Diwali in India is a time for meeting with your friends and family and celebrating. Or, in my case, it’s a time when family members ask for my two cents on their investment portfolios! After all, online share trading often surges during India’s busy festival season from October to November, when 1+ billion people celebrate holidays like Dussehra and Diwali.

The annual festival season in India, which includes 51 festivals with 17 being nationally recognised, plays a monumental role in the country’s economy. During these times, consumer spending rises, particularly in sectors such as electronics, automobiles and gold. This also significantly stimulates the overall GDP growth.

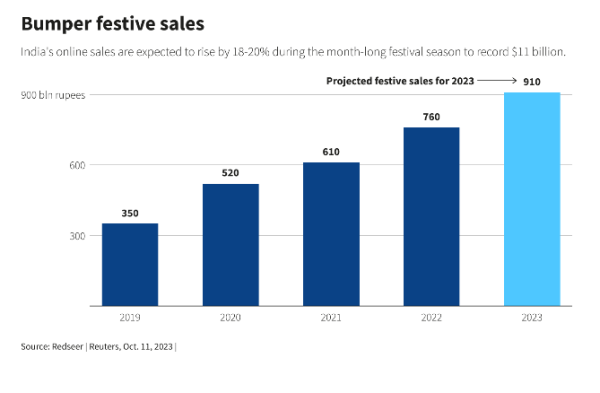

For instance, virtual shoppers spent a record $11billion from October to mid-November this year. This is nearly 20% higher than the same festive period last year. This year also saw a 30%increase in small and medium businesses participating in sales like the Amazon Great Indian Festival sale.

By targeting sectors lifted by festive sales, investors can profit from upticks in the market – most visible in quarter four when consumption peaks. The revenue rise often increases the stock prices of consumer companies. Consequently, investing in India’s festival season can be quite lucrative for savvy investors.

Investment Opportunities

Let’s look at a few of the key areas and the potential they hold.

Stock Market

The festival season typically brings a bullish sentiment to consumer spending which positively affects several sectors.

- FMCG and consumer durables companies usually witness a surge in sales during festivals. For example, this year’s pre-Diwali period saw FMCG sales rise by 4.4%. Such a surge in demand typically leads to an uptick in stock prices.

- The festive season also sees a spike in travel, benefiting the airline industry. Investors can look for airlines with a strong market presence and strategic festive offers. Bookings for air travel rose by 90% during Flipkart’s Big Billion Days sale compared to regular periods.

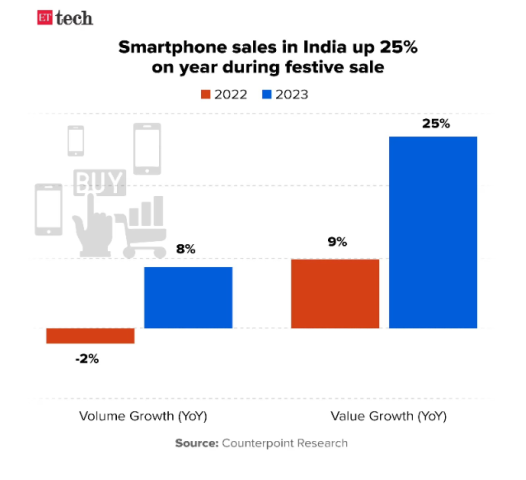

- Retailers, both online and offline, enjoy a significant boost in sales, making retail sector stocks a potentially profitable investment. In the premium segment, Flipkart experienced a 50% year-on-year growth, propelled by items like the iPhone 14 and Galaxy S21 FE. Amazon’s growth in this segment was almost 200%, boosted by sales of the iPhone 13 and Galaxy S23 FE.

Source

- The festival season is auspicious for buying vehicles in India. This year, sales of passenger vehicles were anticipated to exceed the significant mark of 10 million units for the first time. This opens up lucrative opportunities for investing in stocks of leading automobile companies.

The following table illustrates the performance of various stocks that have shown significant returns over the last year, highlighting potential for investors during the festive season:

| Stocks | Returns in last one year (Nov ‘22 – Nov ‘23) |

| Tata Motors | 72.34% |

| M&M | 22.54% |

| Maruti Suzuki | 24.83% |

| Titan | 32.90% |

| Raymond | 11.31% |

Gold & Precious Metals

Investing in gold and precious metals during the Indian festival season is a popular tradition. During Dhanteras, gold demand in India increased by approximately 7.7% in volume to an estimated 42 tonnes and 10% in value to ₹22,000 crores, as reported by the India Bullion and Jewellers Association (IBJA).

Gold ETFs offer a modern twist to this traditional investment. They provide the simplicity of trading like stocks and eliminates the need for physical storage. It is ideal for investors looking to tap into gold without the hassle of handling the physical metal. Another emerging trend is Digital Gold through online trading apps which has similar benefits to Gold ETFs with the additional flexibility of converting it to physical gold anytime.

Finally, Sovereign Gold Bonds (SGBs) issued by the Indian government can also be an attractive Gold investment. They offer the benefit of a 2.5% semi-annual interest besides price appreciation.

Real Estate Investments

The festive season often brings an uptick in home sales. In 2023, sales are expected to increase by 20–30% compared to 2022. This upsurge is particularly evident in the Mumbai market, which recorded 12,600 property registrations during the Navratri and Diwali seasons of 2023.

Conclusion

The festival season in India is a period rich with investment opportunities. Whether it’s Diwali, Christmas, or New Year, each festival has distinct economic patterns which investors should pay attention to.

For those looking to elevate their investment journey, exploring platforms like Appreciate that facilitate global investments at a low cost can be a game-changer. Appreciate offers a range of sophisticated features that enable global portfolio diversification.

Disclaimer: Please note that investments in the securities market are subject to market risks. Investors should read all the related documents carefully before investing.

Media Contact

Company Name: Appreciate

Contact Person: Yogesh Kansal

Email: Send Email

Country: United States

Website: https://appreciatewealth.com/