell lymphoma, ADA-SCID, melanoma (lesions), beta-thalassemia major/SCD, head & neck squamous, cell carcinoma, peripheral arterial disease, spinal muscular atrophy (SMA) and others

- Spinal Muscular Atrophy (SMA) led the gene therapy market in 2020 with the highest revenue share of over 41%. However, the large B-cell lymphoma segment is estimated to account for the maximum revenue share by 2028. Although Spinal Muscular Atrophy (SMA) is a rare disease, it is one of the most common fatal inherited diseases of infancy.

- The development of gene therapy, Zolgensma (AVXS-101), has significantly proven its efficiency in the treatment of SMA, along with changing the disease phenotype. In May 2019, Novartis received approval from the U.S. FDA for Zolgensma, which is designed to address the root cause of SMA. Zolgensma is the first and only approved gene therapy in this segment.

- Novartis and Gilead continue to expand their customer base across the globe for Kymriah and Yescarta, which are designed for the treatment of large B-cell lymphoma. Recently, in May 2019, Novartis received approval to sell its products in Japan. Moreover, as per the investigation, in 2017, around 51% of patients who received Yescarta treatment achieved remission.

Based on the Vector Insights, the market is segmented into lentivirus, AAV, retrovirus & gamma retrovirus, modified herpes simplex virus, adenovirus and non-viral plasmid vector

- The AAV segment led the global market in 2020 and held the largest market share of over 43% as a result of the success of AAV-based Zolgensma. In recent times, usage of AAV is rising significantly across various therapeutic areas, consequently witnessing a considerable demand during the forecast years. Proven records of non-pathogenicity is one of the important key factors boosting their adoption.

- On the other hand, lentiviruses are anticipated to emerge as the fastest-growing vector type segment from 2021 to 2028. This can be attributed to the rising investments by companies and research institutes in this vector type, post-approval of Zynteglo in 2019 and Kymriah in 2017.

- Furthermore, the presence of companies that offer exclusive lentivector platform is accelerating revenue growth in this segment. For instance, Oxford Biomedica Plc has an exclusive lentivector platform, an advanced and safe gene delivery system that can carry payloads of up to 9kb and is capable of permanent modification of dividing and nondividing cells along with no pre-existing immunity.

Based on the Regional Insights, the market is segmented into North America, Europe, Asia Pacific, and Rest of the World

- The North America regional market led the industry in 2020 with a revenue share of more than 55% and will grow further at the fastest CAGR over the forecast years. On account of a strong regulatory framework for promoting the development of cellular therapy and the presence of a substantial number of biopharma companies, several government agencies are investing in the region. This, in turn, is driving the growth of the regional market.

- The presence of centers and institutes engaged in R&D on gene therapies is likely to continue driving the market in North America. Several companies from regions, such as Europe, which have received EU approvals, are planning to receive FDA approvals over.

- On the other hand, Zolgensma’s approval in 2019 has greatly favored the U.S. market. Despite the price controversies, the product managed to witness lucrative revenue growth in the year 2020. These factors are anticipated to maintain the dominance of this region in the global market during the forecast period.

Browse through Grand View Research’s Biotechnology Industry Research Reports.

- Gene Synthesis Market – The global gene synthesis market size was valued at USD 1.47 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 18.1% from 2021 to 2028. The supportive government policies associated with synthetic biology are key driving factors of the market. With the growing demand for synthetic biology, investors have shifted their focus on this field over the past few years. In 2020, approximately, USD 8 billion were invested in the synthetic biology field by public and private financing.

- Cell And Gene Therapy Manufacturing Market – The global cell and gene therapy manufacturing market size was valued at USD 13.1 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 20.3% from 2021 to 2028. The emergence of advanced therapies has played a major role in reshaping the biopharmaceutical industry as well as transformed the treatment paradigm of several life-threatening and rare diseases. The exponential growth of the advanced therapy landscape is a key driving factor for the growth of the market.

Gene Therapy Market Share Insights:

- July 2020: Novartis received the EMA approval for its two European sites for commercial manufacturing of CAR-T therapies. Furthermore, Kite, a Gilead Company, received the U.S. FDA approval for its Tecartus, a CAR T treatment for patients with relapsed or refractory mantle cell lymphoma.

- March 2020: REGENXBIO, Inc. and Ultragenyx Pharmaceutical, Inc. collaborated for the use of the NAV technology platform. Under this collaboration, the latter company received a worldwide license to REGENXBIO’s NAV AAV9 and AAV8 vectors for the development of gene therapies for a rare metabolic disorder.

Key Companies Profile:

An increase in funding and investment for advancements in gene therapies is expected to provide lucrative growth opportunities to market players. Furthermore, companies are engaged in strategic alliances to boost their offerings in the space, which is anticipated to intensify the market competition during the forecast period.

Some of the major players in the global gene therapy market are:

- REGENXBIO, Inc.

- Oxford BioMedica plc

- Dimension Therapeutics, Inc.

- Bristol-Myers Squibb Company

- SANOFI

- Applied Genetic Technologies Corporation

- F. Hoffmann-La Roche Ltd.

- Bluebird Bio, Inc.

- Novartis AG

- Taxus Cardium Pharmaceuticals Group, Inc. (Gene Biotherapeutics)

- UniQure N.V.

- Shire Plc

- Cellectis S.A.

- Sangamo Therapeutics, Inc.

- Orchard Therapeutics

- Gilead Lifesciences, Inc.

- Benitec Biopharma Ltd.

- Sibiono GeneTech Co., Ltd.

- Shanghai Sunway Biotech Co., Ltd.

- Gensight Biologics S.A.

- Transgene

- Calimmune, Inc.

- Epeius Biotechnologies Corp.

- Astellas Pharma, Inc.

- American Gene Technologies

- BioMarin Pharmaceuticals, Inc.

Order a free sample PDF of the Gene Therapy Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/gene-therapy-market