The increasing awareness about safety in a vehicle has increased the demand for active and passive safety systems. As a result, the automotive industry has witnessed the growing adoption of active and passive safety systems in a vehicle. Passive safety systems inside the vehicle include airbags, seatbelts, whiplash protection system, and occupant classification system. Occupant protection system features such as airbags and seatbelts reduce the probability of death or severe injuries in a traffic mishap. Airbags in a vehicle have significantly improved the safety of occupants. Occupant classification system manufacturers utilize a good portion of their engineering resources to develop new products or improve existing passive safety systems for the automobile. All these developments are primarily focused on improving the overall safety of vehicle occupants. This, in turn, has resulted in the reduction of vehicle recalls because of faulty passive safety features.

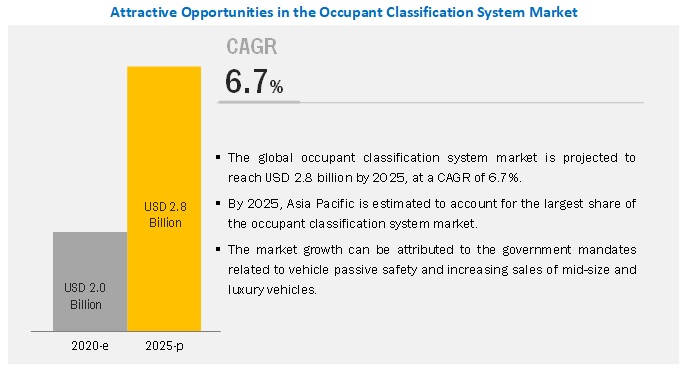

The global Occupant Classification System Market is projected to grow at a CAGR of 6.7% from 2020 to 2025, to reach USD 2.8 billion by 2025. The automotive industry is experiencing a paradigm shift in vehicle production from developed economies to developing economies. Increasing population and improving demographic dividend in countries like India, China, Brazil, and South Africa have contributed to the increasing production of economy-class vehicles. Economy-class vehicle contributed around 37% of the total vehicle production in the year 2017 and is expected to grow at a rate of approximately 3% by the year 2025. Currently, most of the economy-class vehicles produced in developing countries are not equipped with OCS. The installation of active and passive safety systems in vehicles largely depends on government regulations. With the increasing economy-class vehicle production and growing awareness about safety systems among people, OEMs can create new revenue pockets in developing countries.

OCS must be allied with certain innovative technologies such as a camera-based detection system to improve the accuracy of occupant detection. A camera-based detection system can identify the occupant by running certain algorithms. Moreover, some radio frequencies or electromagnetic based technologies can also be leveraged in tandem with sensor-based OCS to identify and classify the passenger accurately.

In 2017, ON Semiconductor came up with an innovative smart passive sensor technology for wireless sensors. Smart Passive Sensor (SPS) devices from ON Semiconductor are wireless and battery-free sensing tags. They enable monitoring of parameters such as temperature, fluid level monitoring, moisture, and proximity at the network edge, where running wires or replacing batteries may be impractical. It is the industry’s first ultra-high frequency RFID sensor tags that can be used for an automotive seat occupant detection system by combining both pressure and moisture sensing functions. Such sensors are used in other applications like leak detection, on-metal moisture sensing, and industrial enclosures. The development and testing of such sensors can create revenue-generating opportunities for Tier I and Tier II suppliers in the near future.

Download PDF Brochure @ https://www.marketsandmarkets.com/Market-Reports/occupant-classification-system-market-257981931.html

Sensors is estimated to be the largest growing market, by component. Globally, sensors are a must-have component of the occupant classification system. It comprises of primary sensors like pressure sensors and seat belt tension sensor. They facilitate the actuation of the front passenger airbag. The combined cost of these sensors is just above that of the airbag control unit. This is the reason for the dominance of the sensor segment, followed by the airbag control unit.

The mid-size class is estimated to be the largest market, by light-duty vehicle type. The global production of the mid-size class vehicle is increasing day by day. Mid-size class comprises of features of luxury class vehicles. Features are active and passive safety features. Tier I companies are trying to make features in luxury vehicles as a pocket-friendly option in the mid-size class. People in the developing economies are buying mid-size class. This is the reason for the dominance of the segment in OCS market.

The Asia Pacific market is estimated to be the largest during the forecast period. The region comprises some of the early adopter of passive safety technology such as Japan, South Korea, and China. Also, the Asia Pacific region is the largest market for light-duty vehicles. The increasing young population is one of the main reasons for the increasing vehicle production in this region. This creates opportunities for Tier I and II suppliers to earn new revenue in this segment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/occupant-classification-system-market-257981931.html