According to a report,“Metal Forging Market Size, Share & Trends Analysis Report By Raw Material (Carbon Steel, Alloy Steel), By Application (Automotive, Aerospace), By Region, And Segment Forecasts, 2019 – 2025”, published by Grand View Research, Inc., The global metal forging market size is expected to reach USD 131.32 billion by 2025, It is anticipated to register a CAGR of 7.6% during the forecast period. Growth of the automotive industry is expected to be one of the key market drivers.

Lightweight forging is expected to remain a key focus area in the automotive sector. Strict emission policies have forced automakers to double the share of lightweight components in automobiles. Under the European Union Legislation regarding carbon dioxide emissions, manufacturers must follow the criteria of 95 g/km of threshold value by 2021. Similar legislation is being adopted by many countries including U.S., China, India, Japan, and Brazil. The ability of the forging process to manufacture lightweight auto parts for applications such as combustion engine and transmission is anticipated to fuel growth.

The government of India has developed an Automotive Mission Plan 2016-2026 (AMP 2026) to boost the automotive sector in the country. This plan is projected to help multiple stakeholders inside and outside India including auto component, automotive vehicle, and tractor manufacturers. As per the objective of this plan, the Indian auto sector is anticipated to grow at 3.5 to 4 times the current value of USD 74 billion by 2026. The government is also planning to scale up the exports in this sector by 30% to 40% over the coming decade.

Increasing expenditure in the defense sector is expected to drive the product demand over the coming years.As per the U.S. administration, the U.S. government signed a USD 1.3 trillion spending bill in March 2018. A value of USD 160 billion was allocated to boost the defense sector in the country over the next two years. These initiatives by the government are likely to facilitate the demand for forged components in military aircraft.

Various processes used for manufacturing of agriculture forged parts include closed die forgings, steel forgings, drop forgings, and custom forgings. Forged parts include connecting rods, gear bodies, flanges, chain links, pistons, shafts, and spindle rods. Rising demand for forgings in this application is largely attributed to the developing economies such as India and Brazil. These countries are modernizing their agricultural equipment to attain a greater level of growth in terms of productivity and efficiency.

Key Takeaways from the report:

-

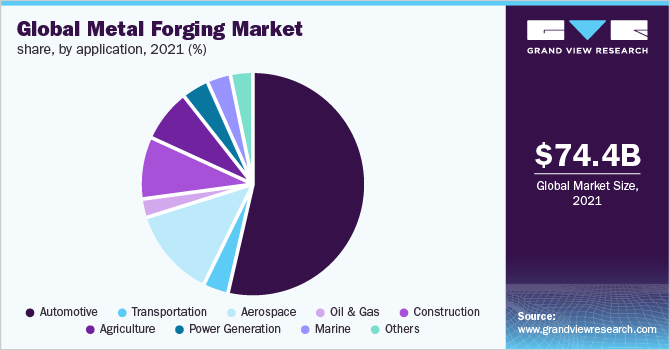

In terms of revenue, automotive segment is anticipated to reach USD 60.11 billion by 2025. The growth is attributed to the increasing demand for forged parts used in combustion engine and powertrain, especially in China and India

-

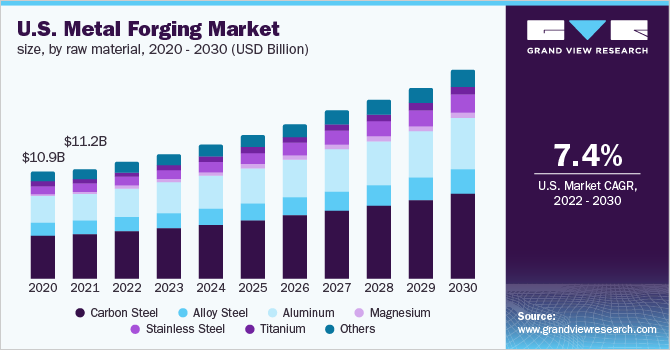

Carbon steel segment dominated the global industry with a revenue share of 44.3% in 2018 on account of easy availability and low prices compared to other materials

-

In terms of revenue, titanium segment is likely to observe the highest CAGR of 9.0% from 2019 to 2025. Increasing R&D activities for development of new titanium alloys is the key driver

-

Asia Pacific accounted for the highest market share in terms of both volume and revenue. High automotive production and consumption in the region are likely to boost the demand

-

In terms of revenue, Europe is projected to witness a significant CAGR of 6.3% over the forecast period. Steady growth in the automotive sector in Germany is likely to positively influence the product demand

-

Some of the global companies present in the metal forging market are Arconic, Larsen & Toubro Limited, Bharat Forge Ltd. and Nippon Steel Corp. Numerous vendors are adopting capacity expansion and new product development as their key strategy

Browse More Reports in Advanced Interior Materials Industry:

- Aluminum Foil Market – Increasing demand from food and pharmaceutical packaging sectors is expected to significantly drive the market over the coming years.

- Bolts Market – The global bolts market size was valued at USD 39.3 billion in 2018 and is expected to exhibit a CAGR of 3.8% from 2019 to 2025.

Regional Insights

In terms of revenue, North America is projected to witness a CAGR of 4.5% on account of growing demand from the automotive and aerospace sector.North America holds a significant share in the global automotive production market. As per the International Organization of Motor Vehicle Manufacturers, North America accounted for 18% of the global market share of automotive production in 2018.

As per the Oxford Economics, the middle class population is expected to account for about 57% of the global population by 2037. Rising spending power of consumers is expected to drive the aerospace industry in the forthcoming years. In 2018, U.S. accounted for a share of over 47% in the global aerospace parts manufacturing industry. U.S., being a leading country in this sector, is projected to have numerous opportunities in the market.

Asia Pacific accounted for more than 50% of market share in 2018 and is projected to register the highest CAGR during the forecast period. The growth is mainly driven by expansion of the manufacturing sector in China and India.China is the largest producer and consumer of forged products globally. It accounted for 26.7% of the global revenue share in 2018 and is projected to advance at a CAGR of 9.2% from 2018 to 2025.

Metal Forging Market Share Insights

Some of the key manufacturers include Arconic, ATI, Bharat Forge Ltd., Bruck GmbH, Nippon Steel and Larsen & Toubro Limited. The market is fragmented with presence of numerous small and medium players.

The key vendors are focused on capacity expansion and new product development. For instance, in June 2017, ELLWOOD Group Inc. acquired Gulfco Forge Company, LLC (Gulfco), an open die forging and rolled rings manufacturer based in Texas, U.S. The acquisition was aimed at providing high-quality forged products in the country and strengthening the position in the market.

Explore the BI enabled intuitive market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research, Inc.

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

For more information: www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: United States

Website: www.grandviewresearch.com/industry-analysis/metal-forging-market