InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Payment HSMs Market Size, Share & Trends Analysis Report By Type (PCI Based, USB Based, Network Based); Applications (Code and Document Signing, Secure Sockets Layer (SSL) and Transport Layer Security (TLS), Authentication, Database Encryption, PKI or Credential Management, Others); End User (BFSI, Government, Technology and Communications, Manufacturing Industry, Energy and Utilities, Retail and Consumer Products, Others) – Market Outlook And Industry Analysis 2031″

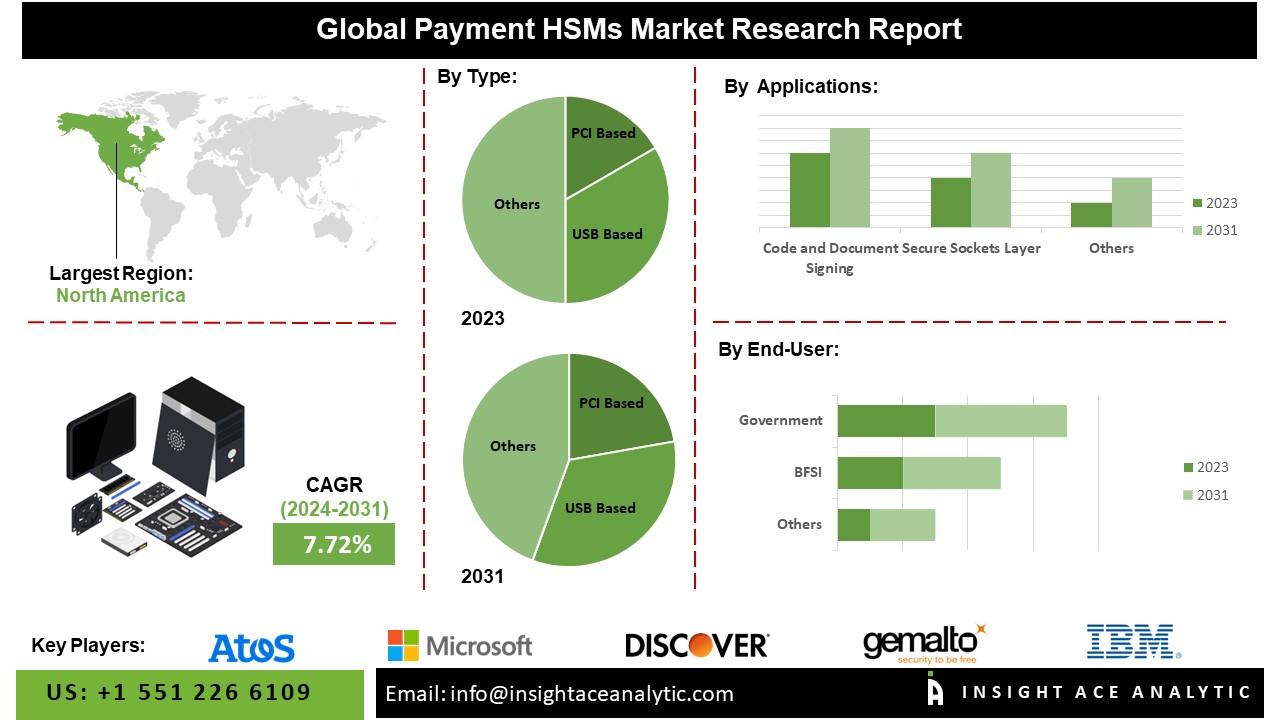

The Global Payment HSMs Market is expected to grow with a CAGR of 7.72% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC : https://www.insightaceanalytic.com/request-sample/2620

The Payment Hardware Security Modules (HSMs) market is an essential component of the financial technology landscape, playing a critical role in securing digital transactions. As reliance on electronic payments grows, the demand for robust security solutions has become paramount. Payment HSMs are specialized devices designed to securely manage, process, and store cryptographic keys and sensitive data, ensuring the integrity and confidentiality of payment information. These modules are utilized across various sectors, including banking, payment processing, and e-commerce, with primary applications in secure transaction processing, key management, and compliance with industry standards such as the Payment Card Industry Data Security Standard (PCI DSS).

The significance of Payment HSMs lies in their ability to safeguard financial transactions against unauthorized access, fraud, and data breaches. As cyber threats become increasingly sophisticated, the role of HSMs in protecting sensitive information is more critical than ever. They not only enhance the security of payment systems but also build consumer trust in digital transactions. Payment HSMs can be categorized into several types based on their deployment and functionality, including PCI Based HSMs, which meet stringent Payment Card Industry requirements; USB Based HSMs, which offer secure key management for smaller-scale applications; and Network Based HSMs, which provide centralized security for multiple applications and users within network environments.

List of Prominent Players in the Payment HSMs Market:

- American Express

- ATOS

- AWS

- Azure

- Discover

- FutureX

- Gemalto NV

- Hewlett-Packard Enterprise Development LP

- IBM Corporation

- Infineon Technologies

- JCB International

- Kryptus

- Mastercard

- Microchip Technology

- Microsoft Corporation

- Procenne

- STMicroelectronics

- SWIFT

- Thales e-Security, Inc.

- Ultra-Electronics

- UnionPay

- Utimaco GmbH

- Visa Inc.

- Worldline

- Yubico

- Intexus

- Securosys

- Broadcom Inc

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2024-02

Market Dynamics:

Drivers-

The Payment HSMs market is driven by the increasing demand for secure payment solutions, rising cybersecurity threats, regulatory compliance requirements, the growth of e-commerce and mobile payments, and the shift towards cashless transactions. As digital transactions become more prevalent, organizations invest in Payment HSMs to protect sensitive data from unauthorized access and fraud. The rise in cyber incidents necessitates robust encryption and secure key management provided by HSMs. Compliance with regulations like PCI DSS mandates secure cryptographic operations, further driving HSM adoption. The expansion of e-commerce and mobile payments, along with government initiatives promoting cashless transactions, underscores the need for secure payment processing solutions, boosting the market growth of Payment HSMs.

Challenges:

The Payment HSMs market faces challenges due to high implementation costs, complex integration with existing systems, and stringent regulatory requirements. These factors can be prohibitive for small and medium-sized businesses, requiring significant investments and expertise.

Regional Trends:

The Payment HSMs market in North America is driven by the presence of major financial institutions, rapid technological advancements, high reliance on digital payment systems, growing cybersecurity concerns, and stringent regulatory compliance requirements. Leading financial and technology companies in the region drive innovation and adoption of secure payment solutions. The well-established digital payment ecosystem supports a high volume of transactions, necessitating robust security measures. Rising cyber threats and data breaches heighten the demand for advanced encryption and key management capabilities offered by Payment HSMs. Additionally, regulatory mandates like PCI DSS further compel organizations to adopt HSMs to ensure secure handling of sensitive payment information.

Empower Your Decision-Making with 180 Pages Full Report @ https://www.insightaceanalytic.com/enquiry-before-buying/2620

Recent Developments:

- In August 2023, Thales launched Thales payShield Cloud HSM, a subscription-based digital payments security service built on its leading payShield 10K Payment HSM technology, to accelerate the adoption of cloud-based payments infrastructure.

- In July 2022, Futurex’s EXP1000 and GSP3000 HSMs are now officially approved for use in Australia’s payment industry by the Australian Payments Network (AusPayNet) and have been added to the IAC Approved Devices list.

Segmentation of Payment HSMs Market-

By Type:

- PCI Based

- USB Based

- Network Based

By Applications:

- Code and Document Signing

- Secure Sockets Layer

By End User:

- BFSI

- Government

- Technology and Communications

- Manufacturing Industry

- Energy and Utilities

- Retail and Consumer Products

- Others

By Region-

North America-

- The US

- Canada

- Mexico

Europe-

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific-

- China

- Japan

- India

- South Korea

- South East Asia

- Rest of Asia Pacific

Latin America-

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa-

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2620

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Media Contact

Company Name: InsightAce Analytic Pvt. Ltd

Contact Person: Diana D’Souza

Email: Send Email

Country: United States

Website: https://www.insightaceanalytic.com/