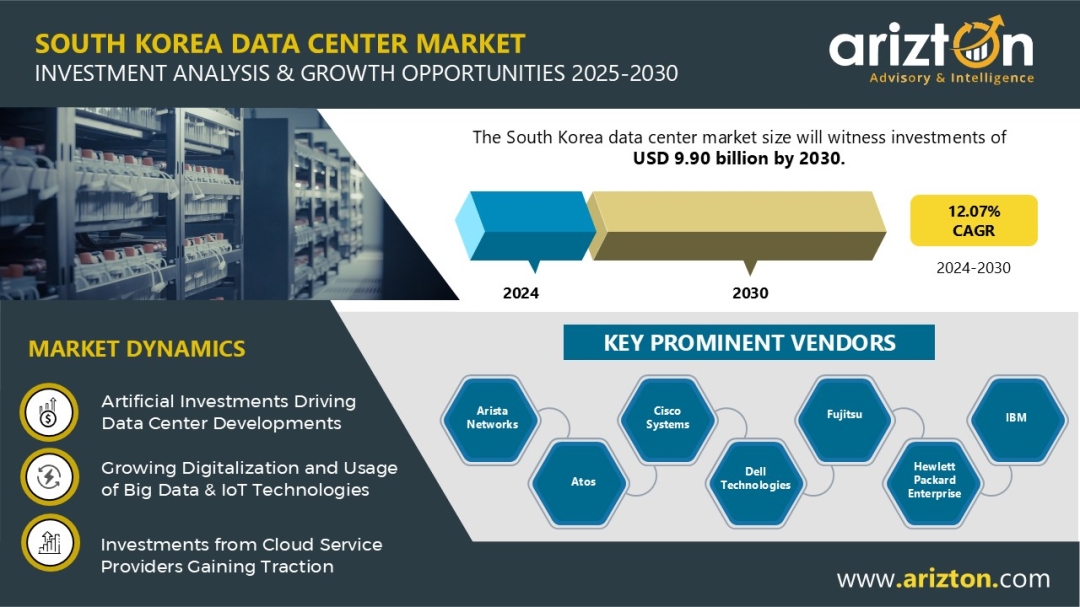

According to Arizton’s latest research report, South Korea data center market is growing at a CAGR of 12.07% during 2024-2030.

To Know More, Click: https://www.arizton.com/market-reports/south-korea-data-center-market-investment-analysis

Report Summary

Market Size – Investment (2030): $9.90 Billion

Market Size – Area (2030): 759 Thousand Sq. ft.

Market Size – Power Capacity (2030): 162 MW

CAGR – Investment (2024-2030): 12.07%

Colocation Market Size – Revenue (2030): $1.79 Billion

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

South Korea Growing Data Center Investment Landscape

South Korea has emerged as a key player in the APAC region for data center investments, driven by its strategic location, government support, and ample land availability. The country accounts for over 50% of the region’s data center investments, fueled by the rise of AI, IoT, big data, and cloud adoption. Efforts by the government to attract data centers outside Seoul, offering incentives like power subsidies, are addressing high demand and rising land costs in urban areas.

South Korea’s strong digital infrastructure is bolstered by its 12 existing undersea cables, connecting to global markets. Major cloud providers like AWS, Microsoft, and Alibaba are active in the region, with new data centers launching regularly. Notable recent developments include SK Telecom’s expansion of its AI-ready data center, SkyLab’s XR cloud partnership, and LS Electric’s collaboration for an AI-powered data center. Additionally, substantial investments, such as a $700 million joint venture for a hyperscale center, highlight the country’s growing prominence in the global data center market.

South Korea Colocation Data Center Market Growth

South Korea is a leading colocation data center hub in the APAC region, with over 43 operational facilities, primarily concentrated in Seoul, which houses more than 20 centers. Major global and local players, such as Equinix, Digital Realty, Telehouse, LG CNS, and KT Cloud, dominate the market. In December 2024, Digital Realty’s operational center in Seoul generated an annualized rent of $4.6 million. The revenue per MW in South Korea is estimated to range from $1.5 million to $2.0 million.

The colocation market is driven by large cloud and IT enterprises, as well as telecom hyperscale operators. New entrants, including OneAsia Network, ST Telemedia Global Data Centres, and others, are expected to boost market competition and revenue. Additionally, significant investments from real estate and investment firms, such as Macquarie Asset Management’s acquisition of Hanam Data Centre, highlight the growing interest in South Korea’s data center sector. Several major hyperscale projects are also in the pipeline, indicating strong market growth in the forecast period.

Why Should You Buy this Research?

This research provides a comprehensive analysis of the South Korea data center market, highlighting key metrics like market size, power capacity, and revenue from the colocation sector. It evaluates data center investments by colocation, hyperscale, and enterprise operators, including square footage and power capacity (MW) across various cities. The study covers existing facilities (43) and upcoming ones (13) in over 12 cities, providing insights into the growth trajectory of data center space and IT load capacity. Forecasts for the colocation market revenue (2021-2030), along with retail and wholesale colocation market analysis, are presented. It also delves into market classifications such as IT, power, cooling, and construction services. A detailed overview of key players, industry trends, growth opportunities, challenges, and a transparent research methodology is included, offering an in-depth understanding of the market’s future prospect.

Buy this Research @ https://www.arizton.com/market-reports/south-korea-data-center-market-investment-analysis

The Report Includes the Investment in the Following Areas:

IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Other Cooling Units

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- Seoul

- Other Cities

Vendor Landscape

IT Infrastructure Providers

- Arista Networks

- Atos

- Cisco Systems

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- IBM

- Inspur

- Intel

- Lenovo

- NetApp

Data Center Construction Contractors & Sub-Contractors

- BEHIVE Architects

- DPR Construction

- GS E&C

- HanmiGlobal

- Heerim Architects & Planners

- Hyundai Engineering & Construction

- ISG

- POSCO DX

- SAMOO Architects & Engineers

- Samsung C&T

- Shinhan Architects & Engineers

Support Infrastructure Providers

- ABB

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Fuji Electric

- Legrand

- Mitsubishi Electric

- Piller Power Systems

- Rittal

- Rolls-Royce

- Schneider Electric

- STULZ

- Vertiv

Data Center Investors

- Digital Edge

- Digital Realty

- Dreammark1

- Epoch Digital

- Equinix

- Hostway IDC

- KT Corp

- LG CNS

- LG Uplus

- Microsoft

- SK Broadband

New Entrants

- Empyrion Digital

- DCI Data Centers

- Macquarie Asset Management

- OneAsia Network

- ST Telemedia Global Data Centres

- STACK Infrastructure

Key Questions Answered in the Report:

How big is the South Korea data center market?

How many existing and upcoming data center facilities exist in South Korea?

How much MW of power capacity will be added across South Korea during 2025-2030?

What is the growth rate of the South Korea data center market?

Who are the key investors in the South Korea data center market?

What factors are driving the South Korea data center market?

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/south-korea-data-center-market-investment-analysis