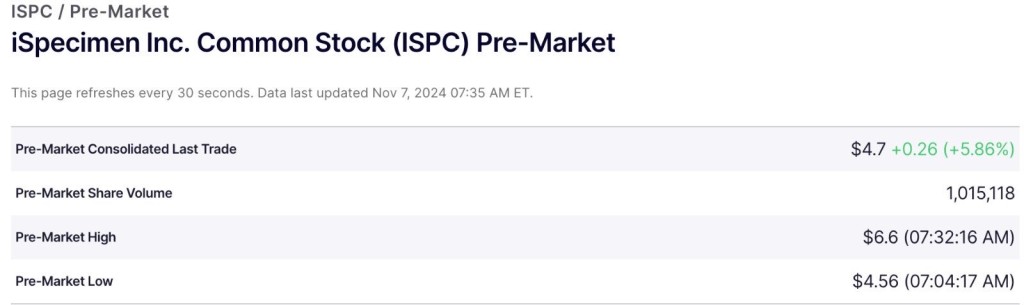

The premarket surge in iSpecimen Inc. (NASDAQ: ISPC) on Thursday caught the attention of many, with the stock leaping 48% to $6.60 at the early morning’s peak. While it moderated slightly after the opening bell, iSpecimen maintained momentum, closing up over 11%amid, a trading volume more than ten times its daily average.

For those familiar with iSpecimen, the jump wasn’t entirely unexpected. Since its founding in 2009, iSpecimen has transformed how researchers source and access human biospecimens. Its pioneering marketplace model addressed long-standing barriers in the sample procurement process, setting a new standard for the industry. After going public in 2021, iSpecimen leveraged its IPO to build a robust digital infrastructure, enhancing its marketplace and positioning itself as an invaluable partner for researchers.

The recent momentum in iSpecimen shares follows a series of strategic moves, including expanding its cancer biospecimen offering. This initiative taps into an accelerating demand in oncology research, with iSpecimen projecting over $9 million in annual revenue from this line alone. The expanded portfolio includes samples from a range of high-demand cancers—colorectal, breast, lung, ovarian, pancreatic, and brain—addressing the nuanced needs of oncology researchers seeking targeted tumor profiles.

iSpecimen Unleashes Its Strategic Revenue Driver

These high-value cancer samples are expected to be a major revenue driver, with iSpecimen projecting, as noted, nearly $10 million annually from this new vertical. Given the specificity and diversity of cancer research demands, iSpecimen’s expanded sample portfolio creates a unique value proposition. This expanded inventory means that researchers can now target precise tumor profiles more efficiently—whether they need samples from a specific cancer type, tumor stage, or genetic marker.

Beyond that, iSpecimen’s unique marketplace model streamlines the entire procurement process. By integrating high-quality biospecimens with advanced data analytics, iSpecimen delivers an experience that is faster, more reliable, and more tailored than traditional methods. This shortened time-to-fulfillment directly boosts profit margins, allowing iSpecimen to capture more value from each transaction while helping researchers expedite their studies.

iSpecimen’s announcement is a major milestone for the company and the industry. With its extensive array of cancer samples, the company isn’t just providing more of the same; it’s reshaping how researchers approach sample procurement, offering solutions that support the drive toward more precise and effective treatments.

Key Differentiation in a Competitive Field

The growing demand for oncology biospecimens aligns well with the market’s emphasis on personalization and specificity. Cancer research is among the most well-funded areas in medical science, and the market rewards innovators. iSpecimen stands out by offering a digital solution for researchers to access exactly the specimens they need without the usual bottlenecks. In an environment where reliability and quick access are paramount, iSpecimen has a critical edge.

iSpecimen’s business model is also highly scalable, an advantage as it caters to the evolving demands of personalized medicine. Following its 2021 IPO, iSpecimen has prioritized digital infrastructure and global partnerships to support its expansion. By establishing relationships with biobanks and healthcare providers worldwide, iSpecimen can deliver diverse biospecimens, meeting the needs of pharmaceutical companies, biotech firms, and academic researchers.

Additionally, the company has recently doubled down on AI capabilities, integrating machine learning algorithms that allow for hyper-targeted specimen matching. This AI-driven matching technology further differentiates iSpecimen, making it an indispensable player for researchers seeking samples that precisely fit their studies’ criteria.

A Robust Digital Platform Driving Precision Medicine

iSpecimen’s digital platform doesn’t stop at oncology samples. Researchers have access to an array of other biospecimens, from blood to biofluids, with iSpecimen’s advanced analytics enhancing the data associated with each sample. This emphasis on data quality makes iSpecimen an essential partner for researchers in precision medicine, a field that’s expected to see exponential growth in the coming years.

The company’s commitment to improving data traceability and specimen quality resonates with today’s researchers, who increasingly rely on nuanced data for complex, personalized treatments. As precision medicine becomes mainstream, iSpecimen’s marketplace is well-positioned to capitalize on the rising demand for high-quality biospecimens tailored to individual genetic markers or disease subtypes.

By harnessing machine learning, iSpecimen ensures that researchers can locate the exact specimens needed for their studies, particularly in fields like oncology where small variations can profoundly impact results. With the added layer of data analytics, researchers have access to a depth of metadata that enhances the reliability and accuracy of their work—a clear value add that bodes well for iSpecimen’s bottom line.

Capitalizing on a Growing Market

iSpecimen’s recent moves align with its broader growth strategy and target an estimated $49 billion precision medicine market expected to exceed $232 billion within a decade. iSpecimen’s business model, built on scalability, data integration, and AI-driven specimen matching, means it’s poised to capture a meaningful share of that market. This focus on precision medicine isn’t merely an operational choice but a strategic positioning in one of the fastest-growing sectors in healthcare.

With less than a million shares outstanding and a float of around 543k, even small revenue gains can have an outsized impact on iSpecimen’s stock price. Thursday’s trading action demonstrates that the market is catching on to this value proposition, with news driving investor enthusiasm and share prices higher. iSpecimen’s recent gains also show investors confidence that this smallcap name could ultimately be a leader in the precision medicine space, an assessment supported by an expanding cancer biospecimen collection and continual investment in digital infrastructure.

Thus, Thursday’s spike may be just the beginning of a more bullish sustained run as iSpecimen’s value proposition becomes more widely recognized by investors. As the company continues to build upon its capabilities to serve an increasingly global scientific community that demands greater precision and diversity in biospecimen sourcing, that’s indeed a path of least resistance.

Additional Disclaimers and Disclosures: This is sponsored content. Hawk Point Media Group, LLC. (HPM) has been compensated, or expects to be, to produce and distribute digital content for iSpecimen Inc. A link to that financial disclosure and additional disclaimers is below and shall be considered a permanent and included part of this production. It should be expressly understood that HPM is not operated by a licensed broker, a dealer, or a registered investment adviser. It should also be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. HPM reports/releases are commercial advertisements and are for general information purposes ONLY. The information made available by HPM is not intended to be, nor does it constitute, investment advice or recommendations. The contributors do NOT buy and sell securities covered before or after any particular article, report and/or publication. HPM holds ZERO shares and has never owned stock iSpecimen Inc. While HPM does not own or market shares, it is prudent to expect that those hiring HPM including that company’s owners, employees, and affiliates, may sell some or even all of the iSpecimen Inc. shares that they own, if any, during and/or after this engagement period. Always do your own due diligence prior to investing in any publicly traded company. Investing in micro and smallcap stocks could lead to losing an entire investment. Forward-Looking Statements: This article contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Statements that are not statements of historical fact may be deemed to be forward-looking statements. The forward-looking statements contained or implied in this article are subject to other risks and uncertainties, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company’s Annual Report on Form 20-F for the year ended December 31, 2023 filed with the SEC on March 18, 2024, which is available on the SEC’s website, www.sec.gov. Hawk Point Media Group, LLC. undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law. Click HERE for Hawk Point Media Group LLC’s full disclaimer and disclosure statement.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email: info@hawkpointmedia.com

Country: United States

Website: https://hawkpointmedia.com/