Companies in the global fintech market are increasingly using blockchain technology for better security and operational efficiency. Blockchain is a technology which involves the implementation of a distributed database that is accessible to all the users over a network, where each user can add a new data record (block), with a timestamp that cannot be altered. Blockchain technology maintains the authentication of data by restricting changes in older data blocks while allowing the users to continue adding new data blocks, thus, providing high security and transparency to companies operating in the fintech market. It enhances trade accuracy, speeds up the settlement process, and reduces risks. As per the Pricewaterhousecoopers (PwC) FinTech report, by 2020, 77% of financial organizations plan to integrate blockchain into their operations & 90% of payment companies plan to use blockchain by the end of 2020.

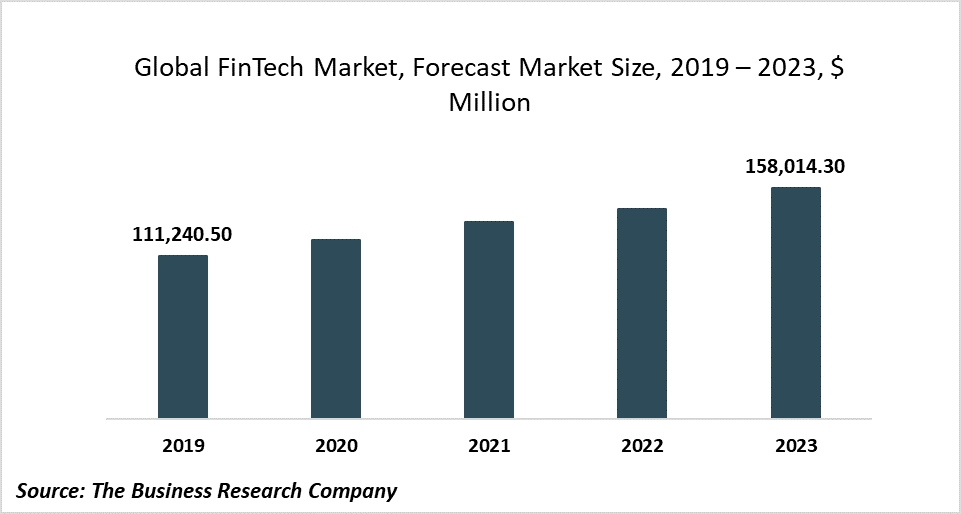

The global fintech market size reached a value of nearly $111,240.5 million in 2019, and is expected to grow at a compound annual growth rate (CAGR) of 9.2% to nearly $158,014.3 million by 2023.

Big tech companies that include Google, Amazon, Facebook and Apple are focusing on financial services, which positively impacts the growth of the fintech market size. Big tech firms keep introducing peripheral banking services to their current offerings, without going full-stack banking. For instance, Facebook, the social media firm, wanted to introduce a digital currency that makes global payments cheaper and faster, called Libra. However, Facebook has lost many of its backers and faced stiff regulatory scrutiny in a federal privacy probe. Apart from Libra, Facebook is also consolidating its payment products under a new brand called Facebook Pay. They will face competition from similar payment apps such as Google Pay and Apple Pay in the US and Chinese payment apps such as Alipay and WeChat Pay. Therefore, big tech companies focusing on financial services are expected to positively impact the fintech market growth rate.

Rise of mobile payment technology is a trend being adopted by the current generation in the fintech market share. A mobile wallet is a type of digital wallet that enables the user to process payments, access account information, and pay for services through a smartphone application. To speed up the entire payment process, the mobile wallet stores details about the payment card on the app itself. Mobile wallets are on the rise and the reason for the large acceptance of mobile wallets can be attributed to the increasing number of smartphones. According to a report by NewZoo, there were nearly 3.2 billion smartphone users by the end of 2019. Therefore, with more mobile users, there are more mobile wallet users. The mobile payments market was valued at around $114 billion in 2019 and is expected to reach $190 billion by 2021.

Here Is A List Of Similar Reports By The Business Research Company:

Digital Payments Global Market Report 2020-30: Covid 19 Implications And Growth

Mobile Payment Technologies Global Market Report 2020-30: Covid 19 Growth And Change

Interested to know more about The Business Research Company?

The Business Research Company is a market intelligence firm that excels in company, market, and consumer research. Located globally it has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services, chemicals, and technology.

Media Contact

Company Name: The Business Research Company

Contact Person: Oliver Guirdham

Email: Send Email

Phone: +44 20 7193 0708

Address:

City: London

State: Greater London

Country: United Kingdom

Website: https://www.thebusinessresearchcompany.com/