Every company touts its brands. They need to if they want to sell them. But how many of these products are actually any good? Don’t answer that in terms of production quality but instead on the value they provide its consumers. In that sense, a common answer is that plenty of well-made products don’t do much of anything. Subsequently, the companies behind them tend to offer rather basic “satisfaction or your money-back guarantees.” Few go beyond that. And CISO Global (NasdaqCM: CISO) is on that list. In a big way.

In fact, CISO does more than provide a money-back warranty; it goes a massive step further by offering clients using its robust cybersecurity solutions an unparalleled $250,000 guarantee if its platform does not effectively defend against cyber attacks. Sounds great. But, clients looking to cash in on that prize may be out of luck. Why? Because if its Argo Edge platforms’ performance at the recent DEF CON conference is any indication, that money could be far from reach. There, it defended against roughly 127,000 attempts by some of the world’s brightest hacker minds trying to infiltrate operating systems.

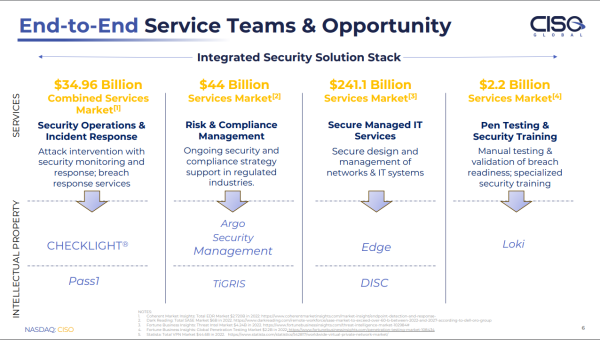

However, bad news in that respect is good news in another. Those clients utilizing Argo Edge and other CISO products will have world-class, robust cybersecurity protections that have proven themselves as a formidable and, for the most part, impenetrable force to protect company assets. CHECKLIGHT™ is the latest addition to CISO’s cybersecurity arsenal.

CHECKLIGHT™ Differences Are Advantages

It provides robust endpoint detection and response that protect its clients from cyber attacks at the edge. Acquired as part of its acquisition of SB Cyber, CHECKLIGHT™ utilizes AI-empowered continuous scanning to identify unauthorized processes associated with fraudulent phishing attacks, hacking, imposter scams, malware, ransomware, and viruses. Through this active learning, the platform studies new viruses it encounters, developing unique defenses to protect the network and its users using next-generation signature, behavior, and machine learning algorithms. While that list is impressive on its own, CHECKLIGHT™ does more.

That “more” is a considerable differentiation. Utilizing kill chain methodology, CHECKLIGHT™ provides protection against zero-day viruses, previously unknown computer viruses, or malware for which specific antivirus software signatures are not yet available. Few, if any, competitors can or are making similar claims. And that’s still not all the platform offers. Another difference, which is a significant advantage, is that CHECKLIGHT™ integrates seamlessly with Windows, Mac OS, and Linux systems and requires minimal system resources, with all processing done on a cloud-native architecture. Also unique, alerts from CHECKLIGHT™ are instantaneous, communicating threats via email, text, and dashboard notifications with the security person or team of an attempted attack. The benefits don’t end there.

By CISO Global creating a culture of cybersecurity awareness, its clients benefit from a top-down approach to cybersecurity that reaches every company layer by providing consultative access to IT security engineers who can address breaches in real-time. Knowing about and understanding how cyber attacks target the endpoint, CISO highlights the need for every organization to have more than a culture of cybersecurity; they need a solution like CHECKLIGHT™ as part of their overall cybersecurity strategy. And CISO isn’t selling the benefits of CHECKLIGHT™ on faulty logic.

Instead, it stands behind its proven value and known performance to protect its client’s environment, an accomplishment reached by research, IP, and rigorous testing challenging the threat from bad cyber actors as they prey upon individuals, businesses, including large enterprises, SMBs, nonprofits, educational institutions, and religious organizations. And, again, CISO puts its money on the line, offering a similar $250,000 service level guarantee.

It’s an excellent product but far from the only CISO value driver.

Argo Security Platform Defends Against 127,000 Breach Attempts

As mentioned earlier, the Argo Security Platform is another value driver. In fact, like CHECKLIGHT™, it’s also expected to drive revenues higher sooner than later. It addresses common challenges that can inhibit effectiveness in cybersecurity, allowing company IT and security teams to manage, track, coordinate, and measure the success of their organization’s security program. As important, it provides visibility across dozens of tools and services combined, empowering decision-makers with the information they need to make more rapid progress in leading their organization’s security program. Emerging from the platform is Argo Edge, part of the customizable Argo Security Management dashboards that layers together multiple cloud security technologies and coordinates them to provide reliable protection for sensitive digital systems and assets hosted in the cloud.

It’s proven more than a formidable defense against hackers; it’s showing itself as virtually impenetrable. Noted earlier, it showed its abilities at the DEF CON hacker convention in Las Vegas, challenging some of the best in the hacker world to breach the firewall in place from the Argo Edge platform. The result- 127,000 failed attempts and zero successful breaches. That included defending against almost every sophisticated trick in the hacker handbook to gain access, including through front, back, and side door vulnerabilities to infiltrate systems and drop malicious adware, data-stealing malware, or worst-case ransomware. And here’s something to consider.

For all intents and purposes, CISO cybersecurity software was set up as a sitting prey to those relentless attacks. Moreover, it wasn’t installed on pricey hardware, giving CISO solutions an edge. Instead, Argo Edge was downloaded into a common Intel NUC (NASDAQ: INTL) computer with a standard operating system. CISO defended against all comers. Impressive, for sure. But here’s the kicker- these computers were connected to the public WiFi in Caesar’s Forum, significantly elevating a hacker’s ability to breach the system. Yes, some did penetrate initial defenses. But beyond that, none were able to complete their sabotage mission. Certainly not near enough to warrant applying for the $250,000. Look, CISO isn’t trying to go to war with hackers, and this article isn’t trying to start one. It’s just fair to point out CISO taking the opportunity to show that its AI-empowered Argo Edge gets continuously stronger in learning from prior attacks. That ability makes it one of the market’s most protective cyber defense shields.

Timely To A Massive Market Need And Opportunity

In fact, combining its platform and services strengths, CISO is introducing itself as fast as it can to significantly reduce an estimated $7 trillion lost to cybercrime in the US alone last year. That includes losses from students, small businesses, and global conglomerates. In other words, few, if anyone, are safe without the right protection. The keywords there are “without the right protections.”

There are some available, and CISO Global may have the best. It’s a subjective measure, sure. However, considering that no other company we saw, including Cisco (NASDAQ: CSCO), Palo Alto (NASDAQ: PANW), and Check Point Software (NASDAQ: CHKP), set themselves up for failure in a magnitude CISO did at DEF CON, and then emerged victorious, it warrants the premium appraisal. Performance also justifies a higher CISO share price. In fact, at roughly $0.10 on Monday, assets and potential expose CISO as one of the most undervalued tech stocks in the market. Tangibles alone justify the bullish calculus.

In August, CISO published an independent appraisal of Argo Edge, which valued it at $49 million- roughly $32 million higher than its current market cap. That’s not the only contributing asset. The company has completed at least 16 acquisitions since its inception and continues to launch cybersecurity platforms, attracting significant multi-sector client interest. Those should drive revenues higher. And provide plenty of them.

CISO is on a revenue run rate expected to reach upwards of $55 million in its new fiscal year. That bullish forecast is supported by recurring revenue streams contributing 63% of income from its over 1,000 customers. And with over 58% of shares held by insiders, investors benefit from something else- management is incentivized to increase shareholder value to reward themselves. That alignment is a big deal. And with CISO positioned to target billions in revenues from a global client list needing what it sells, it could help deliver better-than-expected results, leading to a steepening share price curve faster than many think.

Disclaimers: Hawk Point Media Group, Llc. is responsible for the production and distribution of this content. Hawk Point Media Group, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Hawk Point Media Group, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall Hawk Point Media Group, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Hawk Point Media Group, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point Media Group, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. HPM, LLC has been compensated up to two-thousand-five-hundred-dollars via wire by a third party, Trending Equities,to provide research, editorial production, video graphics, and syndication services for CISO Global, Inc. for a one month period beginning on September 16, 2023, and ending October 25, 2023. HPM, LLC provided similar services for compensation that ended July 25, 2023, August 15, 2023, and September 15, 2023, respectively, by the same third party payer that totaled ten-thousand-five-hundred-dollars. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that are attached to this content. Contributors have no direct financial relationship with any companies featured. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Contributors are under no obligation to accept revisions when not factually supported. Furthermore, because contributors are compensated, readers and viewers of this content should always assume that content provided shows only the positive side of companies, and rarely, if ever, highlights the risks associated with investment. Thus, readers and viewers should accept the content as an advertorial that highlights only the best features of a company. Never take opinion, articles presented, or content provided as a sole reason to invest in any featured company. Investors must always perform their own due diligence prior to investing in any publicly traded company and understand the risks involved, including losing their entire investment. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email: info@hawkpointmedia.com

Country: United States

Website: https://hawkpointmedia.com/