According to a report ,“Heavy-duty Automotive Aftermarket Analysis Report By Vehicle Type, By Replacement Part (Tires, Brake Parts, Turbochargers), By Service Channel (DIFM, DIY), By Region, And Segment Forecasts, 2018 – 2025″ , published by Grand View Research, Inc., The global heavy-duty automotive aftermarket size is anticipated to reach USD 155.8 billion by 2025, exhibiting a 4.5% CAGR during the forecast period. Increasing presence of older, more outdated trucks is leading to rise in demand for replacement parts, which in turn, drives the heavy-duty automotive aftermarket. Other factors expected to drive the market include greater wear and tear of vehicles due to frequent use, growth in number of vehicles, and durability of components.

Key Takeaways from the report:

-

Demand for heavy-duty aftermarket components is expected to grow owing to rising penetration of e-commerce in distribution and sale of automotive components

-

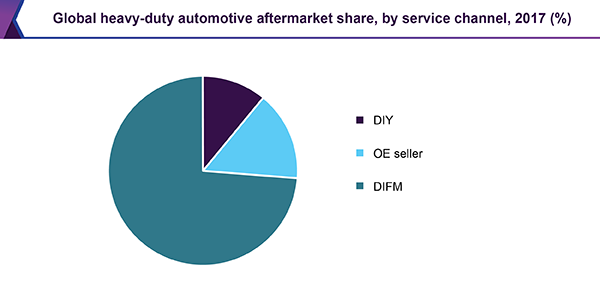

The DIY segment is expected to exhibit the highest CAGR of 9.0% over the forecast period

-

Rising awareness about emission standards and stringent laws laid down by various governments to limit emissions by heavy-duty vehicles is expected to positively impact the market

-

3M Company; ATC Technology Corp; Continental AG; Denso Corporation; Detroit Diesel Corporation; Dorian Drake International Inc.; Dorman Products; Federal-Mogul LLC; Instrument Sales & Service, Inc.; Remy International Inc.; and UCI International Inc. are some of the key players in the heavy-duty automotive aftermarket.

Browse More Reports in Automotive & Transportation Industry:

- Bicycle Market: Increasing adoption of cycling as a form of leisure and awareness regarding the health benefits associated with cycling are expected to bolster bicycles market growth.

- Fuel Cell Vehicle Market: Fuel cell is closing in to be the most efficient form of alternative energy generation. Fuel cell shipments have witnessed rise over the past three years, compelling manufacturers to increase operations.

Connected trucks are embedded with IoT sensors that enable fleet management companies to obtain real-time data on the condition of replacement parts in trucks. Thus, digitalization and IoT have helped drivers gain insights on the health of the vehicle and to schedule preventive maintenance checks. Subsequently, with more real-time data made available about the vehicles, automotive parts can be replaced periodically. This, in turn, is expected to boost demand for heavy-duty automotive aftermarket components over the forecast period.

The Asia Pacific region accounted for the largest market share in 2017, followed by Europe. Increasing number of old trucks in regions such as North America and Europe is expected to fuel demand for replacement parts on account of increased wear and tear of these vehicles.

South America is poised to expand at the highest CAGR over the forecast period, owing to rising sale of trucks in developing countries such as Brazil. The heavy-duty automotive aftermarket is expected to grow at a higher rate in nations such as South Africa and Brazil owing to poor road infrastructure, which triggers the need for frequent maintenance of transportation fleets.

Grand View Research has segmented the global heavy-duty automotive aftermarket based on replacement part, vehicle type, service channel, and region:

Heavy-Duty Automotive Aftermarket Replacement Parts Outlook (Revenue, USD Billion, 2014 – 2025)

- Tires

- Batteries

- Brake parts

- Filters

- Body parts

- Lighting & electronic components

- Wheels

- Exhaust components

- Turbochargers

- Others

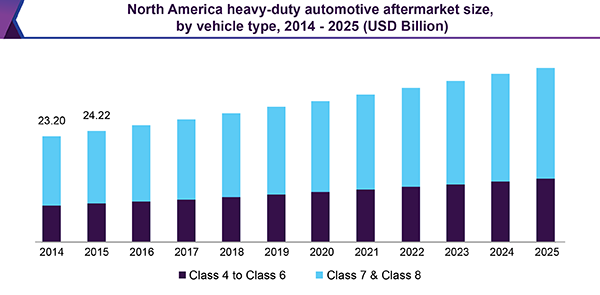

Heavy-Duty Automotive Aftermarket Vehicle Type Outlook (Revenue, USD Billion, 2014 – 2025)

- Class 4 to Class 6

- Class 7 & Class 8

Heavy-Duty Automotive Aftermarket Service Channel Outlook (Revenue, USD Billion, 2014 – 2025)

- DIY

- OE seller

- DIFM

Heavy-Duty Automotive Aftermarket Regional Outlook (Revenue, USD Billion, 2014 – 2025)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Asia Pacific

- China

- Japan

- India

- South America

- Brazil

- Middle East & Africa

Explore the BI enabled intuitive market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

For more information: www.grandviewresearch.com/

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: Switzerland

Website: www.grandviewresearch.com/industry-analysis/heavy-duty-automotive-aftermarket-industry