Lumenswap is an open-source client for the Stellar network that allows you to swap and trade assets on the network using a friendly, minimal interface.

Finding the best price helps each user make an exchange.Lumenswap uses Horizon to choose the best rates for a trade based on the liquidity rates and the submitted order books on the network.Fast and Low Costs Lumenswap client is on the Stellar Network so it benefits from its features such as scalability and low fees.Open and Decentralized By default, all of the available assets on the Stellar Network are also available for trade on Lumenswap. You can add whichever you want to Lumenswap and convert them to each other.Support of Popular Wallets For better accessibility, Lumenswap supports different wallets.

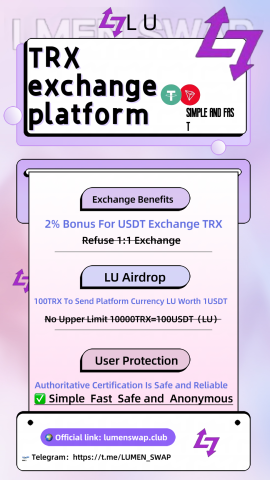

Advantages of using LumenswapUse Lumenswap swap to reduce the TRX fee required for TRON traders. The exchange process is simple and fast, anonymous, and privacy-protected (making funds more secure and clean, making it impossible for others to check). The price is favorable, and the authoritative certification is safe and reliable. 24 hours to provide you with safer and more efficient exchange services.And during the internal test period, the platform will give 2% more when USDT is exchanged for TRX (for example, 102U of TRX will actually be received after purchasing 100U of TRX).About platform currency LUWe will issue platform currency LU in a limited amount. Platform currency (LU) will not be sold through any sales channels. If you want to obtain platform currency (LU), you can only get platform currency (LU) rewards by exchanging TRX on the platform. Our platform will launch the platform currency (LU) in Q4. As long as you interact with the platform and buy 100 TRX, you can get 1 USDT worth of platform tokens. The more TRX you interact with, the more platform tokens you will get. Each address goes online Capped airdrop of 100USDT platform tokens.

Why LU For a number of reasons, a crypto exchange may create its own asset, and exchange owners frequently distribute assets to users as incentives. Most exchange assets are meant to enhance an exchange’s liquidity, reward trading activity, or make the exchange’s community governance process easier.

Let’s take a deeper look on the process:

Enhanced liquidity – In a financial market, liquidity refers to the availability of trading activity that can be depended on. Markets with greater liquidity run more smoothly, and assets with greater liquidity may be traded more readily without significant price changes or slippage. Crypto exchanges can utilize native assets to motivate market makers in the absence of traditional market makers by giving incentives proportionally to their overall trading volume or through specified staking programs.

Governance – Not all cryptocurrency exchange assets are intended to be used as a bonus for platform users. Several crypto exchanges have released native assets as a governance tool for the exchange’s future development. While this use case is less frequent than others, decentralized exchange assets have become an increasingly significant goal for DEXs looking to migrate to completely community-run operations.

Join in: lumenswap.club

Official community: https://t.me/LUMEN_SWAP

Media Contact

Company Name: LUMENSWAP

Email: Send Email

Country: Malaysia

Website: lumenswap.club