Legal Services Industry Overview

The global legal services market size was valued at USD 849.28 billion in 2020 and is anticipated to reach USD 1,196.01 billion by 2028, exhibiting a CAGR of 4.4% over the forecast period. The introduction of Artificial Intelligence (AI) has transformed the legal industry. Software with AI capabilities plays a vital role in enabling lawyers and law firms to save time. Automation software enables more efficient document production and proofreading. Team collaboration software helps to further streamline the execution of documentation processes. These developments and technologies offer greater value to lawyers by helping them decrease their expenses and increase convenience.

Advanced technologies such as AI and Machine Learning (ML) aid professionals to automate several processes and utilize their time and resources on more critical legal operations. These technologies help organizations in drafting and reviewing contracts and mining documents in discovery and due diligence. Big data analytics is also expected to offer promising growth prospects. This has led to the growth of several startups such as InvestCEE Tanacsado Kft., FiscalNote, and Ravel law, which offer advanced analytical insights to their clients.

Gather more insights about the market drivers, restrains and growth of the Global Legal Services Market

The use of legal library applications such as LawSauce, NotaryCam, and iLegal Legislation has become common, enabling people and lawyers to access legal services in a hassle-free manner. Service providers are also providing in-house digital strategies to transform and enhance a company’s processes and activities. By applying AI and ML to large datasets, law firms can identify former unknown correlations among data, thereby providing them with enhanced capacity to mitigate risk, optimize delivery, predict outcomes, and tailor solutions to consumer demands.

Furthermore, there has been a steady rise in the adoption of cloud technology by law firms and legal departments. The implementation of stricter rules and regulations is making cloud computing a safer space for managing critical files and client information. Cloud computing also facilitates the implementation of practice management software, which provides clients with access to documents via a client portal. Clio, MyCase, and NetDocuments are the most popular legal-specific cloud service providers.

Legal Services Market Segmentation

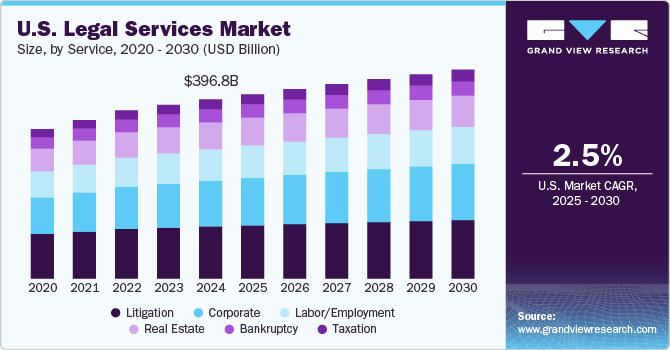

Based on the Services Insights, the market is segmented into Taxation, Real Estate, Litigation, Bankruptcy, Labor/Employment, and Corporate.

- The corporate segment led the legal services market in 2020, accounting for a 29.2% share of the global revenue. This high share can be attributed to the advent of new modes of financial transactions on corporate fronts.

- The litigation segment held a significant revenue share in 2020 as business organizations continue to incur notable expenses on their litigation management.

Based on the Firm Size Insights, the market is segmented into Large Firms, Medium Firms, and Small Firms.

- The large firms segment led the market in 2020, accounting for a 38.9% share of the global revenue. This high share can be attributed to the diverse range of services provided by large firms.

- The small firms and medium firms segments are expected to gradually obtain notable revenue share over the forecast period.

Based on the Provider Insights, the market is segmented into Private Practicing Attorneys, Legal Business Firms, Government Departments, and Others.

- The legal business firms segment led the market in 2020, accounting for a 46.2% share of the global revenue. This high share can be attributed to the strategic investments made by legal service firms.

- Legal business firms have started using predictive analytics tools for the analysis of massive datasheets for information extraction, pattern recognition, and trends prediction.

Based on the Legal Services Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

- North America led the market in 2020, accounting for a 42.5% share of the global revenue. This high share can be attributed to the increasing assignment volumes within the legal departments of the corporate industry in the U.S.

- Asia Pacific accounted for a considerable market share in 2020, which can be attributed to the rapid implementation of regulatory and judicial requirements, particularly in countries such as China and India.

Browse through Grand View Research’s Communication Services Industry Research Reports.

- Legal Process Outsourcing Market – The global legal process outsourcing market size was valued at USD 10.77 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 30.9% from 2022 to 2030. The LPO providers, once acquainted with the organization’s business procedures, provide numerous services that include contract drafting and management, e-discovery, review & management, compliance assistance, litigation support, and patent support.

- Business Process Outsourcing Market – The global business process outsourcing market was valued at USD 245.9 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030. The market is driven by factors such as the increasing focus of organizations on improving efficiency and business agility, decreasing operating costs, and emphasizing core competencies to survive the constantly changing business dynamics.

Market Share Insights:

- November 2020: Clifford Chance, a U.K.-based multinational law firm, renewed its global partnership with the WEFCOS (Women’s Forum for the Economy & Society).

- January 2020: Baker McKenzie, a U.S.-based multinational law firm, collaborated with SparkBeyond, an AI-based problem-solving platform provider, to implement SparkBeyond’s technology to disrupt the industry.

Key Companies Profile:

Vendors active in the market are focusing on expanding their customer base and gaining a competitive edge over their rivals. They are adopting various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and new product/technology development.

Some prominent players in the global legal services market include

- Baker & McKenzie

- Clifford Chance LLP

- Deloitte

- DLA Piper

- Ernst & Young (E&Y)

- Kirkland & Ellis LLP

- KPMG

- LATHAM & WATKINS LLP

- PwC

- Skadden, Arps, Slate, Meagher & Flom LLP

Order a free sample PDF of the Legal Services Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/global-legal-services-market