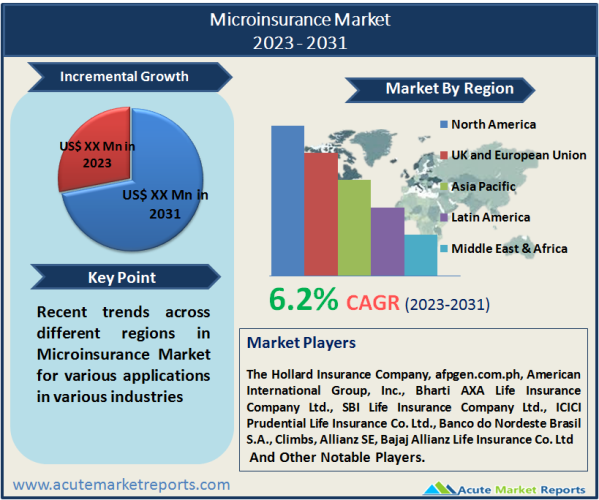

The demand for accessible and affordable insurance solutions for low-income individuals and marginalized populations is anticipated to propel the growth of the microinsurance market at a CAGR of 6.2% from 2023 to 2031. Microinsurance refers to insurance products designed specifically for low-income individuals, microenterprises, and small-scale businesses that provide coverage for a variety of risks at affordable premiums. Microinsurance market revenue has steadily increased, reflecting the expanding demand and adoption of microinsurance products worldwide. The revenue is affected by factors such as the expansion of microinsurance initiatives, partnerships between insurers and microfinance institutions, and government regulations that are favorable. Microinsurance has acquired popularity in emerging economies where insurance penetration has historically been low, but there is a growing awareness of the significance of insurance coverage. The hazards covered by microinsurance include health, life, property, agriculture, and livestock. It provides financial protection and risk mitigation for vulnerable individuals and small enterprises that lack access to conventional insurance products. The increasing emphasis on inclusive finance and sustainable development goals, which seek to alleviate poverty and promote financial inclusion, has fueled the expansion of the microinsurance market.

Financial inclusion and growing awareness among low-income and underserved populations are major market drivers for microinsurance. As more individuals become aware of the advantages of insurance and the potential risks they face, the demand for accessible and affordable insurance solutions increases. According to studies, financial inclusion initiatives, such as microinsurance, have a positive effect on poverty alleviation and economic stability. A study conducted in India, for instance, found that access to microinsurance increased low-income households’ financial resilience and enhanced their economic well-being. The emergence of mobile technology and digital platforms has also increased microinsurance’s visibility and accessibility. In developing countries, mobile penetration has been particularly high, making it simpler for insurance providers to reach a larger audience and educate them on the significance of insurance coverage.

The microinsurance market is largely driven by partnerships between insurance providers and microfinance institutions (MFIs). MFIs have an established presence in local communities and have earned the trust of their clients, which makes them effective distribution channels for microinsurance products. A case study conducted in the Philippines revealed that partnering with MFIs significantly increased microinsurance adoption. By leveraging the existing client base and infrastructure of MFIs, insurance providers were able to reach a greater number of low-income people who were already familiar with microfinance services. Partnerships between insurance providers and MFIs also aid in addressing affordability and trust issues. MFIs frequently have a greater understanding of the financial needs and preferences of their clients, allowing them to offer microinsurance products that are specifically tailored to the needs of low-income individuals.

Browse for the report at: https://www.acutemarketreports.com/report/microinsurance-market

The microinsurance market is largely driven by government support and regulatory frameworks. Insurers are able to offer microinsurance products and expand their reach to marginalized populations as a result of policies and regulations that are conducive to this endeavor. Governments in numerous nations have implemented microinsurance promotion initiatives. For example, the Indian government introduced the Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) schemes to provide economically vulnerable populations with affordable life and personal accident insurance coverage. In a number of nations, microinsurance-specific regulatory frameworks have been established. These regulations defend consumers, promote product transparency, and foster the expansion of the microinsurance market. Such regulations provide insurance providers with clear guidelines and nurture both insurer and policyholder confidence.

The limited financial literacy and lack of trust among low-income individuals and marginalized populations is one of the major factors inhibiting the growth of the microinsurance market. Lack of awareness and comprehension of insurance products, as well as skepticism regarding the benefits and dependability of insurance, are significant obstacles to microinsurance adoption. The significance of financial literacy in driving insurance adoption has been highlighted by studies. Low-income individuals frequently have a limited understanding of insurance concepts, terms, and the claims process, which can discourage them from purchasing coverage. According to a study conducted in Kenya, a dearth of insurance knowledge is a significant barrier to microinsurance adoption. Trust is another crucial factor influencing microinsurance adoption. Numerous low-income individuals may have had negative interactions with financial services or insurance providers in the past, resulting in a distrust of insurance products. Building trust requires insurance providers to be transparent, communicate effectively, and keep their promises. The influence of cultural beliefs and social norms on insurance trust and perception can also be observed. In some communities, informal risk-sharing mechanisms or reliance on community support networks may be preferred over formal insurance. To overcome these cultural barriers, education and awareness campaigns must be tailored to the particular requirements and preferences of each community.

The microinsurance market is comprised of a variety of insurance products designed to meet the unique requirements of low-income individuals and underserved populations. Property Insurance, Health Insurance, Life Insurance, Index Insurance, Accidental Death and Disability Insurance, and Others make up the product segment. Health Insurance carried the highest revenue share among these categories in 2022. Low-income individuals can purchase health insurance that provides coverage for medical expenses, hospitalization, and access to healthcare services. Due to the rising cost of healthcare and the importance of health coverage, Health Insurance has garnered considerable traction. Alternatively, Accidental Death and Disability Insurance is anticipated to exhibit the maximum CAGR on the microinsurance market between 2023 and 2031. These products provide financial protection and support for individuals and their families in the event of accidental mortality or disability. The risks associated with occupational hazards and accidents are mitigated by accidental death and disability insurance, assuring financial stability during difficult times. In addition, Property Insurance, Life Insurance, Index Insurance, and Other microinsurance products contribute to the overall market revenue by meeting the diverse requirements of low-income individuals and small businesses. Promoting financial inclusion and risk protection, the availability of a vast selection of microinsurance products enables insurers to tailor their offerings to the specific needs of their target consumers.

Get your free sample copy from https://www.acutemarketreports.com/request-free-sample/139631

On the microinsurance market, insurance products are made available via two distinct provider segments: Microinsurance (Commercially Viable) and Microinsurance through Aid/Government Support. Microinsurance (Commercially Viable) providers are independent insurance organizations that provide microinsurance products on a commercially viable basis. These providers generate income through premium payments and seek profitability while meeting the needs of low-income individuals. Microinsurance (Commercially Viable) currently holds the largest revenue share in 2022, due to its ability to provide economically viable insurance solutions to underserved populations. Microinsurance through Aid/Government Support providers, on the other hand, offer microinsurance products backed by aid organizations or government support. These providers provide insurance coverage to low-income individuals who lack access to traditional insurance markets. Microinsurance through Aid/Government Support is anticipated to exhibit the highest CAGR between 2023 and 2031. This expansion is attributable to efforts by humanitarian organizations and governments to promote financial inclusion and social protection for vulnerable populations. By leveraging external support, Microinsurance through Aid/Government Support providers can offer affordable insurance solutions and expand microinsurance’s reach to those who require it the most. The diverse provider segments in the microinsurance market contribute to the overall growth and accessibility of microinsurance products, ensuring that low-income individuals and underserved populations have access to a variety of options.

Emerging economies, especially those in Asia-Pacific, have emerged as crucial microinsurance market drivers. These regions, which are characterized by large populations and a significant proportion of low-income individuals, offer microinsurance providers enormous growth opportunities. Asia-Pacific was the region with the highest percentage of revenue in 2022, due to the increasing adoption of microinsurance products and the rising awareness of financial protection. In addition, Africa has the highest CAGR on the microinsurance market between 2023 and 2031, as predicted. The potential of the region resides in its efforts to close the insurance coverage gap and promote financial inclusion among underserved populations. African nations have witnessed the development of innovative distribution channels, such as mobile-based microinsurance platforms, in order to increase accessibility and reach remote areas. Together with supportive regulatory frameworks, these initiatives have contributed to the rapid expansion of microinsurance in the region. The microinsurance market also has significant development potential in Latin America and the Caribbean. These regions have adopted microinsurance as a strategy for addressing social and economic vulnerabilities and promoting inclusive finance. Governments and regulatory authorities have played an essential role in supporting microinsurance initiatives through policies that promote consumer protection, product innovation, and market growth. Despite being relatively lesser in terms of market size, Europe and North America contribute to the overall growth of the microinsurance market. These regions concentrate predominantly on niche microinsurance products and target specific segments, including migrant workers, gig economy workers, and small-scale entrepreneurs.

Other popular reports https://www.acutemarketreports.com/category/mortgages-and-financing-market

Microinsurance market participants include insurance companies, microfinance institutions, non-profit organizations, and technology-driven start-ups. These competitors seek to capture market share and differentiate themselves through the development of novel products, distribution channels, and strategic alliances. Several notable companies have made significant contributions to the microinsurance market, although a complete list of market leaders is not provided here. Numerous established insurance companies have entered the microinsurance market to serve marginalized populations after recognizing its potential. These businesses provide microinsurance products tailored to the requirements of low-income individuals by utilizing their expertise, resources, and existing distribution networks. They frequently implement a customer-centric approach, with an emphasis on affordability, simplicity, and accessibility. MFIs also play an important role in the microinsurance market. MFIs have profound roots in their local communities and established relationships with low-income individuals, making them ideal partners for insurers. By integrating microinsurance with their existing microfinance services, MFIs increase the reach and efficacy of microinsurance, thereby promoting financial inclusion. Non-profit organizations and aid agencies have played a crucial role in promoting microinsurance initiatives, especially in regions with high levels of poverty and vulnerability. These organizations collaborate with local communities, governments, and insurance providers to develop microinsurance models that address the unique risks encountered by individuals with low incomes. In addition to profit maximization, they prioritize social impact and the welfare of vulnerable populations. In recent years, technology-driven businesses have emerged as significant market disruptors in microinsurance. These businesses utilize digital platforms, mobile technology, and data analytics to provide innovative and accessible microinsurance solutions. Their adaptable and customer-focused strategy has enabled them to enter previously untouched markets.

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com