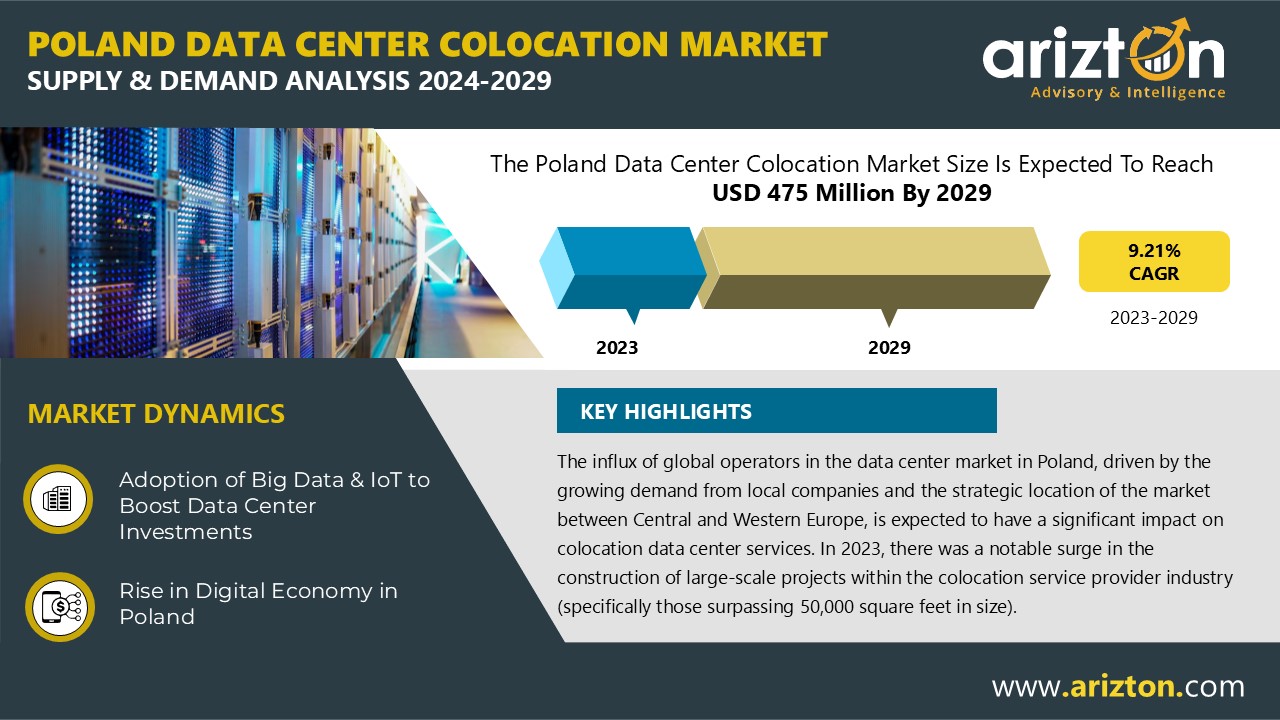

According to Arizton’s latest research report, the Poland data center colocation market is growing at a CAGR of 9.21% during 2023-2029.

Looking for More Information? Click:

https://www.arizton.com/market-reports/poland-data-center-colocation-market

Report Scope:

Market Size – Colocation Revenue: $475 Million (2029)

CAGR – Colocation Revenue: 9.21% (2023-2029)

Market Size – Utilized White Floor Area: 1.63 Million Sq. ft (2029)

Market Size – Utilized Racks: 39.25 Thousand Units (2029)

Market Size – Utilized IT Power Capacity: 310 MW (2029)

Base Year: 2023

Forecast Year: 2024-2029

Poland currently hosts around 57 data center facilities. Warsaw is a major location for colocation data center development with 28 third-party data centers. The upcoming colocation data center investments are from Equinix, Atman, and others in Warsaw, Katowice, and several other places.

Poland is at a crucial juncture in its energy transition, needing to shift significantly toward renewable sources. As the 8th largest electricity market globally, the country faces challenges in expanding its renewable energy capacity, largely due to its dependence on energy imports, which make up 90% of its supply. Despite these hurdles, the potential for growth in the renewable sector is substantial. The Polish government, in line with the Polish Energy Policy until 2040, plans to leverage offshore wind farms to help meet the EU’s renewable energy target of 32% gross final energy consumption by 2030. The Offshore Wind Act is a key driver in this effort, setting regulations that encourage the participation of Polish companies in building a local supply chain. In addition, the onshore renewable energy sector benefits from two main support mechanisms: the issuance of green certificates by the Energy Regulatory Office (ERA) to verify electricity generation from renewable sources, and a competitive auction system. In January 2023, Atman, a major energy firm, announced that it would power all its facilities using green energy sourced through renewable energy sources (RES), signaling a shift toward more sustainable energy practices in Poland’s industrial sector.

Cloud Providers and Digitalization Fuel Colocation Market Expansion in Poland

The Polish data center market is experiencing strong growth, particularly in demand for colocation services, driven by sectors such as cloud/IT and Banking, Financial Services, and Insurance (BFSI). This surge is largely due to government-led digitalization initiatives, which are expected to further boost colocation demand, especially within the public sector.

There is a notable shift from on-premises data centers to colocation facilities, which is further fueling market expansion. The increasing presence of foreign companies in Poland is also contributing to the rising demand for colocation services, as international businesses seek reliable, scalable infrastructure.

Looking ahead, the revenue from wholesale colocation is projected to continue growing, with cloud service providers making significant investments. These providers are expected to colocate large amounts of space within Poland’s colocation data centers, driving further market growth. This trend reflects a broader regional shift toward centralized, outsourced data management as businesses increasingly embrace cloud-based solutions.

Key Highlights

As of September 2024, colocation operators in Poland have added approximately 33,450 core and shell rack cabinets, with around 23,810 units currently in use, reflecting an impressive utilization rate of over 71%. A key trend in the market is the increasing adoption of rack cabinets with heights ranging from 42U to 47U.

Beyond.pl’s Data Center 2 facility offers 42U rack cabinets, providing flexibility for diverse equipment configurations. Meanwhile, Atman’s Warsaw-2 facility supports 47U rack cabinets, accommodating larger equipment and optimizing space efficiency. These developments in rack cabinet specifications highlight the growing focus on adaptability and scalability in Poland’s colocation market. The enhanced options are designed to meet clients’ specific needs, ensuring the efficient use of data center resources and promoting long-term growth in the sector.

What’s Included in the Report?

- Transparent research methodology and insights on the colocation of demand and supply.

- The market size is available in terms of utilized white floor area, IT power capacity, and racks.

- Market size available in terms of Core & Shell Vs Installed Vs Utilized IT Power Capacity along with the occupancy %.

- The study of the existing Poland data center market landscape and insightful predictions about market size during the forecast period.

- An analysis of the current and future colocation demand in Poland by several industries.

- Study on sustainability status in the region

- Analysis of current and future cloud operations in the region.

- Snapshot of upcoming submarine cables and existing cloud-on-ramps services in the region.

- Snapshot of existing and upcoming third-party data center facilities in Poland

- Facilities Covered (Existing): 57

- Facilities Identified (Upcoming): 4

- Coverage: 13+ locations

- Existing vs. Upcoming (White Floor Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data Center Colocation Market in the Poland

- Colocation Market Revenue & Forecast (2023-2029)

- Retail Colocation Revenue (2023-2029)

- Wholesale Colocation Revenue (2023-2029)

- Retail Colocation Pricing along with Addons

- Wholesale Colocation Pricing along with the pricing trends.

- An analysis of the latest trends, potential opportunities, growth restraints, and prospects for the Poland data center colocation industry.

- Competitive landscape, including industry share analysis by the colocation operators based on IT power capacity and revenue.

- The vendor landscape of each existing and upcoming colocation operator is based on the existing/ upcoming count of data centers, white floor area, IT power capacity, and data center location.

Looking for More Information? Click: https://www.arizton.com/market-reports/poland-data-center-colocation-market

The Report Includes:

- Colocation Supply (MW, Area, Rack Capacity)

- Colocation Demand (MW, Area, Rack Capacity) and by End-User (Cloud/IT, BFSI, etc)

- Colocation Revenue (Retail & Wholesale Colocation Services)

- Competitive Scenario (Share Analysis by Revenue & MW Capacity)

Vendor Landscape

Existing Operators

- 3S Group

- Atman

- Equinix

- Beyond.pl

- Vantage Data Centers

- DATA4

- Polcom

- T-Mobile

- Orange Business Services

- Exea

- Other Operators

The Arizton Advisory & Intelligence market research report provides valuable market insights for industry stakeholders, investors, researchers, consultants, and business strategists aiming to gain a thorough understanding of the Poland data center colocation market. Request for Free Sample to get a glance of the report now: https://www.arizton.com/market-reports/poland-data-center-colocation-market

What Key Findings Our Research Analysis Reveals?

What factors are driving the Poland data center colocation market?

What is the count of existing and upcoming colocation data center facilities in Poland?

How much MW of IT power capacity is likely to be utilized in Poland by 2029?

Looking for Customization According to Your Business Requirement? https://www.arizton.com/customize-report/4624

Other Related Reports that Might be of Your Business Requirement

Ireland Data Center Colocation Market – Supply & Demand Analysis 2024-2029

https://www.arizton.com/market-reports/ireland-data-center-colocation-market

Belgium Data Center Colocation Market – Supply & Demand Analysis 2024-2029

https://www.arizton.com/market-reports/belgium-data-center-colocation-market

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/poland-data-center-colocation-market